With earnings season winding down, Firstpost decided to take a look at the companies that reported the heaviest losses for the September-ending

[caption id=“attachment_146545” align=“alignleft” width=“380” caption=“Oil marketing companies populate the top of the list as they continued with their losing streak in profits. Reuters”]

[/caption]

[/caption]

quarter. Quite interestingly, of the 3,770 companies for which results were available, 1,092 companies or almost 30 percent of the companies, in the list reported a loss totaling Rs 28,501 crore.

Here is the list of companies that win the dubious distinction of being India’s biggest corporate losers in the July-September quarter.

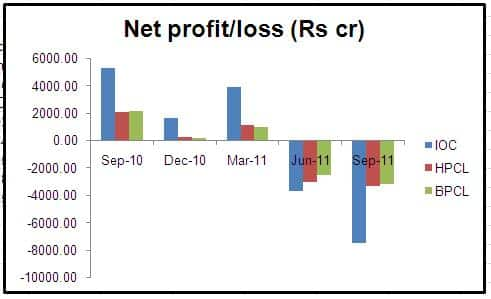

•Oil marketing companies populate the top of the list as they continued with their losing streak in profits. Coming in first was Indian Oil Corporation (IOC), which reported a staggering Rs7,485 crore loss for the September-ended quarter. It was followed by Bharat Petroleum (BPCL) and Hindustan Petroleum Corporation (HPCL), whose losses also widened (see chart) during the quarter.

The main reason for their poor performance was the failure of the government to compensate all three companies for selling diesel, kerosene and LPG at subsidised prices.

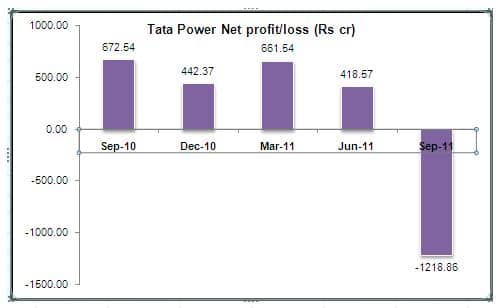

•In fourth place was Tata Power with a net loss of Rs 1,218 crore for the quarter. The company was hit by a provision for impairment charge (Rs 823 crore) and a forex loss (Rs 638.96 crore) of nearly Rs 1,462 crore due to its upcoming Mundra power project.

According to Financial Express , the huge provision was made on account of the rising price of Indonesian coal that is expected to fire up the country’s first ultra-mega power project at Mundra in Gujarat. However, a lot depends on the management’s decision to restructure the ownership of its investments in Indonesian coal companies to Mundra project.

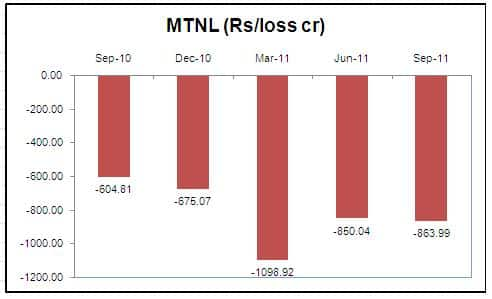

•State-owned MTNL is a an excellent example of how government mismanagement is destroying public-sector units. MTNL has been posting losses for the past eight consecutive quarters; it last reported a profit in September 2009.

The main problem with the company is the number of employees: 43,311. Employee costs are a huge expense for the company. In fact, in the year ending March 2010, the employee cost stood at Rs 4,967 crore, far higher than the company’s net sales of Rs 3,710 crore.In the year ending March 2011, employee cost was still high at Rs3,260 crore vis-a-vis revenues of Rs 3,745 crore.

And the situation just gets worse. For the six months ended September this year, its loss of Rs 1,714 crore exceeded its market cap of Rs1,694 crore (as of 2 December). If this state of affairs continues, it will be only be a matter of time before it approaches the government with a begging bowl.

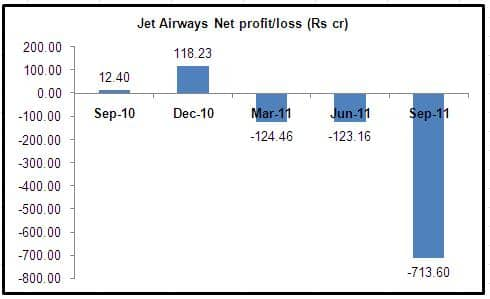

•Jet Airways was the sixth-biggest loser on the list after it incurred a quarterly net loss of Rs 713.6 crore, its highest-ever loss. The company was brought down by high jet fuel prices and a depreciating rupee. Forex losses stood at Rs 276 crore versus a gain of Rs 374 crore a year ago. Jet is also in plans to raise funds to pare its debt.

Firstpost had reported earlier that it plans to raise up to $300 million over the next six months through sale and leaseback of its aircraft.

Rounding off the top 10 list were Shree Renuka Sugars, Kingfisher Airlines (which, incidentally, has never reported a profit since it began flying in 2005, barring a one-time meagre quarterly profit of Rs 9.6 crore in the December-ended quarter of 2006, according to data compiled by Ace Equity) and Ranbaxy Laboratories.

)