The sharp 25 percent correction in the markets is a tempting offer to dive in. And, with a large number of stocks now trading close to their March 2009 price-to-earnings multiples, the prices seem just too attractive to pass by.

Hold On. Be warned as India is still trading at a premium.

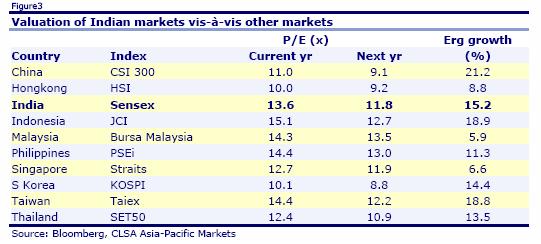

“MSCI India still trades at a 15 percent premium to MSCI Asia, leaving further room for a downside,” says CLSA in its report published on Thursday (see table). (The MSCI index, ex-Japan, consists of 10 developed and emerging market country indices and helps to measure the equity performance of Asia).

[caption id=“attachment_162958” align=“alignleft” width=“541” caption=“Source: CLSA”]

[/caption]

[/caption]

Here are some of the reasons why they are still cautious on India :

• First, there are indications of a slowdown in consumer demand, as noticed by them on their recent field trip to Punjab and a channel check.

• Second, the policy and governance paralysis continues to remain a cause of concern, as noticed by the recent rollback of the FDI (foreign direct investment) in retail. The agitation over the Lokpal bill seems to be coming to a boil again.

• Third, in spite of the fall in the premium in Indian markets to 17 percent from 25 percent during the last five years, India continues to trade at a premium. It was only during the last global financial crisis that India traded at a discount.

While it does not rule out the possibility of another global crisis, India is only 10 per cent away from its March 2009 low in terms of price-earnings multiples and valuation support should restrict the downside.

Overall, if you are interested in picking stocks, you could look at their top picks - ITC, Dr.Reddy, M&M’s and ICICI Bank - says CLSA.

)