Special to Firstpost

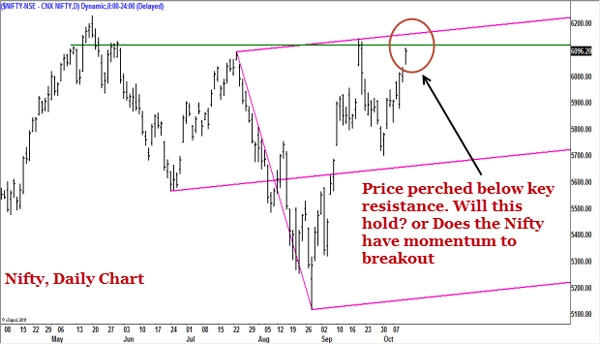

CNX Nifty (6,096.20): The stock market sentiment was positive during the just concluded week. The narrowing of trade data and the Infosys earnings played a key role in propelling the index up by 3% on a week-on-week basis. The rally this week has pushed the index to a key resistance level at 6,100.

[caption id=“attachment_1168103” align=“aligncenter” width=“600”]

Index heavyweights such as Reliance Industries, HDFC Bank, Bajaj Auto and Larsen & Toubro are scheduled to announce their quarterly earnings this week.[/caption]

Index heavyweights such as Reliance Industries, HDFC Bank, Bajaj Auto and Larsen & Toubro are scheduled to announce their quarterly earnings this week.[/caption]

This level has acted as resistance on numerous occasions. It remains to be seen if there is enough momentum to push the Nifty past this resistance level. The prior swing high at 6,140 is another key level to contend with for the Nifty.

Index heavyweights such as Reliance Industries, HDFC Bank, Bajaj Auto and Larsen & Toubro are scheduled to announce their quarterly earnings this week. The performance scorecard of these companies could play a key role in influencing the near term market direction.

[caption id=“attachment_1168099” align=“alignleft” width=“380”]

From a trading perspective, the resistance at 6,140 and support at 5,825 are the levels to watch.[/caption]

From a trading perspective, the resistance at 6,140 and support at 5,825 are the levels to watch.[/caption]

From a trading perspective, the resistance at 6,140 and support at 5,825 are the levels to watch. A breach of either of these levels would trigger a big move in the direction of the breakout. Above 6,140, the Nifty could target the life-time high of 6,357 while a fall below 5,825 could push the index towards the major support at 5,625-5,650.

CNX Bank Index (10,622.15): This index has traced out a micro-level bullish sequence of higher highs and higher lows since Sept.30. The short-term trend is bullish and the index could test 11,250-11,300 as long as the support at 9,500 is intact.

A breakout past 11,300 would be a big positive sign and could trigger a rally to the major resistance zone at 11,150-11,300. The chart pattern in the private sector banks and select public sector banks are supportive of the bank index heading to 11,300 and beyond.

Maruti Suzuki (Rs.1,467): After a sharp fall, the stock has been in a recovery mode since Aug.28. The short-term outlook is bullish and the stock could rally to the immediate resistance at Rs.1,650.

Long positions may be considered in Maruti with a stop loss at Rs.1,360 and target of Rs.1,650. A move past Rs.1,650 would lend momentum to the uptrend and the stock could then target the major resistance at Rs.1,720

Escorts (Rs.97): After a sideways consolidation, the stock has resumed its uptrend a couple of weeks ago. The pick-up in momentum and trading volumes suggests that the buying interest in the stock. The short-term outlook is positive and the stock could rally to the immediate target at Rs.115.

[caption id=“attachment_1168101” align=“aligncenter” width=“600”]

The uptrend would gain momentum on a breakout past Rs.115 and the stock could then target Rs.122.[/caption]

The uptrend would gain momentum on a breakout past Rs.115 and the stock could then target Rs.122.[/caption]

Investors may buy the stock at the prevailing levels as well as on declines, with a stop loss at Rs.88 and target of Rs.115. The uptrend would gain momentum on a breakout past Rs.115 and the stock could then target Rs.122.

(The views and recommendations featured in this column are based on the technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)