Special to Firstpost

S&P CNX Nifty (5,333.55): The price action last Friday indicates that the anticipated downward correction is over. It is positive to note that the index has bounced off the key support level of 5,200 and it could now target the next significant resistance at the 5,700-level.

Wednesday’s low of 5,171 now becomes the crucial reference point for the bullish camp. As long as the index trades above this level, there would be a strong case for a rally to 5,700. On the other hand, a fall below 5,171 would indicate that the recent downward correction is not complete.

[caption id=“attachment_240065” align=“alignleft” width=“380” caption=“Long-term investors may hold on to their equity exposures and have a stop-loss at 5,000. Reuters”]

[/caption]

[/caption]

Long-term investors may hold on to their equity exposures and have a stop-loss at 5,000. As observed the previous week, a breach of the 5,000-level would raise doubts about the credibility and sustenance of the medium-term bullish trend.

CNX Bank Index (10,505.65): That the index managed to bounce off the crucial support at 10,070 (mentioned in the week before) is a sign of strength. The CRR cut announced by the Reserve Bank of India on Friday should bolster sentiment in the banking sector.

The index could now rally to the next resistance at the 11,500 level. Until the index falls below Wednesday’s low of 9,939, there would be a strong case for a rally to 11,500. A breakout past 12,100 would lend further momentum to the uptrend and also strengthen the medium-term bullish case scenario.

Grasim Industries (Rs 2,713.65): The short-term outlook is bullish and the stock could rally to the resistance at Rs 2,920. A breakout past Rs 2,910 would not only impart momentum to the uptrend, but would also propel the stock to the major target-cum-resistance level at Rs 3,300.

Long positions may be considered with a stop-loss at Rs 2,590, for an initial target of Rs 2,920. Those willing to play the waiting game may shoot for the target of Rs 3,300.

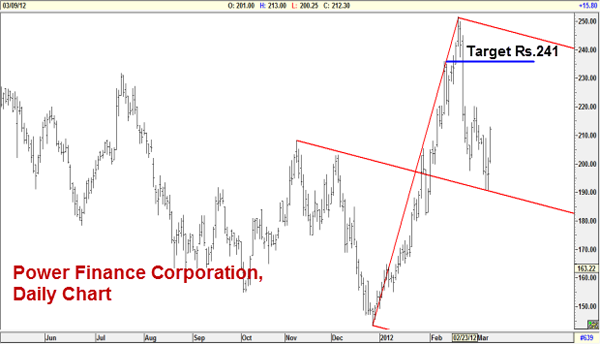

Power Finance Corporation (Rs 212.30): After a sharp run-up, the stock got into a downward corrective phase since 21 February. The price action in the past few days indicates that a downward correction over and the next leg of the uptrend is underway.

[caption id=“attachment_240060” align=“alignleft” width=“600” caption=“After a sharp run-up, the stock got into a downward corrective phase since 21 February.”]

[/caption]

[/caption]

Long positions may be considered with a stop-loss at Rs.165, for a target of Rs 241. A move past the initial resistance at Rs 241 could trigger a rally to the major resistance at Rs 260.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)