Special to Firstpost

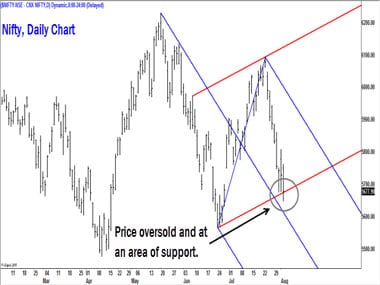

CNX Nifty (5,677.90): Stock market sentiment was bearish with the Nifty closing on a weak note for the eighth day in succession on 2 August. In the process, the Nifty also closed in the red on all days of the week gone by. The fall pushed the index to the support zone of 5,600-5,650 mentioned in the week before.

The slide from the 6,093-high has been so very one-sided that the Nifty is now in a deeply oversold region. While this does not preclude the index from falling further, there is a case for a meaningful pullback before the downtrend resumes.

While a breakout past the resistance at 5,760 would confirm the start of the anticipated pullback, a fall below 5,566 would suggest a continuation of the recent downtrend. As always, it makes sense to let the price action take the lead before drawing any conclusion about the near term trend.

Bank Index (9,997.80): Similar to the Nifty, this index too ruled weak and almost hit the downside target of 9,250-9,500 mentioned last week. The index is now perched at a crucial support level and a fall below 9,750 would not only be a sign of weakness but would also lend momentum to the downtrend.

Like in the Nifty, there is a possibility of a counter-trend rally in the Bank Index. This, however, hinges on the support at 9,750 remaining intact. A breach of this support would invalidate the chances of a meaningful recovery any time soon.

A move past 10,250 would suggest that a pull back to 11,000-11,250 is underway. As long as 9,750 is not breached, it would be reasonable to work on the premise that the index is headed towards 11,250.

Reliance Communications (Rs 123.60): The stock has been one of the top performers since April. The rally off the 26 March low of Rs 50.25 was arrested right at the crucial resistance-cum-target of Rs 146-150 range. The price action in the past few days suggests that the stock is in a short-term downward correction and a fall to Rs 108-110 appears likely.

Shareholders may reduce exposures while traders may consider short positions on any rally, with a stop-loss at Rs 145 and target of Rs 110. A fall below Rs 110 could open up downsides extending up to Rs 100.

ITC (Rs 335): After a sharp rally, the stock has fallen sharply in the past few trading sessions. The recent fall has pushed the price closer to the area of support at Rs 320-325 range.

Investors may buy the stock on weakness with a stop-loss at Rs 305 and target of Rs 365. A breakout above the initial target-cum-resistance level of Rs 365 would lend momentum to the uptrend and the stock could then rally to Rs 378-380 range.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)

)

)

)

)

)

)

)

)