Special to Firstpost

S&P CNX Nifty (5,626.60): The price action during the week gone by was lacklustre and the index is still groping for direction. The absence of any sort of trigger, positive or negative, has pushed the Nifty back into a trading range. As long as the index trades below the immediate resistance at 5,690, the path of least resistance would be on the way down.

A breakout past 5,690 would be a sign of strength and would indicate that the journey towards the 6,000-target is underway. On the contrary, a fall below 5,540 would confirm that the index could slide to major support at 5,450.

From a medium-term perspective, the trend remains bullish and a rally to 6,000 remains the preferred view. The only uncertainty is whether the downward correction from the 5 October high of 5,815 is complete or not.

Considering the short-term uncertainty, Nifty is best avoided from a trading perspective. Compulsive Nifty traders may take the options route to scalp money from the broad range-bound action.

CNX Bank Index (11,475.80): The Nifty would get back into a trending mode once there is some traction in the bank index. Similar to the Nifty, the bank index too has been doing a whole lot of nothing in the past few weeks.

The index has to move past the recent high of 11,720 to indicate resumption of the medium-term uptrend. If not, there would be a strong case for a drift to the immediate support zone at 10,650-10,700.

Similar to the Nifty, the medium term outlook for the bank index too is positive and investors may use any weakness to build long positions in banking stocks. A fall below the major swing low at 8,990 is required to negate the medium-term bullish view.

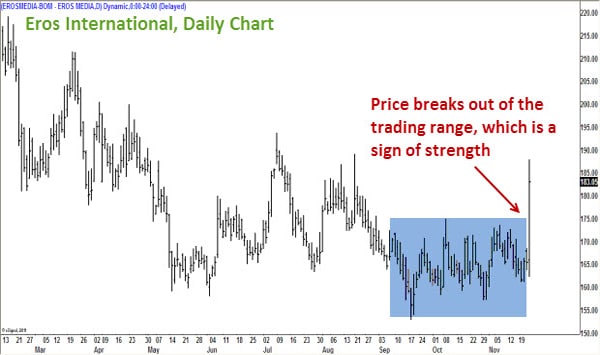

Eros International (Rs 183.05): This stock was one of the top gainers on Friday. This sharp rally has resulted in a breakout past the prior trading that the stock was confined to. The short-term outlook is bullish and a rally to Rs 205 appears likely. Considering the spike on Friday, investors may await a downward correction to buy the stock.

[caption id=“attachment_534089” align=“aligncenter” width=“600”]

Considering the spike on Friday, investors may await a downward correction to buy the stock.[/caption]

Considering the spike on Friday, investors may await a downward correction to buy the stock.[/caption]

The stop-loss for long positions may be placed at Rs 158, for an initial target of Rs 205. Long-term investors are likely to get exit opportunities at the major resistance at Rs 240.

India Glycols (Rs 187.20): After a sharp run-up, the stock has been in a downward correction in the past few weeks. The correction was arrested at the crucial support zone of Rs 175-177 and the chart patterns suggest that the stock could rally to Rs 210.

Long positions may be considered with a stop-loss at Rs 171 for a target of Rs 210. A breakout past the initial resistance at Rs 210 would be a sign of strength and could propel the stock to the major resistance at Rs 230.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)