Wipro, India’s third-largest software services provider, will demerge its consumer care and medical diagnostics units into a privately held company. The demerger is expected to be completed by next financial year, subject to regulatory approvals.

The separation of the IT services and consumer businesses would help command a better valuation for the software business, say analysts.

The company’s stock surged 3.35 percent to Rs 363 on BSE following the announcement, while the BSE Sensex is down 0.03 percent at 18499 levels.

“Creating a technology-focused company will allow us to better serve the needs of our customers, and accelerate investments necessary to capitalize on market growth opportunities” said TK Kurien, CEO, IT Business and Executive Director, Wipro in a statement today.

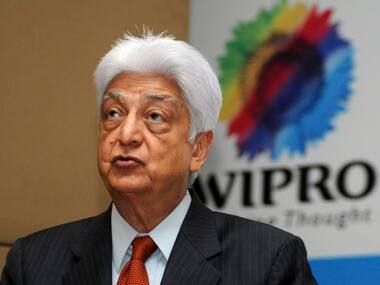

[caption id=“attachment_510563” align=“alignleft” width=“380”]

The company has initiated steps to hive off its consumer care and lighting business unit.[/caption]

The company has initiated steps to hive off its consumer care and lighting business unit.[/caption]

Wipro will continue to be a publicly listed company that will focus exclusively on information technology. The board will remain unchanged and the demerger will have no impact on the management structure of the company, the statement said.

“The board of directors of the company in their meeting held on today, approved the demerger of the Wipro Consumer Care & Lighting (including Furniture business), Wipro Infrastructure Engineering (Hydraulics & Water businesses), and Medical Diagnostic Product & Services business (through its strategic joint venture), into a separate company to be named Wipro Enterprises,” Wipro said in a regulatory filing.

Wipro has constituted a special committee of its board o to oversee the planning and execution of the demerger plan.

Azim Premji will remain Executive Chairman of the Board of Wipro and will assume the position of Non-Executive Chairman of Wipro Enterprise.

According to the restructuring scheme as currently proposed, resident Indian shareholders can choose from multiple options as per their investment objectives. They may opt to:

(i) receive one equity share with face value of Rs.10 in Wipro Enterprises for every five equity shares with face value of Rs.2 each in Wipro that they hold; or

(ii) receive one 7% Redeemable Preference Share in Wipro Enterprises, with face value of Rs.50, for every five equity shares of Wipro that they hold; or

(iii) exchange the equity shares of Wipro Enterprises and receive as consideration shares of Wipro held by the Promoter. The exchange ratio will be 1 equity share in Wipro for every 1.65 equity shares in Wipro Enterprises .

Each redeemable preference share shall have a maturity of 12 months and shall be redeemed at a value of Rs.235.20.

)