The BSE IT index was the top gainer in a flat market on the back of stellar results from US-based Cognizant.

The company reported Q3 revenues at $2.31 billion, a growth of 6.7 percent sequentially and 21.9 percent compared to the same quarter last year. TCS , Wipro and Infosys were up around 1-2 percent in morning trade asCognizant’s results were seen as indicative of a sustainable turnaround for the industry.

Last quarter, Cognizant had given a revenue guidance of $2.25 billion, up 4.1 percent.

Owing to the performance of all four IT majors this quarter and the depreciating rupee; foreign brokerages like JP Morgan had expected Cognizant to beat its own guidance and see a revenue growth of 5 percent. However, the 6.7 percent gain not only indicates a positive impact of the rupee but are rebound in discretionary spending too.

At 09:30 am, the BSE IT index was trading 1.3 percent higher at 8405, as compared to 0.2 percent rise in the BSE Sensex to 21,026.34.

Sudarshan Sukhani of s2analytics.com recommends going long on the top five IT stocks.

In an interview with CNBC-TV18 he said, “IT sector has corrected and we have all seen that correction and we were all saying, avoid it, that correction now seems to be coming to an end. So certainly this is a very good time to go long in the five IT majors. Today is a good day.”

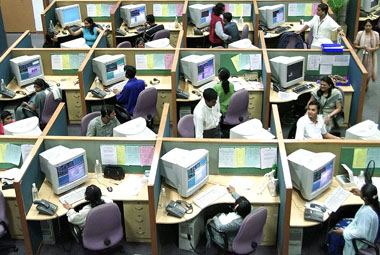

[caption id=“attachment_1211993” align=“alignleft” width=“380”]  Indians at work. Reuters[/caption]

Cognizant also reported a better-than-expected rise in revenue in third quarter, helped by contracts from insurers setting up online exchanges as part of President Barack Obama’s healthcare reforms. The company, which also raised its full-year forecast for both profit and revenue, said it would focus on winning more business from governments.

)

)

)

)

)

)

)

)

)