Special to Firstpost

S&P CNX Nifty (5,316.95): The index didn’t do much during the recently concluded week. The price action was devoid of any trend and the Nifty was confined to a narrow trading range. This, however, is not surprising if viewed in the context of the sharp rally witnessed the week before.

After having expended a lot of energy in that spike up on 29 June, the index appears to be taking a breather. There was, however, a lot of action in individual stocks, resulting in a whole host of trading opportunities.

As highlighted in the attached daily chart, the index is at a crucial resistance area. The Nifty has already met its minimum expectations of a rally to the upper blue trendline and has also almost met the target of 5,350 mentioned in prior weeks.

[caption id=“attachment_370823” align=“alignleft” width=“380”]

It is now imperative that the price registers a quick breakout past the resistance line to sustain the momentum.[/caption]

It is now imperative that the price registers a quick breakout past the resistance line to sustain the momentum.[/caption]

It is now imperative that the price registers a quick breakout past the resistance line to sustain the momentum. Else, the Nifty could drift lower to the support at 5,250-5,260 range.

Investors may use price weakness to build exposures in stocks that are in an uptrend. The likes of IDFC, Dr Reddy’s Laboratories, Voltas and Titan Industries come to mind readily.

CNX Bank Index (10,655.35): The index ruled firm and moved past the first target of 10,600 mentioned in prior weeks. The recent price action strengthens the case for a rally to the next target at 10,880. The short-term positive view would be under threat only if the index falls below the support level of 9,900.

Active traders may consider long positions in Bank Nifty, with a stop-loss at 9,900, basis the spot price. Long positions may also be considered on weakness, in stocks such as Reliance Capital, Punjab National Bank and IDFC.

USD/INR (Rs 55.45): The US dollar moved in line with expectations and turned at the support level of Rs 54.75-54.80 mentioned last week. The short-term outlook for the US dollar remains bullish and a rally to Rs 56.30-56.50 appears likely.

The bearish trigger level for the US dollar is at Rs 54.10. As long as the greenback trades above Rs 54.10, there is no reason to consider bearish stance. A breakout past the key resistance at Rs 56.80 would lend momentum to the uptrend and propel the dollar to new highs.

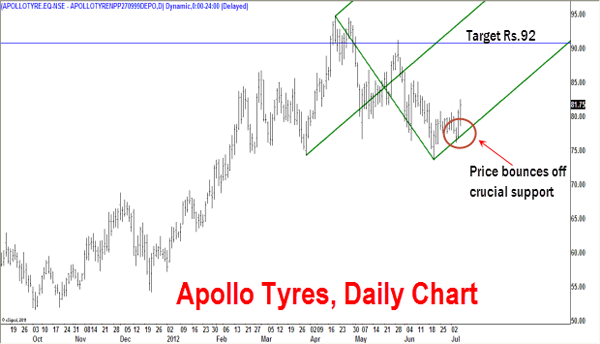

Apollo Tyres (Rs 81.75): The minor downward correction off the 19 April high of Rs 94.80 was arrested at the low of Rs 73.75 on 20 June. The subsequent price action suggests that the next leg of the uptrend is underway. A rally to the short-term resistance at Rs 92 appears likely.

Long positions may be considered on weakness, with a stop-loss at Rs 76, for a target of Rs 92. A breakout past Rs 92 would trigger a rally to the major resistance at Rs 99.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)