On Wednesday, A M Naik, the group chairman of Larsen & Toubro (L&T), the largest infrastructure developer in the country,

said there are little signs of economic recovery

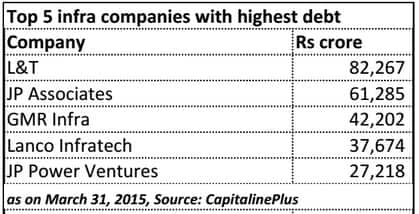

happening on the ground so far. “In terms of economic revival, it is not happening on the ground," Naik said speaking to news agency Reuters. He said a recovery in private sector capital expenditure remained at least one year away, since companies are grappling with high debt problems. Several of L&T’s factories ready to build defence equipment for Prime Minister Narendra Modi’s “Make-in-India” campaign are waiting for orders, Naik said. Naik also questioned how the government could deliver on a pledge to build up to 30 kilometres of roads a day when less than a dozen highway projects had been put up for tender. [caption id=“attachment_2444448” align=“alignleft” width=“380”]

L&T group chairman AM Naik. Image: Co website[/caption] Given the emerging global situation and India’s opportunities, Naik’s comments assume significance. They should ring alarm bells for the government. The single factor that stands between India and its big chance to emerge as a major economic power in a slowing world is dearth of new investments. Though the government has begun spending in some areas like roads, economists have been pushing for more. They content that the focus of the government’s investment has to be on infrastructure development because that has the potential to revive activities in related segments such as cement, power and electricity.

L&T group chairman AM Naik. Image: Co website[/caption] Given the emerging global situation and India’s opportunities, Naik’s comments assume significance. They should ring alarm bells for the government. The single factor that stands between India and its big chance to emerge as a major economic power in a slowing world is dearth of new investments. Though the government has begun spending in some areas like roads, economists have been pushing for more. They content that the focus of the government’s investment has to be on infrastructure development because that has the potential to revive activities in related segments such as cement, power and electricity.

Private sector capital expenditure is just not happening now. According to rating agency, India Ratings, capex spending in 2014-15 may have nosedived to Rs 2.76-2.8 lakh crore, the lowest in last five years. In the current fiscal year (2015-16), the capex spend may range between Rs 2.8-3 lakh crore, slightly up from the previous year, the agency estimates. This is a serious concern, particularly considering the government’s hesitance to give a big fiscal boost, because it means the economy is unlikely to see a turnaround for another year.

Private sector capital expenditure is just not happening now. According to rating agency, India Ratings, capex spending in 2014-15 may have nosedived to Rs 2.76-2.8 lakh crore, the lowest in last five years. In the current fiscal year (2015-16), the capex spend may range between Rs 2.8-3 lakh crore, slightly up from the previous year, the agency estimates. This is a serious concern, particularly considering the government’s hesitance to give a big fiscal boost, because it means the economy is unlikely to see a turnaround for another year.

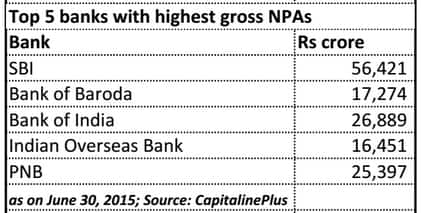

Theoretically, India grew at a pace matching China in the last quarter of the year but the divergence between the GDP numbers and rest of the economic indicators, such as high stress on companies’ balance sheets, huge NPAs on banks’ books, low-credit growth and capital investment, has been puzzling economists. The Reserve Bank of India (RBI) acknowledges the gravity of the situation too. “A major concern today is the leverage of corporates, which has enhanced substantially in the last few years,” RBI deputy governor S S Mundra said on Wednesday.

Theoretically, India grew at a pace matching China in the last quarter of the year but the divergence between the GDP numbers and rest of the economic indicators, such as high stress on companies’ balance sheets, huge NPAs on banks’ books, low-credit growth and capital investment, has been puzzling economists. The Reserve Bank of India (RBI) acknowledges the gravity of the situation too. “A major concern today is the leverage of corporates, which has enhanced substantially in the last few years,” RBI deputy governor S S Mundra said on Wednesday.

