Stock broking firm Indo Thai Securities has opened its initial public offering for subscription today.

Indo Thai plans to raise funds anywhere between Rs 28 and Rs 33.6 crore through the offer. The price band will range within Rs 70 to Rs 84.

The company intends to spend the IPO fund for expansion and upgradation of existing branches and setting up branch network (with an outlay of Rs 2 crore), purchasing of office space for Mumbai regional office (with cost of Rs 4 crore), purchasing and setting up of office space for corporate office (with Rs 4 crore), brand building and advertising (Rs 3 crore) and augmenting long term working capital requirement (Rs 10 crore).

[caption id=“attachment_96852” align=“alignleft” width=“380” caption=“ITSL is a stock broking firm, dealing in securities, commodities and derivatives. Screengrab/indothai.com”]

[/caption]

[/caption]

Set up in 1995 ITSL deals in securities, commodities and derivatives. The client base of the company is 7200 across its 14 branches. Out of these, 13 are in Madhya Pradesh and one is in Maharashtra. The total employee strength is 59.

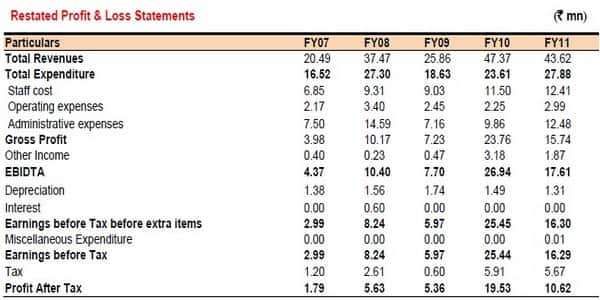

Though the company’s income and PAT have been rising consistently over thelast five years, its income for the first nine months of FY11 was down 7 percent to Rs 4.36 crore, while profits declined to Rs 1.06 crore compared to the previous year. The EPS declined to Rs 1.77 per share from Rs 9.75 in FY10, as the company issued bonus shares in the ratio of 2:1 in July 2010.

The number of active accounts also declined significantly from 2250 in FY10 to 1108 in FY11. In the first half of FY12 the company managed to open only 75 new accounts, compared to 500 it had opened in the last fiscal. This will put significant pressure on the company’s topline in the coming year.

Source: Keynote IPO note

Indo Thai is a very small player as compared to the established broking houses like Edelweiss, India Infoline and others. The total revenue of the company is about Rs 5 crore annually, which speaks very poorly of the company’s prospects. It is therefore very tough for the company to carve out a market for itself. Also the company is mainly present in central India, where it is planning to expand further. This will limit its business.

Where the bigger players are generating negative returns year to year, it is not too difficult to fathom that ITSL may not be able to do things differently.

Coming at a post issue PE multiple of 70.09 of FY11 earnings, the IPO is blatanly overpriced. A look at its peers is enough to substantiate that argument - the PE of India Infoline is 16 and India Bulls just 8.

The short conclusion: Put your money in better options.

)