The Goods and Services Tax (GST) Council held its crucial meeting on 11 July in New Delhi. The 50th meeting, which was presided over by Union Finance Minister Nirmala Sitharaman, covered a variety of topics, including the definition of multi-purpose vehicles, new taxation rates for online gaming, and improving registration and claim requirements for Input Tax Credit (ITC). Some goods and services will become more expensive while others will become less expensive as a result of the GST Council’s unanimous approval of a number of proposals. Let’s take a closer look. [caption id=“attachment_12856532” align=“alignnone” width=“640”] Union Minister for Finance and Corporate Affairs Nirmala Sitharaman poses for a group photo at the 50th meeting of GST Council, at Vigyan Bhawan in New Delhi. PTI[/caption] Also read: Indian markets are well regulated: Finance Minister Nirmala Sitharaman to Network18

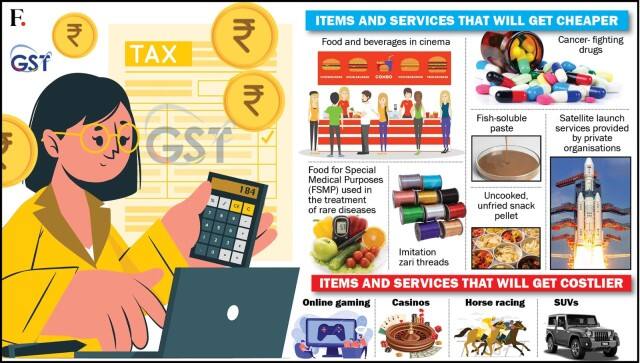

Items and services that will get low-priced Uncooked, unfried snack pellets and fish-soluble paste now have a GST rate of just five per cent instead of the previous 18 per cent. In place of the previous 12 per cent GST, imitation zari threads and yarn will now be subject to five per cent GST. The Council also agreed that instead of levying an 18 per cent tax on movie services, food and beverages eaten inside movie theatres will instead be subject to a five per cent GST without any input tax credits. The Council decided to exempt from GST foods for special medical purposes (FSMP) used in the treatment of rare diseases, medicines for uncommon diseases, and drugs connected to cancer. Sitharaman added, “On services, we have offered exemption on GST for satellite launch services provided by private organisations." Also read: GST has done justice to consumers by bringing rates down, says Finance Minister Nirmala Sitharaman

Items and services that will get dearer Additionally, the Council voted to eliminate the difference rate of compensation cess and move all Utility Vehicles (UVs) into the 22 per cent cess bracket, an increase of two per cent. This also implies that the new tax bracket will apply to sport utility vehicles (SUVs) and multi-utility vehicles (MUVs). No matter what the vehicle is termed, according to the Council, as long as it satisfies certain requirements, it will be subject to a 22 per cent compensation cess over and above 28 per cent GST. The GST Council decided to impose the highest tax rate of all four slabs — 28 per cent — putting an end to a dispute that had lasted years about how to tax online gambling, casinos, and horse racing. The GST legislation will be changed to cover internet gaming, according to Sitharaman, and bets and wagers made on all three activities would be subject to a 28 per cent levy whether they entail skill, chance, both, or none. According to FM Sitharaman, amendments to the GST law will make it clear that these three supplies are not actionable claims, unlike lotteries and wagering, and that they are not subject to penalties. [caption id=“attachment_12857452” align=“alignnone” width=“640”]

Union Minister for Finance and Corporate Affairs Nirmala Sitharaman poses for a group photo at the 50th meeting of GST Council, at Vigyan Bhawan in New Delhi. PTI[/caption] Also read: Indian markets are well regulated: Finance Minister Nirmala Sitharaman to Network18

