[caption id=“attachment_150105” align=“alignleft” width=“380” caption=“Equities have lost about 18 percent, one of the worst performances in the past three decades. AFP”]

[/caption]

[/caption]

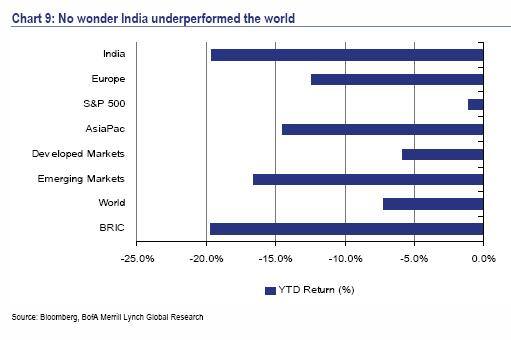

Indian equities rank among the worst-performing stock markets in the world in 2011, according to Bank of America Merrill Lynch (BoAML). Equities have lost about 18 percent, one of the worst performances in the past three decades, and erased the entire 17 percent gains made in 2010, it said in a report entitled “2011: Lost in chaos”.

A confluence of negative local (high inflation, high interest rates, slowing corporate earnings) and international factors (eurozone crisis, stalling global economic recovery) have contributed to the market’s poor performance.

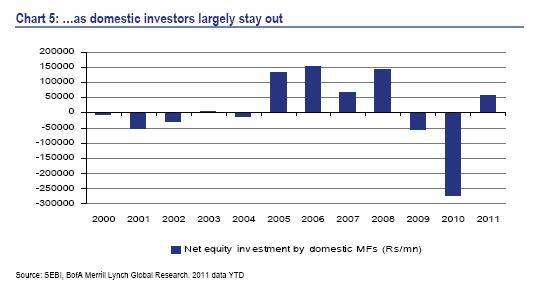

Domestic investors, put off by the local economic slowdown and growing global uncertainty, stayed away from the markets.

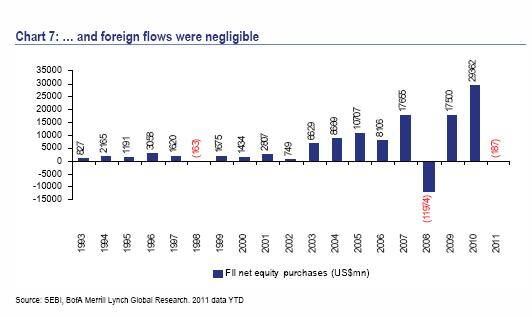

Foreign investors have also shied away. According to the brokerage, foreign institutional investors have been marginal sellers in Indian markets.

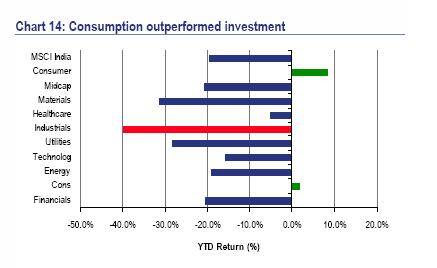

Among sectors, domestic consumption-related stocks were clear winners, according to BoAML. Discretionary consumption and staples (consumer necessities) were the only sectors that handed positive returns to investors. Investment was the worst-performing theme. The question is, how long will that trend continue? Consumption growth slowed to 5.9 percent in the September-ending quarter as high interest rates and inflation start to bite.

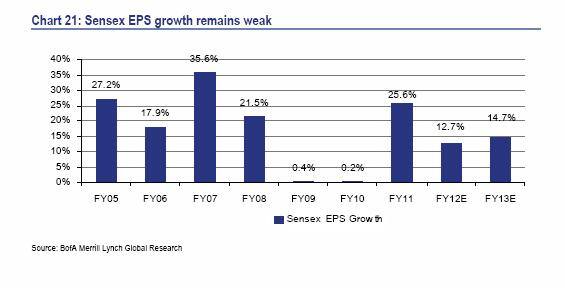

For the 12 months ending March 2012, the earnings per share for the Sensex is expected to grow by 12.7 percent - almost half the growth seen the previous year (26 percent). While sales have been strong for Corporate India, margins are being squeezed, which will affect profit growth going forward. The brokerage believes earnings downgrades will continue in the next financial year.

The brokerage said Sensex earnings for the year ending March 2012 will be marginally lowered to Rs 1,100 per share from current estimates of around Rs 1,115. For the year ending March 2013, earnings are likely to be downgraded substantially to Rs 1,200 per share from the current estimate of Rs 1,275, BoAML said.

)