Rich, richer and richest… India’s wealth creation is rapidly rising with the number of millionaires rising by the minute. In fact, the country has added a dollar millionaire household every 30 minutes during the past four years, with the number of such households — families with at least Rs 8.5 crore in assets — nearly doubling from 4.58 lakh in 2021 to 8.71 lakh in 2025.

But how does this compare to China, the Asian giant with the world’s second-largest economy?

According to the Mercedes-Benz Hurun India Wealth Report 2025 and Hurun China Wealth Report 2024, the gap between India and China when it comes to ‘crorepatis’ is closing in faster.

Here’s what the report reveals.

India’s rich list grows bigger

As per the Mercedes-Benz Hurun India Wealth Report 2025, India is witnessing a rapid rise in affluence . The number of millionaire households in India (those having a net worth of more than Rs 8.5 crore) has dramatically increased, from 4.58 lakh in 2021 to 8.71 lakh this year. The report added that these millionaire families now form 0.31 per cent of all households in the country.

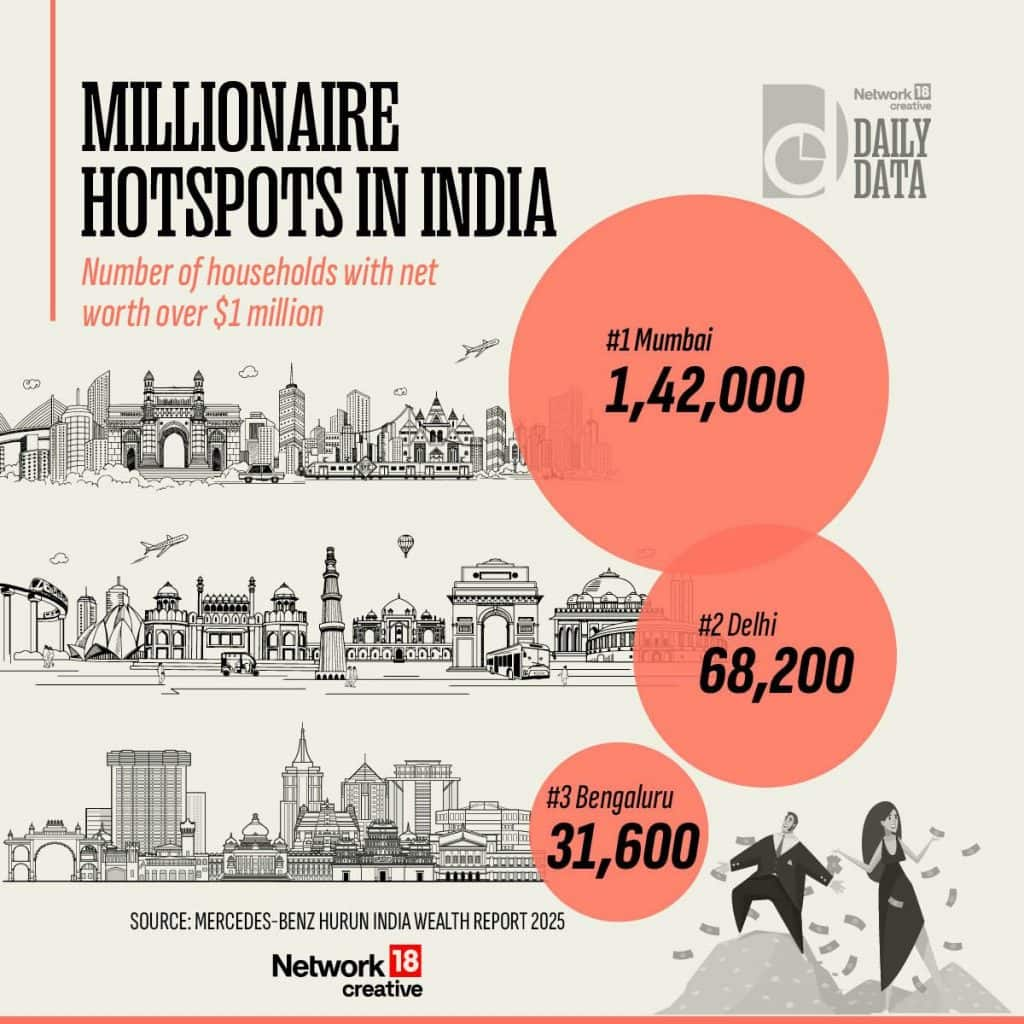

It further added that Maharashtra leads with 1,78,600 millionaire households, fuelled by Mumbai’s 1,42,000. Delhi has 68,200, and Bengaluru has 31,600. Other prominent cities include Ahmedabad, Kolkata, Chennai, Pune, and Hyderabad.

