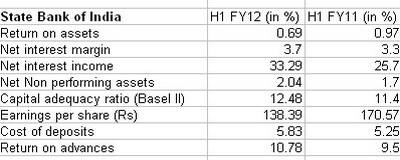

State Bank of India (SBI), India’s largest bank, has posted better-than-expected net profit for the quarter ending September. However, asset quality remains the biggest concern for the bank, as well as Tier 1 capital adequacy ratio, which, at 7.47 percent, falls short of the 8 percent required by the RBI.

[caption id=“attachment_126959” align=“alignleft” width=“380” caption=“Asset quality remains a concern for SBI. Reuters”]

[/caption]The bank posted a net profit of Rs 2,810 crore for the quarter ended 30 September against Rs 2,501 crore for the same period last year. Total income is Rs 29,394 crore for the second quarter against Rs 23,813 crore for the same quarter last year.

[/caption]The bank posted a net profit of Rs 2,810 crore for the quarter ended 30 September against Rs 2,501 crore for the same period last year. Total income is Rs 29,394 crore for the second quarter against Rs 23,813 crore for the same quarter last year.

Pratip Chaudhury, chairman and managing director, SBI, said, “There is still stress on asset quality across portfolios, but the bank has provided adequately for the same. The sectors under maximum duress over this quarter were agro based industries, iron and steel, metal and mining, textiles and hospitality.

The only relief comes from its exposure to the power sector: from its exposure of Rs 31,000 crore, only Rs 1,200 crore is made up of loans to SEBs. However, demand for retail loans is still growing, the bank’s management said in a media briefing.

SBI’s gross bad loans shot up to 4.19 percent from 3.35 percent from a year ago.

Net bad loans also increased, rising to 2.04 percent from 1.7 percent. The slippage ratio which indicates the ratio of loans that could potentially become bad loans stand at 5.2 percent.

The provision coverage ratio as on 30 September 2011 works out to 63.50 percent, a fairly good number, although the Reserve Bank is urging banks to achieve 70 percent.

The provision coverage ratio as on 30 September 2011 works out to 63.50 percent, a fairly good number, although the Reserve Bank is urging banks to achieve 70 percent.

The bank made an additional provision of Rs 1,100 crore for the half year ended 30 September 2011, thus achieving the required counter-cyclical provisioning buffer of Rs 3,430 crore.

The capital adequacy ratio has slipped to 11.4 from 12.4 percent.

)