Items and services that will get low-priced Uncooked, unfried snack pellets and fish-soluble paste now have a GST rate of just five per cent instead of the previous 18 per cent. In place of the previous 12 per cent GST, imitation zari threads and yarn will now be subject to five per cent GST. The Council also agreed that instead of levying an 18 per cent tax on movie services, food and beverages eaten inside movie theatres will instead be subject to a five per cent GST without any input tax credits. The Council decided to exempt from GST foods for special medical purposes (FSMP) used in the treatment of rare diseases, medicines for uncommon diseases, and drugs connected to cancer. Sitharaman added, “On services, we have offered exemption on GST for satellite launch services provided by private organisations." Also read: GST has done justice to consumers by bringing rates down, says Finance Minister Nirmala Sitharaman

Items and services that will get dearer Additionally, the Council voted to eliminate the difference rate of compensation cess and move all Utility Vehicles (UVs) into the 22 per cent cess bracket, an increase of two per cent. This also implies that the new tax bracket will apply to sport utility vehicles (SUVs) and multi-utility vehicles (MUVs). No matter what the vehicle is termed, according to the Council, as long as it satisfies certain requirements, it will be subject to a 22 per cent compensation cess over and above 28 per cent GST. The GST Council decided to impose the highest tax rate of all four slabs — 28 per cent — putting an end to a dispute that had lasted years about how to tax online gambling, casinos, and horse racing. The GST legislation will be changed to cover internet gaming, according to Sitharaman, and bets and wagers made on all three activities would be subject to a 28 per cent levy whether they entail skill, chance, both, or none. According to FM Sitharaman, amendments to the GST law will make it clear that these three supplies are not actionable claims, unlike lotteries and wagering, and that they are not subject to penalties. [caption id=“attachment_12857452” align=“alignnone” width=“640”] Graphic: Pranay Bhardwaj[/caption] “GST Council’s discussions today on online gaming were substantive. The Council will ensure it is in touch with the IT ministry. We will align with the regulation the ministry brings in,” the Finance Minister said, adding that however, the effective date for the 28 per cent GST levy on online gaming will roll out after amendments to GST law, Sitharaman clarified. “The GST Council’s intention is not to hurt the online gaming industry or states with casinos. A few states shared their concerns. But there is a moral question: can we encourage them more than essential goods? So I am proud to say that the GST Council discussed and understood the matter deeply and took a decision which had been pending for 2-3 years. The issue is very complex,” Finance Minister Sitharaman said. Currently, online betting and gambling are subject to a 28 per cent GST regardless of whether they involve skill or chance. On other games’ gross gaming revenue (GGR), there is an 18 per cent tax. Notably, the GST Council had previously established a commission to study taxes on casinos, horse racing, and internet gaming, but it was unable to determine whether to impose a 28 per cent GST on the face value of bets, gross gaming revenue, or only platform fees. Conrad Sangma, the chief minister of Meghalaya, served as the GoM’s convener, and he sent Union Finance Minister Nirmala Sitharaman a report on the taxation of online gaming, casinos, and racetracks in December. After delivering the report back then, Sangma said that the GoM had failed to reach an agreement and had instead provided the report with opposing points of view. He continued by saying that the GST Council must now make a final decision on the topic. Also read: Online gaming platforms want their users to believe that their products are a game of skill. Are they really?

