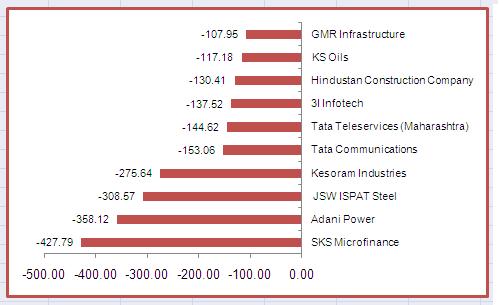

The December-ended quarter has been a disaster for several companies as they battled high interest and input costs, falling demand and consequently, lower earnings. Quite a few of them also posted losses. Using data compiled by Ace Equity,_Firstpost_drew up a list of companies from the BSE 500 that made the biggest losses so far. Of 315 companies that announced their results, 33 posted losses for the quarter.

[caption id=“attachment_208476” align=“alignleft” width=“503” caption=“Source : Adani Power incurs a loss on higher coal costs.”]

[/caption]

[/caption]

Here are the top five biggest losers:

•SKS Microfinance, the troubled microfinance company whose founder Vikram Akula left in November last year,topped the list with a net loss of Rs 427 crore -its fourth straight quarterly loss and the highest since listing on the exchange.

The company has been struggling to keep its head above water after being forced to make huge provisions for its bad loans -provisions for bad loans in the December quarter rose to Rs 358.66 crore from Rs 100.75 crore in the year-ago period.

The company has booked losses of Rs 1,100.8 crore since March 2011, which has wiped out nearly 60 percent of the funds raised during its initial public offer ofRs 1,628.78 crore, Firstpost reported earlier. No wonder then, the stock has fallen by a massive 84 percent in the last one year.

•Adani Power plunged into the red with a loss of Rs 358 crore due to a rise in global coal prices and foreign exchange losses. The company’s fuel costs shot up to Rs 2.44 per unit for the December-ended quarter against Rs 1.48 per unit in the September-ended quarter due to a change in the Indonesian government policy.

Margins are expected to stay under pressure until the issues plaguing the coal sector are resolved, said Prabal Banerjee, chief financial officer, Adani Power, to CNBC TV-18. Responding to the results (released on 6th Feb), the stock has fallen by almost 10 percent in the past two trading sessions. HSBC Global Research downgraded the stock to ‘underweight’ with a price of Rs 75.

•JSW Ispat continued its loss-making trend for the third consecutive quarter as it reported a Rs308 crore loss in December. It had posted a net loss of Rs 409 crore in the year-ago quarter.

According to the company’s press release, the financial results were adversely impacted due to a steep decline in the value of the Indian rupee against the dollar and of the dollar against the Japanese Yen. While its raw material costs jumped three-fold, its power cost also doubled during the quarter.

•Tyre and cement company, Kesoram Inds reported a loss of Rs 275 crore for the December-ended quarter - the seventh straight quarter of losses and steepest ever. A sharp spike in operational expenses led to a loss at the operating margin level. A whopping 52 percent jump in interest expenses increased losses at the net profit/loss level. The stock has fallen by almost 10 percent in the last three trading sessions (results announced on 6th Feb).

•Tata Communications’ loss of Rs 126 crore highlights the losing streak the company has been on for two years. The telecom firm last posted a net profit of Rs 49.2 crore in December 2009. However, that has not deterred the company from its investment plans as it plans to invest around $450 million, or Rs 2,250 crore, in areas like cloud computing, mobile broadband, video telepresence etc. After its results were announced on 25 January, the stock , however, has dipped by only 1.3 percent.

)