The last three months have not been good for investors. The Sensex gained just half a percent during the period and what’s worse? Indian equities rank among the worst-performing stock market this year.

However, a smart investor knows that there are always pockets of growth in the markets, if you just know where to look. In the past three months, it turned out that money could be made if you had invested in specific mid-cap stocks.

[caption id=“attachment_150754” align=“alignleft” width=“380” caption=“While a majority of the 270 companies analysed declined, 60 stocks posted gains in the last three months. Reuters”]

[/caption]

[/caption]

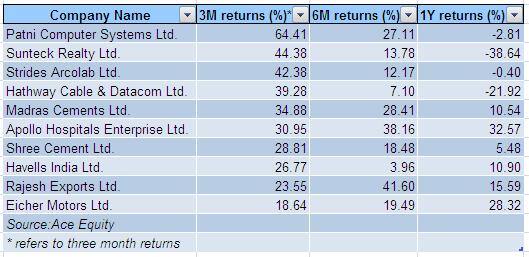

Firstpost did a quick analysis of the stocks comprising the BSE Midcap index using information available from Ace Equity’s database. While a majority of the 270 companies analysed declined, 60 stocks posted gains in the last three months. The top 10 gainers jumped more than 19 percent (with the top mid-cap stock earning 64 percent), which is quite impressive considering the Sensex’s gain of 0.55 percent.

In fact, these stocks even outperformed the BSE mid-cap index, which slumped 9.4 percent.

Some of the top gainers include:

•Patni Computer Systems ranked first with a gain of 64 percent after its promoter iGate decided to delist shares of its Indian unit so that it could acquire a majority shareholding in the company. While iGate currently holds 80.4 percent stake in the company, it requires another 10 million shares to satisfy the criteria for delisting, according to an article in The Economic Times.

iGate is offering share holders a minimum price of Rs356.74 per share. The delisting process is expected to be completed by mid-2012, the newspaper said.

•Mumbai-based Sunteck Realty came second with a 44 percent jump in market value over the past three months. The company hit the news recently after its promoters increased their stake in the company to around 70.08 percent for the September-ended quarter from 67 percent at the end of the previous quarter.

Another positive trigger was a 56 percent jump in Sunteck’s net profit to Rs4.6 crore for the September-ended quarter. It is currently quoting at Rs 368 per share.

•Strides Arcolab came in third handing 42 percent returns in the past three months. According to an article in Moneylife magazine, the promoters reduced their pledged shares by 1.5 percentage points during the quarter. It is currently quoting at Rs 425 per share.

•Hathway Cable & Datacom also soared nearly 40 percent in the past three months as investors bid prices up over expectations that it would be one of the top beneficiaries of the Cabinet nod to the Digitalisation Bill, which the industry had been awaiting for the past one year.

The implementation of the bill is expected to reduce carriage fees of broadcasters and promote the migration of analog cables customers to digital cable TV. The stock is currently quoting at Rs 121 per share.

•The 35 percent rise in Madras Cement’s stock can be primarily credited to the huge 256 percent jump in net profit for the September quarter, while sales rose by 28 percent. According to Angel Broking, the strong performance was because of a whopping 47 percent year-on-year jump in realisations as well as a low base.

Currently, the stock is trading at Rs116.3.

Below is the table of the top 10 stocks that outperformed the Sensex in the last 3 months.

[caption id=“attachment_150129” align=“alignnone” width=“529” caption=“Stock price as on 5th Dec.”]

[/caption]

[/caption]

)