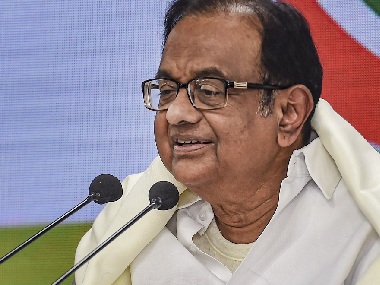

New Delhi: Senior Congress leader P Chidambaram hit out at the government on Friday, saying its “ability to govern and regulate financial institutions stands exposed”. The comments came a day after Yes Bank was placed under a moratorium, with the Reserve Bank of India (RBI) capping deposit withdrawals at the bank at Rs 50,000 per account for a month and superseding its board. The bank will not be able to grant or renew any loan or advance, make any investment, incur any liability or agree to disburse any payment during the period.

Will the government confirm that the Loan Book of YES Bank has grown under the BJP’s watch as follows:

— P. Chidambaram (@PChidambaram_IN) March 6, 2020

FY2014: 55,000 cr

FY2015: 75,000

FY2016: 98,000

FY2017: 1,32,000

FY2018: 2,03,000

FY2019: 2,41,000

For the next month, Yes Bank will be led by RBI-appointed administrator Prashant Kumar, a former chief financial officer of the State Bank of India (SBI). “BJP has been in power for six years. Their ability to govern and regulate financial institutions stands exposed. First, it was PMC Bank. Now it is YES Bank. Is the government concerned at all? Can it shirk its responsibility? Is there a third bank in the line?,” Chidambaram said in a tweet. The former finance minister also wondered if the BJP-led government would confirm that the loan book of YES Bank had grown under its watch from Rs 55,000 crore in FY 2014 to Rs 2,41,000 core in FY 2019. “When overall bank credit during the above period grew by about 10 per ent, how did YES BANK’s loan book grow by about 35 percent?,” he asked.

)

)

)

)

)

)

)

)

)