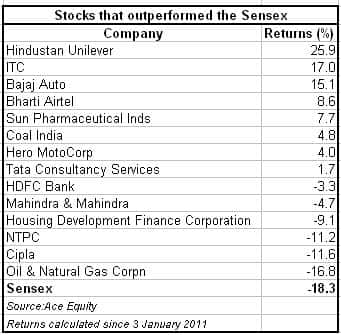

No surprises for guessing which stocks topped the list of gainers: Hindustan Unilever and ITC -both fast-moving consumer goods (FMCG). While HUL added on nearly 26 percent since January, ITC soared 7 percent.

[caption id=“attachment_152107” align=“alignleft” width=“380” caption=“Reuters”]

[/caption]

[/caption]

Meanwhile, the Sensex lost 18 percent during the same period and turned Indian markets into one of the worst-performing stock markets in the world in 2011.

FMCG stocks were in the limelight for most of the year as investors piled into defensive sectors during a prolonged period of market uncertainty.

Among the 30 stocks that constitute the Sensex, eight reported gains, while another six outperformed the Sensex but still posted losses (see table).

[caption id=“attachment_151925” align=“alignleft” width=“341” caption=“Table”]

[/caption]

[/caption]

Sixteen stocks underperformed the Sensex.

The outlook for FMCG stocks remains relatively buoyant, although some analysts have said that stock valuations are already quite high in the sector.

HSBC Equities recently initiated coverage on the FMCG sector with a preference for HUL. The brokerage put a price target of Rs 460 per share against the share’s current market price of Rs 386.

According to the brokerage, the Indian arm of Unilever is set to outpace domestic rivals in the home and personal care categories by growing at a compounded annual rate of 14.5 percent and 21 percent, respectively, between the financial years 2010-11 and 2013-14 (April March).

ITC, the second-biggest Sensex gainer, was given a price target of Rs 242; the stock is currently trading at Rs 196. HSBC expects the cigarette segment, its core business, to continue driving value for the company. It expects the company to clock a top-line CAGR of 19 percent between financial years 2010-11 and 2015-16 (April-March).

Bajaj Auto was next with a gain of 15 percent. Ambit is positive on the company due to its strong exposure to the export markets. It has a buy rating on the company with a price target of Rs 1,840 per share compared to its current price of Rs1,668 per share.

Other gainers include Bharti Airtel, Sun Pharma, Coal India, Hero MotoCorp, TCS and HDFC Bank.

[caption id=“attachment_151987” align=“alignleft” width=“289” caption=“Table 2”]

[/caption]

[/caption]

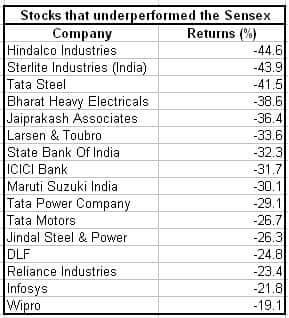

Metal and mining stocks were the worst Sensex performers, with Hindalco, Sterlite Industries and Tata Steel leading the list of losers.

All three companies posted dismal financial performances for the September-ended quarter, and the outlook for the near future does not seem buoyant.Brokerage Kim Eng has a ‘sell’ rating on Tata Steel as it expects a sharp rise in coal prices at its European business to continue affecting profits for the December-ending quarter.

Other losers include BHEL, Jaiprakash Associates, L&T, SBI, ICICI Bank and Maruti Suzuki etc. (see table 2 )

For now, a lot depends on which direction Foreign Institutional Investors (FIIs) go in 2012 - buy or sell.

)