CMC, a subsidiary of IT giant Tata Consultancy Services, gained 15 percent to Rs 995 per share after it reported a sharp jump of 67.5 percent in net profit to Rs 58.4 crore for the June 2012 quarter, yesterday. Net sales rose by 48.3 percent to Rs452.3 crore against Rs305 crore in the corresponding year-ago quarter.

The sharp increase in profits was mainly due to strong growth in domestic and international market and higher revenues from its SEZ operations. For the year ended March 2012, the company had reported an eight percent fall in profits while sales had grown 20 percent.

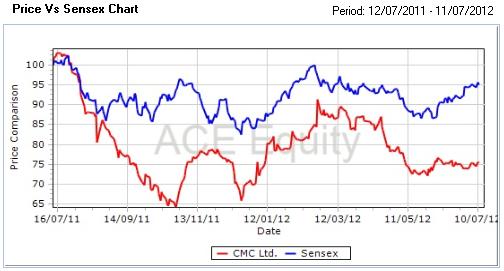

Over the last one year, the stock has fallen 15.8 percent compared to the 6.7 percent fall in the Sensex.

The company has four strategic businesses namely, customer services, systems integration, IT enabled services and Education and Training. It derives a large chunk of its business from customer services.

Its promoter, TCS, has a majority 51.12 percent stake in the company. Other share holders who have a substantial stake in the company include Aberdeen Global India Equity Fund (6.34 percent), HDFC Equity Fund (6.31 percent), LIC (3.95 percent), DSP Blackrock Equity Fund (1.02 percent), among many others.

)

)

)

)

)

)

)

)

)