Even as investors struggle to make money in stock markets across the globe, there are some pockets in the Indian market that continue to show jaw-dropping growth.

Find that hard to believe? Well, we’re not kidding. Where did we find these stocks ? In that usually neglected space of small-cap stocks.

_Firstpost_looked at some companies making up the BSE- Small cap index (comprising around 541 companies) and found that the top gainers in this list boasted some stunning returns of more than 500 percent in the past one year.

[caption id=“attachment_137241” align=“alignleft” width=“380” caption=“BSE-Small cap index comprises extremely high-risk stocks that are typically very speculator-driven. Reuters”]

[/caption]

[/caption]

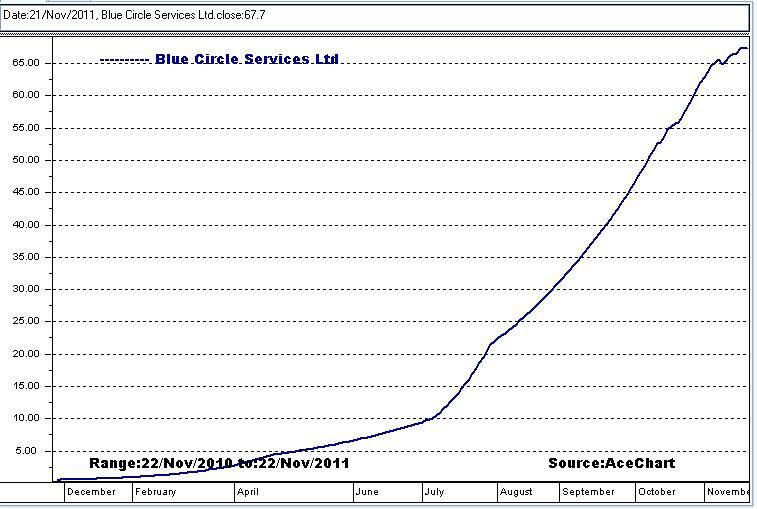

In fact, our list of small-cap winners was led by Blue Circle Services, which yielded a flabbergasting 29,207 percent over the past one year (see chart). The stock, which_Firstpost_admits to never having heard of, sky-rocketed to Rs 65 per share from 20 paise per share (adjusted for split) in the past 12 months and certainly warrants some analysis.

On a preliminary examination, thecompany’s financials are nothing to write home about.While its revenues moved up to Rs 1.89 crore for the year ended March 2011 from Rs 17 lakh the previous year, that alone does not justify the phenomenal jump in returns. Over the past 12 months, the company’s market capitalisation has soared to Rs 1,377 crore from Rs 3 crore or so.

As per the company’s annual report, it provides “advisory services to clients and also invests its surplus funds in capital, securities and commodities markets as well as doing financing for corporate clients and HNIs (high net-worth individuals)”.

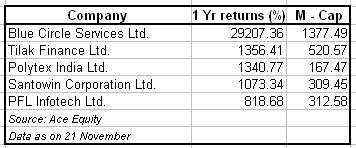

A couple of other stocks also gave eye-popping returns, such as Tilak Finance, Polytex India and Santowin Corporation. All three gained more than 1,000 percent over the past one year.However, if one looks at their net profit for the year ended March 2011, it’s less than Rs 16 lakh.

[caption id=“attachment_137245” align=“alignleft” width=“356” caption=“Small cap stocks”]

[/caption]

[/caption]

Of course, before you decide to whip out your cheque books and buy these stocks in the hope that they’ll continue their sterling run, consider this: the BSE-Small cap index comprises extremely high-risk stocks that are typically very speculator-driven. In addition, they can also be quite illiquid -difficult to buy and sell easily.

We’ve all heard the horror stories: investors, in a bid to make a quick buck, end up investing in these stocks and then get stuck after traders pump up the stocks’ value and then exit at high levels, causing the stock to fall and leaving the naive investor penniless in the end. Investors buy into these stocks in the hope that they could be buying the next Infosys cheap, said one market analyst who declined to be named, or in the belief that there is ample room for the stock to appreciate.

So, while the stock returns in this segment might look irresistible, investors need to exercise caution and be fully aware of the risks while investing.

FIRSTPOST DISCLAIMER: Firstpost brings you information and opinions on shares, funds and other investment options based on broker reports and private equity research. Investors are, however, warned that they should NOT take any buy or sell decision based on the views expressed in our posts or what market movements. Investors should consult their own financial and share advisors before taking purchase or sale decisions. Firstpost does not take any responsibility for any losses incurred by investors who take their cues from our posts and chat sessions.

)