With the Sensex tanking on Thursday on reports of Foreign Institutional Investors (FIIs) fleeing from the market, Firstpost decided to run a query to check which companies have the highest FII stake. For our analysis, we have chosen companies from the BSE-500 index and only those firms where shareholding pattern is available for the September and June 2011 quarter.

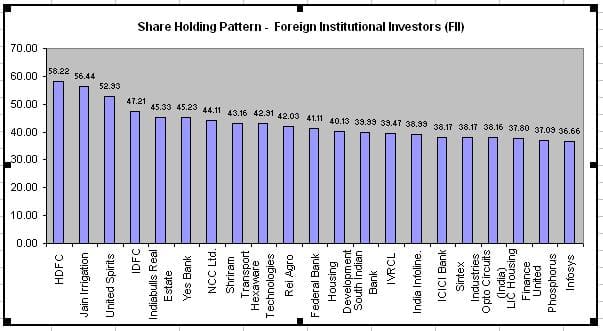

The table below shows the top 20 FII holding in companies.

[caption id=“attachment_139176” align=“alignleft” width=“603” caption=“Source:Ace Equity”]

[/caption]

[/caption]

• HDFC takes the top spot with a FII stake of 58.22 percent for the September quarter. Over the last one year its stock has fallen by only 11.37 percent compared to a steeper 20 percent fall in the Sensex. Today it was trading lower by one percent at Rs 619 vis Sensex rise of 0.19 percent.

Citigroup Strategic Holdings Mauritius emerged as the top fund holding an 8.79 percent stake in the company followed by Europacific Growth Fund at 4.46 percent. Over very own Life Insurance Corporation of India (LIC) also has a 3.21 percent stake in the company which increased marginally over the last quarter. Overall, the FII holding increased by a minuscule 0.10 percent.

• Jain Irrigation Systems is in at second place in spite of a whopping 43.2 percent fall in its stock over the last one year. The stock has fallen by almost three percent today (Rs 119.8), far more than the markets. FII holding stood at 56.44 percent, up 1.27 percent over the June quarter. Top funds here include the likes of Emerging Markets Growth Fund (5.05 percent), Janus Orion Fund (4.57 percent) and Smallcap World Cap Fund INC (4.5%).

•United Spirits also reported a 47 percent fall in market value over the last one year. Today it is lower by a marginal 0.2 percent. However, this did not deter FIIs which increased their stake by 1.5 percent to 52.93 percent in the company for the September quarter. HSBC Global Investment funds (Mauritius) holds a substantial chunk, totaling 7.57 percent, for the September quarter. Emerging Markets Growth Fund Inc and New World Inc were some of the other funds holding a 4.52 percent and 3.98 percent stake in the company, respectively.

•Infrastructure Development Finance Company (IDFC) FII holding increased by a minuscule 0.44 percent to 47.21 percent for the September quarter. However, its stock return was nothing to talk about as it reported a 45.5 percent fall in the last one year vis-a-vis Sensex’s fall of 20 percent. Today, its stock was up by 3.25 percent to Rs106.3 per share.

The ‘President of India’ has the largest stake in the company with a 17.86 percent stake for the September quarter. Sipadan Investments is in at second spot with a 8.87 percent stake followed by LIC who’s stake increased by 0.55 percent to 4.42 percent during the quarter.

Overall, a majority of companies reported an increase in their FII holdings with only a handful reporting a fall. IVRCL, India bulls Real Estate and Yes Bank reported a 8.83 percent, 4 percent and 2.86 percent fall.

)