After the quarterly results of the following four companies were released earlier this week, some leading brokerages brought out result review notes.

Here is what they had to say:

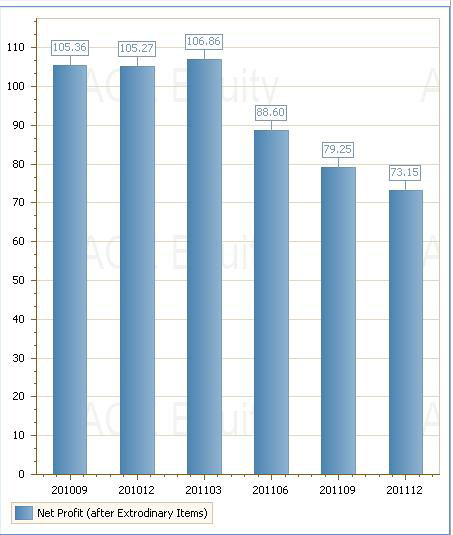

•Edelweiss is bearish on Aban Offshore with a price target of Rs 363 per share. The stock is currently trading at Rs 471. In spite of reporting higher-than-expected revenue numbers, the company’s net profit was below expectations due to higher interest and depreciation costs.

[caption id=“attachment_201012” align=“aligncenter” width=“453” caption=“Edelweiss expects net profit to deteriorate further as the company’s NOK bonds were recently refinanced at a higher 12 percent against the earlier rate of 9.3 percent”]  [/caption]

Edelweiss expects net profit to deteriorate further as the company’s bonds raised in Norway (NoK) were recently refinanced at a higher 12 percent against the earlier rate of 9.3 percent. Also, a further $170 million in bonds come up for refinancing in March 2012, which will lead to even higher interest costs. That will offset any gains Aban would have made from improvements in the oil rig market.

Moreover, its four rigs - accounting for 30 percent of Aban’s revenues -deployed in Iran are a cause of concern as there could be problems regarding payments after Europe imposed sanctions on Iran for pursuing a nuclear weapons programme.

Continues on the next page

•JP Morgan is underweight on Titan Industries with a price target of Rs 200 per share. The stock is currently trading at Rs 195 per share. Sales and net profit rose by 25 percent and 16 percent, respectively, for the quarter ended December 2011, below market expectations on account of lower demand for jewellery and a weak margin performance by the watches division.

[caption id=“attachment_201029” align=“aligncenter” width=“458” caption=“According to a conference call with analysts, the company noted that consumer demand for jewellery was muted in the current environment (jewellery accounts for 77 percent of Titan’s sales).”]  [/caption]

According to a conference call with analysts, the company noted that consumer demand for jewellery was muted in the current environment (jewellery accounts for 77 percent of Titan’s sales). Volatile and high gold prices remain a cause of concern, especially for impusle jewellery purchases, the report added.

Titan was one of the first companies in India to enter the organised jewellery retail segment with the launch of ‘Tanishq’, and accounts for 40 percent of the organized jewellery market, according to JP Morgan.

Continues on the next page

•Kotak Securities is bearish on Siemens with a price target of Rs 735 per share (its current price is Rs 730). The company reported a sharp 70 percent fall in net profit, its lowest since March 2008, after being hit by a lack of activity in the domestic power transmission and distribution arena as well as muted industrial capex.

[caption id=“attachment_201032” align=“alignleft” width=“493” caption=“Margins are likely to stay subdued because of higher labour costs and input prices, the brokerage predicted.”]  [/caption]

Growth in the power sector remains elusive due to skewed policies, high interest rates and regulatory hurdles, the report noted. While Kotak expects the domestic business to remain muted in the first half of calendar 2012, there could be increasing competition in the power segment from domestic rivals, it added. Margins are also likely to stay subdued because of higher labour costs and input prices, the brokerage predicted.

Continues on the next page

•Edelweiss is bearish on Punjab National Bank with a price target of Rs 879 per share. The stock is currently trading at Rs 949. For the December-ending quarter, the company reported a lower-than-expected net profit largely due to higher provisioning for bad loans.

[caption id=“attachment_201034” align=“aligncenter” width=“410” caption=“Edelweiss is bearish on Punjab National Bank with a price target of Rs 879 per share.”]  [/caption]

According to the report, higher levels of restructured assets and consistently high slippages (loans turning bad) are some of the reasons for the strained earnings growth ( the bank’s net profit has hovering in the Rs 1100-1200 crore range for the past eight quarters).

)

)

)

)

)

)

)

)

)