Special to Firstpost

CNX Nifty (5,872.60): As anticipated in the week before, the Nifty struggled at the resistance zone of 5,940-5,970. After touching a high of 5,971 on Monday, the index cracked sharply in the next couple of trading sessions. Despite the impressive recovery on Thursday, the Nifty failed to get past this resistance zone on Friday, indicating selling pressure at higher levels.

Unless the index clears this resistance zone, the path of least resistance would be on the way down. A fall below Thursday’s low of 5,791 would be an early sign that the Nifty has resumed its downward corrective move.

The stage seems set for the Nifty to make a big decisive move. While a move to the lower side is the favoured view, it always makes sense to await confirmation from the price action. A move past 5,970 or a fall below 5,791 would set the tone for the next big move.

Index constituents such as HDFC Bank, Reliance Industries, ICICI Bank and ONGC sport a bearish outlook as well, strengthening the bear case scenario. Ahead of the key event such as the 19 March credit policy, it is safer to await confirmation from price action as volatility could increase.

Bank Index (11,816.55): The price pattern in this index was no different from the Nifty. A sharp crack in the early part of the week was followed by a sharp recovery on Thursday. Technically, the failure to get past the resistance at 12,500 is a sign of weakness.

Unless the Bank Index moves above 12,550, there would be a strong case for a slide to the short-term support in the 10,500-10,600 range. From a trading perspective, the levels of 12,550 and 11,550 would be something to pay attention to. A move beyond any of these levels would influence the next major move.

Rolta India (Rs 68.40): After a prolonged downward move, the Rolta stock has been in a consolidation mode in the past few weeks. The sharp rally on Friday, on the back of a spurt in trading volumes, suggests that a short-term uptrend may be underway.

Investors may use any price weakness to buy the stock with a stop-loss at Rs 63 and target of Rs 75. A fall below Rs 63 would, however, indicate that the prior downward move is still incomplete and may signal a further slide to support at Rs 58.

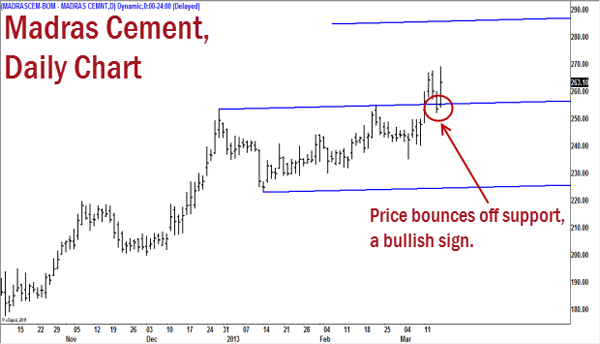

Madras Cement (Rs 263.65): The stock has been in a major uptrend and appears headed to its immediate target-cum-resistance at Rs .285. Long positions may be considered with a stop-loss at Rs 248, for a target of Rs 285.

[caption id=“attachment_663763” align=“alignleft” width=“600”] A breakout past the immediate resistance at Rs 285 would be a major sign of strength[/caption]

A breakout past the immediate resistance at Rs 285 would be a major sign of strength[/caption]

A breakout past the immediate resistance at Rs 285 would be a major sign of strength and the stock could then target the next resistance at Rs 296.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)