Criticism Many people view the government’s plan to impose a 28 per cent GST as a serious blow for the $1.5 billion industry in the nation. Indian gaming businesses like Dream11 and Mobile Premier League, famed for fantasy cricket, have received funding from international investors like Tiger Global and Sequoia Capital. The All India Gaming Federation (AIGF), which represents companies like Nazara, GamesKraft, Zupee and Winzo, said the decision by the council is unconstitutional, irrational, and egregious. “The decision ignores over 60 years of settled legal jurisprudence and lumps online skill gaming with gambling activities. This decision will wipe out the entire Indian gaming industry and lead to lakhs of job losses and the only people benefitting from this will be anti-national illegal offshore platforms,” AIGF CEO Roland Landers said. He said that when the central government has been supporting the industry, it is unfortunate that such a legally untenable decision has been taken, ignoring the views of most GoM states who studied this matter in detail. “The implementation of a 28 per cent tax rate will bring significant challenges to the gaming industry. This higher tax burden will impact companies’ cash flows, limiting their ability to invest in innovation, research, and business expansion,” IndiaPlays COO Aaditya Shah said. He also said that skill-based games and apps engaged in betting or casinos should not be treated in the same manner. E-Gaming Federation (EGF), whose members include Games 24x7 and Junglee Games, said that a tax burden where taxes exceed revenues will not only make the online gaming industry unviable but also boost black market operators at the expense of legitimate tax-paying players. “It is in addition to the loss of employment opportunities and the huge impact on marquee investors who are heavily invested in this sunrise sector,” EGF Secretary Kumar Shukla said. EGF claimed that online gaming is different from gambling, and the Supreme Court and various High Court decisions have reaffirmed the status of online skill-based games as legitimate business activity protected as a fundamental right under the Indian constitution. “While the industry was quite optimistic with the new developments including amendments to the IT rules and implementation of TDS on net winnings, all this will be moot if the industry is not supported by a progressive GST regime,” Shukla said. PlayerzPot Co-Founder & Director Mitesh Gangar said the higher burden will also impact the country’s massive gaming industry and deter new players from entering the industry. “The rising gaming economy will take a big hit and trigger economic stress, restrict job creation and curtail economic growth within the sector,” Gangar said. The Federation of Indian Fantasy Sports (FIFS) said the decision will shift users to illegal betting platforms leading to user risk and loss of revenue for the government. Deloitte India, Partner, Shilpy Chaturvedi said the council has proposed to increase the tax rate to 28 per cent rate and that too on the entry amount particularly for real money games. “Moreover, the GST Council has recommended removing the critical distinction between a game of skill and a game of chance, which has always been a determining factor in applying the rate of tax and valuation. This distinction had its fair share of challenges, not only for the GST but under regulatory laws as well,” Chaturvedi said. Also read: Multi-crore GST scam: Three more held, total arrests 19

About GST Council GST Council members must agree on any modifications to these policies before they can be implemented. The GST Council is in charge of making decisions about GST rates, rules, and regulations. For Indian firms and consumers, the council’s decisions might have a big impact. Conrad Sangma, the chief minister of Meghalaya, organised the Group of Ministers in the GST Council, which includes representatives from eight states: West Bengal, Uttar Pradesh, Goa, Tamil Nadu, Telangana, Gujarat, and Maharashtra. The council has already held 49 meetings and made over 1,500 decisions in the spirit of cooperative federalism prior to the 50th meeting.

Graphic: Pranay Bhardwaj[/caption] “GST Council’s discussions today on online gaming were substantive. The Council will ensure it is in touch with the IT ministry. We will align with the regulation the ministry brings in,” the Finance Minister said, adding that however, the effective date for the 28 per cent GST levy on online gaming will roll out after amendments to GST law, Sitharaman clarified. “The GST Council’s intention is not to hurt the online gaming industry or states with casinos. A few states shared their concerns. But there is a moral question: can we encourage them more than essential goods? So I am proud to say that the GST Council discussed and understood the matter deeply and took a decision which had been pending for 2-3 years. The issue is very complex,” Finance Minister Sitharaman said. Currently, online betting and gambling are subject to a 28 per cent GST regardless of whether they involve skill or chance. On other games’ gross gaming revenue (GGR), there is an 18 per cent tax. Notably, the GST Council had previously established a commission to study taxes on casinos, horse racing, and internet gaming, but it was unable to determine whether to impose a 28 per cent GST on the face value of bets, gross gaming revenue, or only platform fees. Conrad Sangma, the chief minister of Meghalaya, served as the GoM’s convener, and he sent Union Finance Minister Nirmala Sitharaman a report on the taxation of online gaming, casinos, and racetracks in December. After delivering the report back then, Sangma said that the GoM had failed to reach an agreement and had instead provided the report with opposing points of view. He continued by saying that the GST Council must now make a final decision on the topic. Also read: Online gaming platforms want their users to believe that their products are a game of skill. Are they really?

