With the onset of the earnings season, focus will initially be on 12 October, the day Infosys is expected to announce its second quarter results. The anticipation of better-than-expected numbers and the recent rupee depreciation has certainly led to a surge in investor interest in IT shares.

The BSE IT index, which reflects the performance of the IT sector, has gained close to 5 percent over the past one month, while the broader market, the BSE Sensex, declined by 5.5 percent during the same period.

[caption id=“attachment_101326” align=“alignleft” width=“380” caption=“Among the list, Cognizant, TCS and HCL are expected to lead the pack. Reuters”]

[/caption]

[/caption]

“We expect a strong 2QFY12 (September-ending quarter) performance from Tier-I IT companies driven by a likely limited impact from current economic uncertainty on demand and an expected significant positive impact from rupee depreciation vs the dollar,” Nomura Equity Research said in an IT sector earnings preview note recently.

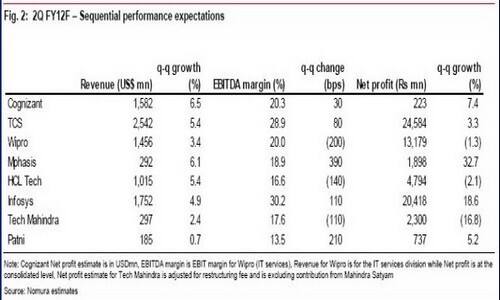

Nomura expected dollar revenues of Tier 1 companies (see table) to grow in the range of 3.4 to 6.5 percent for the September quarter vis-a-vis the June quarter. IT company performances are typically compared on a sequential basis.

Among the list, Cognizant, TCS and HCL are expected to lead the pack with better-than-expected numbers on the revenue front, while Wipro is expected to lag its peers.

US-listed Cognizant is expected to clock 6.5 percent growth in revenues, while net profit is expected to grow by 7.5 percent.

On the domestic front, TCS will lead the pack with a 5.4 percent rise in revenues while its EBDITA margins will increase owing to better rupee realisation and SG&A (Selling, General and Administrative expenses) leverage. However, net profit is expected to grow at a slower pace of 3.3 percent. The company’s exposure to the banking, financial services and insurance sector, coupled with its European exposure, are the key risk elements, Nomura said.

HCL Technologies’ profits are forecast to decline by 2.2 percent due to wage hikes and fresh recruitments.

While Infosys’ revenues growth will be in line with its guidance (4.9%), the recent depreciation in the rupee is expected to lead to an increase in profits. Wipro is expected to continue to lag its peers with a 3.4 percent growth in dollar revenues, even as margins contract due to wage hikes and a corporate acquisition (SAIC).

Nomura said the current global economical slowdown was unlikely to have a major impact on IT companies compared with the post Lehman crisis, as companies today are fundamentally stronger.

Also, positive earnings growth guidance from global tech companies like Accenture and Oracle have changed market perceptions towards the IT sector. Accenture reported upbeat quarterly results, and reported new order bookings of $8.4 billion for the fourth quarter, the highest in its history. It also expected revenues to grow 1.5-4.5 percent in the first quarter of 2012.

Oracle has also indicated 6-16 percent growth, implying resilience in demand.

While it seems like there will be no major surprises in the September quarter results, Nomura said the impact of the slowdown will become more evident after company managements offer their guidance in the December 2011 quarter after gaining clarity on global FY13 budgets.

Finally, Nomura expects Tier 1 IT companies to report revenue growth in the low teens for the year ending March 2013, down from the average 22 percent expected in year ending March 2012.

)