The fact is the ability of Indian companies to borrow and invest more in projects is limited given their constrained balance sheets. This would also mean they averse to taking risks,

though that is what the government wants them to

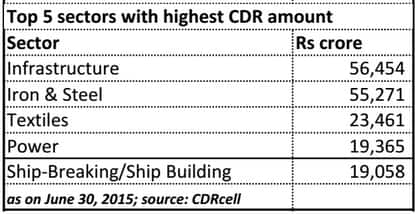

. The burning question is how can corporations, with over-leveraged balance sheets, borrow more and invest? The RBI itself is advising against the idea. How will banks, neck-deep in bad loans, lend more even if one assumes that the RBI would go for further rate cuts? Clearly a few basis points high interest rates is not what playing spoilsport in the recovery story, but slow-paced activity on the ground and lack of investment push. The only way out is much higher government spending to breathe life back into the real economy, where there is little activity as of now. Indeed, there is a slight uptick on the government spending if one goes by the available data, especially in the road sector. But, when it comes to the rest, there isn’t any major improvement in the scenario, said DK Joshi, chief economist, at Crisil, the Indian arm of global rating agency, Standard and Poor’s. “We have information that spending is happening in the road sector, which is a good sign. But, we don’t know about the rest. Sectors such as steel and cement are highly stressed. Unless private sector investment happen, sustainable recovery isn’t easy. So far there is no sign of that happening," Joshi said. At this stage, it is doubtful if the government shows the willingness to increase spending. On Thursday, the Economic Times quoted Economic Affairs secretary, Shaktikanta Das as saying the government doesn’t plan any additional fiscal boost to revive economy than what is already budgeted. The only way out of the current deadlock for the government is to shed its obsession with fiscal deficit numbers (targeted 3.9 percent this year) and rev up public spending in a big way to trigger the big investment cycle. (Data compiled by Kishor Kadam)

The fact is the ability of Indian companies to borrow and invest more in projects is limited given their constrained balance sheets. This would also mean they averse to taking risks,

though that is what the government wants them to

. The burning question is how can corporations, with over-leveraged balance sheets, borrow more and invest? The RBI itself is advising against the idea. How will banks, neck-deep in bad loans, lend more even if one assumes that the RBI would go for further rate cuts? Clearly a few basis points high interest rates is not what playing spoilsport in the recovery story, but slow-paced activity on the ground and lack of investment push. The only way out is much higher government spending to breathe life back into the real economy, where there is little activity as of now. Indeed, there is a slight uptick on the government spending if one goes by the available data, especially in the road sector. But, when it comes to the rest, there isn’t any major improvement in the scenario, said DK Joshi, chief economist, at Crisil, the Indian arm of global rating agency, Standard and Poor’s. “We have information that spending is happening in the road sector, which is a good sign. But, we don’t know about the rest. Sectors such as steel and cement are highly stressed. Unless private sector investment happen, sustainable recovery isn’t easy. So far there is no sign of that happening," Joshi said. At this stage, it is doubtful if the government shows the willingness to increase spending. On Thursday, the Economic Times quoted Economic Affairs secretary, Shaktikanta Das as saying the government doesn’t plan any additional fiscal boost to revive economy than what is already budgeted. The only way out of the current deadlock for the government is to shed its obsession with fiscal deficit numbers (targeted 3.9 percent this year) and rev up public spending in a big way to trigger the big investment cycle. (Data compiled by Kishor Kadam)

Why govt should take note of RBI's worries over corporates and AM Naik's disappointment

Dinesh Unnikrishnan

• September 24, 2015, 16:53:11 IST

The only way out of the current deadlock for the government is to shed its obsession with fiscal deficit numbers (targeted 3.9 percent this year) and rev up public spending in a big way to trigger the big investment cycle

Advertisement

)

End of Article