Criticism Many people view the government’s plan to impose a 28 per cent GST as a serious blow for the $1.5 billion industry in the nation. Indian gaming businesses like Dream11 and Mobile Premier League, famed for fantasy cricket, have received funding from international investors like Tiger Global and Sequoia Capital. The All India Gaming Federation (AIGF), which represents companies like Nazara, GamesKraft, Zupee and Winzo, said the decision by the council is unconstitutional, irrational, and egregious. “The decision ignores over 60 years of settled legal jurisprudence and lumps online skill gaming with gambling activities. This decision will wipe out the entire Indian gaming industry and lead to lakhs of job losses and the only people benefitting from this will be anti-national illegal offshore platforms,” AIGF CEO Roland Landers said. He said that when the central government has been supporting the industry, it is unfortunate that such a legally untenable decision has been taken, ignoring the views of most GoM states who studied this matter in detail. “The implementation of a 28 per cent tax rate will bring significant challenges to the gaming industry. This higher tax burden will impact companies’ cash flows, limiting their ability to invest in innovation, research, and business expansion,” IndiaPlays COO Aaditya Shah said. He also said that skill-based games and apps engaged in betting or casinos should not be treated in the same manner. E-Gaming Federation (EGF), whose members include Games 24x7 and Junglee Games, said that a tax burden where taxes exceed revenues will not only make the online gaming industry unviable but also boost black market operators at the expense of legitimate tax-paying players. “It is in addition to the loss of employment opportunities and the huge impact on marquee investors who are heavily invested in this sunrise sector,” EGF Secretary Kumar Shukla said. EGF claimed that online gaming is different from gambling, and the Supreme Court and various High Court decisions have reaffirmed the status of online skill-based games as legitimate business activity protected as a fundamental right under the Indian constitution. “While the industry was quite optimistic with the new developments including amendments to the IT rules and implementation of TDS on net winnings, all this will be moot if the industry is not supported by a progressive GST regime,” Shukla said. PlayerzPot Co-Founder & Director Mitesh Gangar said the higher burden will also impact the country’s massive gaming industry and deter new players from entering the industry. “The rising gaming economy will take a big hit and trigger economic stress, restrict job creation and curtail economic growth within the sector,” Gangar said. The Federation of Indian Fantasy Sports (FIFS) said the decision will shift users to illegal betting platforms leading to user risk and loss of revenue for the government. Deloitte India, Partner, Shilpy Chaturvedi said the council has proposed to increase the tax rate to 28 per cent rate and that too on the entry amount particularly for real money games. “Moreover, the GST Council has recommended removing the critical distinction between a game of skill and a game of chance, which has always been a determining factor in applying the rate of tax and valuation. This distinction had its fair share of challenges, not only for the GST but under regulatory laws as well,” Chaturvedi said. Also read: Multi-crore GST scam: Three more held, total arrests 19

About GST Council GST Council members must agree on any modifications to these policies before they can be implemented. The GST Council is in charge of making decisions about GST rates, rules, and regulations. For Indian firms and consumers, the council’s decisions might have a big impact. Conrad Sangma, the chief minister of Meghalaya, organised the Group of Ministers in the GST Council, which includes representatives from eight states: West Bengal, Uttar Pradesh, Goa, Tamil Nadu, Telangana, Gujarat, and Maharashtra. The council has already held 49 meetings and made over 1,500 decisions in the spirit of cooperative federalism prior to the 50th meeting.

Before the recent meeting, FM Sitharaman’s Office tweeted, “The 50th meeting is a milestone which indicates the success of cooperative federalism and establishment of a good and simple tax regime.” With inputs from PTI

)