Foreign institutional investors continued to pour money into Indian equities in the third quarter of FY13, pumping in $8.4 billion during the period. FIIs now hold about 20 percent in the BSE100, which is an all-time high. By contrast, domestic institutional investors (DIIs) sold $3.4 billion during the quarter.

FII flows into Indian equities are seen to be robust in the fourth quarter as well, with the Reserve Bank of India (RBI) beginning the easing of interest rates and a firm reform push being provided by the government.

[caption id=“attachment_622760” align=“alignleft” width=“380”]  The Edelweiss report showed the FIIs continued to be overweight on BFSI, IT and auto. Reuters[/caption]

According to an Edelweiss report on institutional ownership trends, the major chunk of the FII inflows was hogged by the banks, financial services and insurance (BFSI) sector, where 41 percent of the flows went. Besides, the relative positioning of BFSI, autos, utilities, capital goods and materials increased during the quarter, while there was a reduction in the relative positioning in consumers and IT. The proportion of flows to the auto sector also increased to 11 percent from 4 percent in the immediately preceding quarter.

Compared to the immediate previous quarter where FII flows were to the tune of $8.1 billion, the third quarter figures showed that the FII inflows into Indian markets continued to be robust.

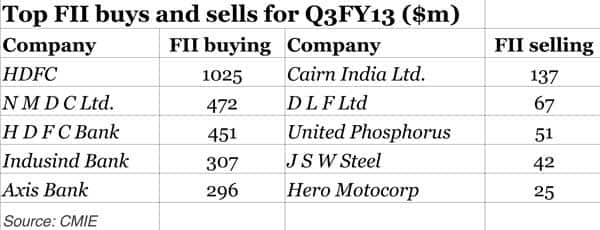

The Edelweiss report showed the FIIs continued to be overweight on BFSI, IT and auto, while they were underweight on sectors like capital goods, energy and consumer. Over the past few quarters, FIIs have been seen to have consistently increased their relative positioning in banks and reducing the relative positions in IT. The top FII buys for the quarter were HDFC, NMDC and HDFC Bank, while Cairn India, DLF and United Phosphorus were top sells for FIIs during the period, the report added.

By contrast to the FII flows, the DII holding in the BSE100 universe dipped to 12 percent during the quarter. DIIs continued to be overweight in consumer, capital goods and the energy sector, while they remained underweight on BFSI and software. The top DII buys during the quarter were NMDC, Reliance Power and Cairn India, while top DII sells were HDFC Bank, Mahindra & Mahindra and L&T.

The outlook for the fourth quarter also is turning out to be similar in terms of FII flows, with DIIs continuing to be net sellers. As at February 9, FIIs pumped in $7.1 billion into Indian equities in the fourth quarter.

[caption id=“attachment_622757” align=“alignleft” width=“600”]  CMIE[/caption]

)

)

)

)

)

)

)

)

)