**Mumbai:**As companies revealed their share-holding pattern post the December-quarter results,Firspost decided to do a quick analysis of stocks in which foreign investors have reduced their holding, over the last four quarters ending December 2011.

First, some big numbers. Owing to the worsening debt crisis in the euro zone, Foreign Institutional Investors (FIIs) offloaded almost Rs 2,500 crore of equities during the October-December quarter. While this is quite a steep amount, we decided to find the stocks in which they have reduced their exposure. For our analysis, we have taken stocks in which FII holding has been reducing consistently for the last four quarters.

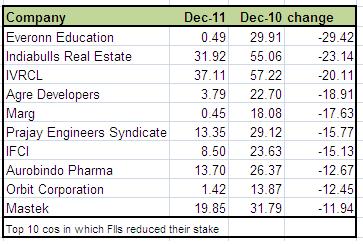

Almost 107 companies have seen a reduction in FII holding, as per data compiled from Ace Equity. Of these, 12 companies have reported a double-digit fall in foreign investor share holding pattern.

Top of the list was scam-tainted Everonn Education in which foreign investors have reduced their stake to a negligible amount (0.49 percent) from almost 30 percent in the year-ago quarter. Indiabulls real estate, IVRCL, Agre Developers, were some of the 12 stocks that saw a double-digit fall year-on-year.

Among sectors, banking was one area where FIIs reduced their stake, and this was largely seen in public sector banks like SBI and Union Bank of India (see table). The sharp reduction in bank share holding could mainly be because of concerns related to Non-Performing Assets (NPAs) as that amount could be as huge as Rs 94,000 crore. The recovery of loans has always been a problem for banks and financial institutions.

Among private sector banks, ICICI was the only one to report a fall in foreign holding so far. Concerns over its exposure towards troubled segments such as infrastructure and aviation and its exposure to international markets may have led to a 4.6 percent fall in holding to 34.74 percent for the December quarter. Incidentally, it also has the highest NPA among its private sector peers at Rs 9,816 crore.

)

)

)

)

)

)

)

)

)