Special for Firstpost

S&P CNX Nifty (5,740.75): Last Friday’s trading was an eventful one for the Nifty. The flash crash and the subsequent recovery were quite dramatic. This, however, does not alter the overall bullish view and the target for this leg of the rally remains at 6,000 for the Nifty.

Given the overall bullish undertone, any weakness in the near term would be labelled as a correction within an uptrend. The index has to crack the 5,400-mark to question the scope for a rally to 6,000. Until 5,400 is breached, it would be safe to operate on the premise that the medium-term trend is bullish.

The prior resistance at 5,650 is likely to act as an immediate support in the event of a downward correction. If this level is breached, the index could then ease to the major support at 5,500-5,550

[caption id=“attachment_481643” align=“alignleft” width=“380”]

Given the overall bullish undertone, any weakness in the near term would be labelled as a correction within an uptrend. Reuters[/caption]

Given the overall bullish undertone, any weakness in the near term would be labelled as a correction within an uptrend. Reuters[/caption]

As observed last week, a breakout past the green line, highlighted in the chart, would signal resumption of the uptrend and would also lend momentum to the rally. Investors may capitalise on any downward correction by picking up exposures in fundamentally sound stocks from the high-beta sectors such as banking, realty, engineering and infrastructure.

CNX Bank Index (11,511.40): Similar to the Nifty, this index too has been charting out a bullish sequence of higher highs and higher lows. Frontline banking stocks such as State Bank, Axis Bank and ICICI Bank have displayed strong momentum in recent weeks, which is a positive sign.

While there is the possibility of a short-term downward correction to the 10,900-10,950 range, such a correction ought to be viewed as an opportunity to buy banking stocks from a long-term perspective.

A breakout past the 12,000-mark would impart momentum to the uptrend and the index would then target the major resistance at 13,200. Only a fall below the bearish trigger level of 9,800 would indicate a reversal of the bullish trend.

Crompton Greaves (Rs 139.35): This stock has seen a sharp recovery in the past few weeks. The recent rally has been backed by increased trading volumes, indicating buying interest. Considering that the recent run-up has been very swift, there is a possibility of a minor downward correction.

Investors may buy the stock at or below the Rs 135-mark, with a stop-loss at Rs 122, for a target of Rs 156. Slightly longer term investors may get exit opportunities at Rs 170.

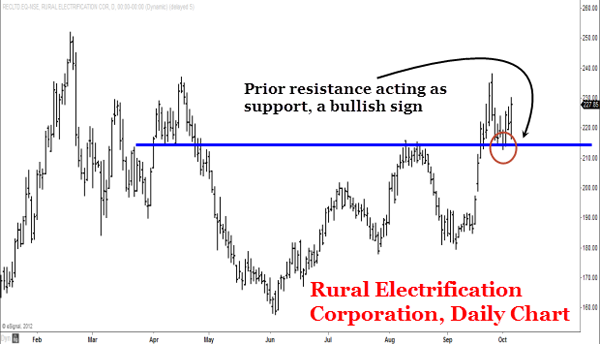

Rural Electrification Corporation (Rs 227.85): The stock, last featured in this column on 25 August, has already hit the then mentioned downside target of Rs180 and has since been in a recovery mode. The short-term outlook is bullish and a rally to the immediate resistance at Rs 250 appears likely.

[caption id=“attachment_481645” align=“alignleft” width=“600”]

The short-term outlook is bullish and a rally to the immediate resistance at Rs 250 appears likely.[/caption]

The short-term outlook is bullish and a rally to the immediate resistance at Rs 250 appears likely.[/caption]

Investors may buy the stock with a stop-loss at Rs 210, for a target of Rs 250. The uptrend would gather momentum on a move past Rs 250 and the stock could then rally to the major target-cum-resistance at Rs 270. Patient investors may await an exit opportunity at Rs 270.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)