Revising forecast ratings seems to be the ‘in thing’ as Nomura equity research cut its target price on United Spirits by almost 50 percent, citing lower domestic profitability and an increase in debt levels. Near term concerns about funding requirements at its group company Kingfisher Airlines is also a cause of concern.

Nomura expects the company’s domestic business profitability to suffer owing to strong extra neutral alcohol (ENA) prices, steep rise in glass prices and lack of pricing power. While it expects United Spirits to clock a 19.3 percent rise in revenues, net profit is expected to decline by 6.7 percent for the year ended March 2012.

[caption id=“attachment_101818” align=“alignleft” width=“380” caption=“Kingfisher Airlines Chairman Vijay Mallya. Reuters”]

[/caption]

[/caption]

The company’s high debt levels are also a cause of concern as it plans to invest Rs 600 crore in setting up a glass manufacturing unit over the next year.

However, a major concern here is to do with Kingfisher, another group company that is bleeding profusely. Kingfisher had accumulated losses of around Rs 5,350 crore while its net worth has been completely eroded due to the losses incurred by the company in the recent years.

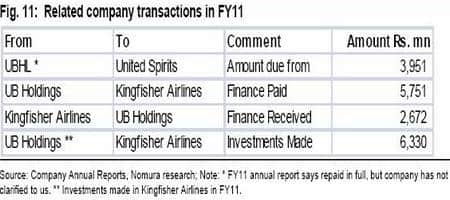

The airline company needs a significant chunk of fund infusion. Nomura had studied the transfer of funds between group companies and noticed that UB Holdings had given Rs 575 crore to Kingfisher airlines and made fresh investments worth Rs630 crore in fiscal 2011. In the United Spirits annual report, there were two transactions (see table) with related parties of Rs 369 crore and Rs 395 crore with the promoter. While Nomura has asked for some clarity on this matter from the company, they still have not received a response. Hence they say that they are unable to comment on these transactions.

)