Speaking on the same, Anas Rahman Junaid, founder & chief researcher, Hurun India said: “India’s wealth creation is real and resilient.”

He added, “I am struck by the extraordinary upward mobility we’re witnessing in India. In less than a decade, the number of Indian households worth over $1 million has skyrocketed by 445 per cent: a surge that underlines how wealth creation is reaching a broader base of our society. This democratisation of prosperity speaks to the resilience of our economy, with opportunity spreading to millions of new wealth creators.”

And Santosh Iyer, MD & CEO, Mercedes-Benz India, added that the index reflects the pulse of India’s affluent class and its evolving luxury consumption patterns.

Experts opine that the rise in affluence is owing to strong equity markets, soaring gold prices and growing luxury consumption. Between 2021 and 2025, the Nifty has climbed nearly 70 per cent, whereas gold prices have currently surpassed the Rs 1 lakh-mark per 10 grammes. Furthermore, India is witnessing a boom in the luxury goods market . It amounted to $17.67 billion in 2024 and is poised to grow annually by 3.17 per cent (CAGR 2024-2029). Management consulting firm Bain & Co has predicted that India’s luxury market is set to skyrocket past $85 billion by 2030, bolstered by the country’s economic growth and discretionary spending habit, hinting at greater opportunity and growth.

The spending choices of India’s rich

And where is it that India’s Richie rich are spending their crores of rupees?

These high-net individuals (HNIs) prefer to spend their money on real estate in Mumbai, Delhi, and Bengaluru, with second homes in Goa and the Himalayas also becoming a trend, revealed the Hurun report. Stocks and gold were the other assets that the millionaires of India wished to spend their money on.

The report also revealed that over half of India’s millionaires own more than one car, with many upgrading within three to six years. Additionally, around 60 per cent of wealthy households spend under Rs 1 crore yearly, mostly on tourism, education and entertainment.

Comparing India to China

But how does India’s Richie rich compare to China?

India’s count of millionaires is modest when it comes to China. The Asian giant, as per a Hurun report of 2024, boasts nearly 51 lakh (5.1 million) households with wealth above $0.84 million while India has 872,000 households with over $ 1 million.

Even when it comes to the category of millionaires between $1.2 million and $1.4 million too, there’s a disparity between India and China. India has 589,600 such households whereas China has 2,066,000.

The report reveals that when it comes to the ultra HNIs, China has 130,500 households with wealth above $14 million whereas India has 66,800 households above $12 million.

However, analysts behind the report note that India is closing the gap, buoyed by its economic conditions. “As of today, India counts roughly 8.7 lakh millionaire households – still modest next to China’s nearly 51 lakh (5.1 million), and a far cry from the even larger base in the United States. I don’t view this gap as a disadvantage; I see it as our runway. It underscores the immense growth potential of India’s wealth story,” Junaid was quoted as saying.

And if India’s economy continues to grow, the number of wealthy people in the country will also rise. The Economic Times reports that the affluent households (more than $1 million) could rise from 872,000 to 1.7–2 million. Similarly, HNIs ($1.2–over 1.4 million) may grow from 590,000 to over 1.2 million and ultra-HNIs ($12–14 million) could double to 130,000, almost matching China’s current numbers.

Also, as India grows, China is seeing an economic slide. The Hurun Research Institute noted that China’s wealthiest people are seeing a dip in their net worth drop sharply because of economic turbulence and beleaguered stock markets.

Only time will tell if the Elephant outdoes the Dragon but we shall wait and watch.

With inputs from agencies

)