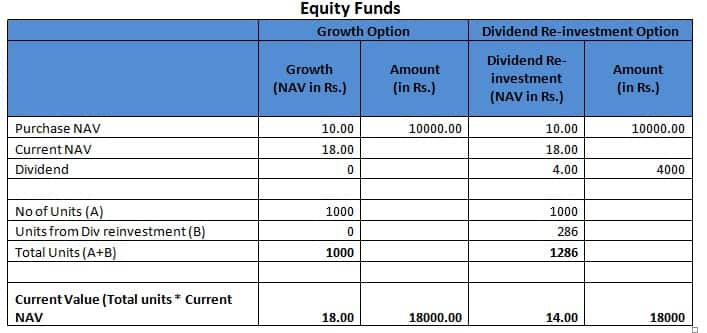

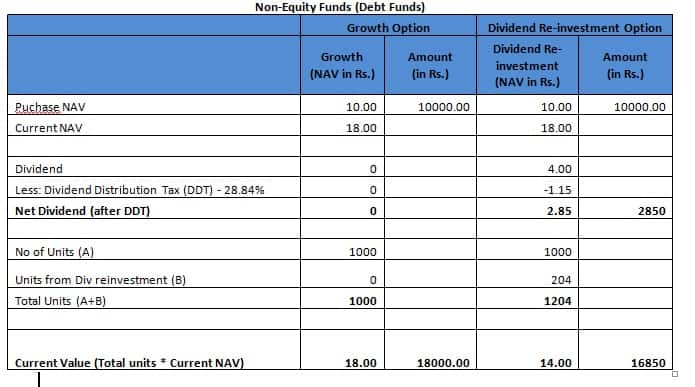

Growth, Dividend payout & Dividend re-investment A new investor who is looking at investing in mutual funds would face a big challenge of choosing the right investment option. Choosing the right option is based on investment objective and tax scenario. Growth option: In growth option, the NAV increases in line with the underlying Share prices leading to capital appreciation. This option is beneficial to investors looking for capital appreciation in the long-term. Eg.: A fund has 1000 units and the initial NAV is Rs. 10. So, the total fund size is Rs. 10,000. Suppose after 1 year, NAV has grown to Rs. 14, increasing the fund size to Rs. 14,000 (1000 units × Rs. 4), resulting in a capital appreciation of Rs. 4000. Dividend pay-out option: In this option, certain portions of the profits made by the fund shall be paid back to investors frequently in the form of dividends and the NAV of the scheme is adjusted to that extent post-dividend pay-out. This option is beneficial for investors looking for regular income. Eg.: A fund has 1000 units and the initial NAV is Rs. 10. So, the total fund size is Rs. 10,000. Suppose after 1 year, NAV has grown to Rs. 18. If a dividend of Rs. 4 is declared per mutual fund unit, then Rs. 4000 (1000 units× Rs. 4) shall be paid to investors as dividend and the NAV shall be adjusted to Rs. 14 (Rs. 14 – Rs. 4). Dividend re-investment option: In this option, the dividend is declared but not paid to investors. Additional mutual fund units shall be bought with the dividend and the NAV will be adjusted to that extent. Eg.: A fund has 1000 units and the initial NAV is Rs. 10. So, the total fund size is Rs. 10,000. Suppose after 1 year, NAV has grown to Rs. 18. If a dividend of Rs. 4 is declared per mutual unit, then the total dividend declared would be Rs. 4000 (1000 units × Rs. 4) and the NAV shall be adjusted to Rs. 14. New units equal to 286 (Rs. 4000 / Rs. 14) shall be created and issued to investors. Which is the best option available? How do I choose between these 3 options? There is no standard answer for this question where one could say a specific option is the best option. Choosing the right option is based on the investment objective, the tax scenario of an individual etc. In the case of equity mutual funds, there are no capital gains tax and there is not dividend distribution tax (DDT).  Illustration disclaimer: The above example is only for illustration purposes & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. The growth option NAV would be at Rs. 18/- per unit and units originally purchased would remain same. When one chooses the dividend reinvestment option, the dividend declared would be reinvested back into the fund. In dividend reinvestment option, the investor would end up having more number of units when compared to Growth option (1286 units in Dividend reinvestment as opposed to 1000 units in growth option) and NAV would be adjusted down after a declaration of dividend. But at the end of the day the value of the portfolio remains the same. The growth option NAV would be at Rs. 18/- per unit and units originally purchased would remain same. When one chooses the dividend reinvestment option, the dividend declared would be reinvested back into the fund. In dividend reinvestment option, the investor would end up having more number of units when compared to Growth option (1286 units in Dividend reinvestment as opposed to 1000 units in growth option) and NAV would be adjusted down after a declaration of dividend. But at the end of the day the value of the portfolio remains the same. The investment objective of equity funds is to generate long-term capital appreciation for generating long-term wealth. Keeping this objective in mind growth option would serve the purpose.  Illustration disclaimer : The above example is only for illustration purposes & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. In the case of Debt funds (non-equity oriented funds), the DDT for individuals is fixed at 25% (net of 28.84%) and same would be deducted before passing on the dividend to the investor. In the above illustration, the investor would get Rs. 2850/- as dividend as against Rs. 4000/- which was declared. 1.Short Term Investment (less 3 years): For the investor in income tax bracket of 10-20%, if he chooses Dividend option he would end up paying DDT of 28.84%. At the same time, if growth option is chosen he would pay 10-20% depending on income tax bracket. So it would be wise to choose “Growth Option” if the investor’s annual net income is less than Rs. 10 lakhs 2.If the investor’s annual net income is more than Rs. 10 lakhs, he would be in 30% tax bracket. In such case by choosing Dividend option the investor would have tax advantage over growth optionLong Term Investment (more than 3 years): The applicable 3.Long Term Investment (more than 3 years): The applicable long-term capital gains tax on non-equity investments is 20% with indexation. It’s recommended that he chooses growth option for investments with long-term horizon Since all the 3 options belong to the same fund can I switch easily and what are the tax implications? Switching from one option to the other is possible. Both the options (Growth & Dividend) generally carry different NAVs and switching in and out of options would be treated as a redemption and fresh purchase. The necessary capital gains tax needs to be paid after every switch. Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully. This is a sponsored post.

The investment objective of equity funds is to generate long-term capital appreciation for generating long-term wealth.

Advertisement

End of Article

Written by FP Archives

see more

)

)

)

)

)

)

)

)

)