Penny stocks (stocks trading below Rs 10 per share) are always alluring to investors as they offer an easy way to make money in what is usually a short period of time (if you’re lucky, that is).

[caption id=“attachment_324912” align=“alignleft” width=“380” caption=“Reuters”]

[/caption]

[/caption]

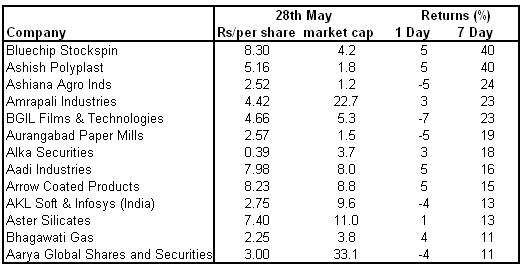

Below is a list of penny stocks that generated 10-40 percent since 17 May i.e., the past seven trading sessions. In comparison, the benchmark Sensex is up 2 percent during the same period. But be warned. Penny stocks are usually the easiest to manipulate - and don’t be surprised if you actually lose it all.

Top of our list is Bluechip Stockspin which is up 40 percent to Rs 8.3 per share from Rs 5.9 in the last seven trading sessions. The company has a market cap of Rs 4 crore and had reported a loss in the December quarter.

Ashish Polyplast comes in second with similar gains as the stock is at Rs 5.16 per share from Rs 3.69 earlier. The company, which claims to be in the business of hoses and hoses assemblies, has a market cap of Rs 1.75 crore. It reported a profit of Rs 2 lakh for the December quarter.

Ashish Polyplast comes in second with similar gains as the stock is at Rs 5.16 per share from Rs 3.69 earlier. The company, which claims to be in the business of hoses and hoses assemblies, has a market cap of Rs 1.75 crore. It reported a profit of Rs 2 lakh for the December quarter.

Other penny scrips that generated good returns are Ashiana Agro Inds, Amrapali Industries and BGIL Films & Technologies (see table).

Disclaimer: Firstpost is looking at penny stocks to tell you what may be going on there, and not to bring you an investment opportunity. Investors are warned that they should NOT take any buy or sell decision based on the information presented in our posts or market price trends. Investors should consult their own financial and share advisors before taking purchase or sale decisions. Firstpost does not take any responsibility for any losses incurred by investors who take their cues from our posts and chat sessions.

)