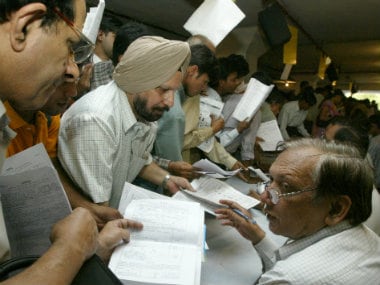

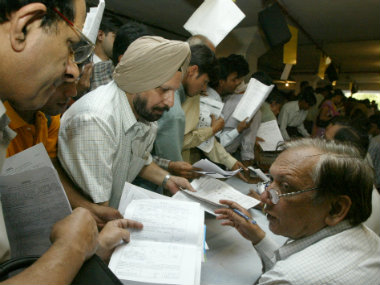

With a new Budget announced for every financial year, it is important to keep track of the changes in tax laws and rules that are relevant to you as a taxpayer. For instance, the eligibility of filing your tax return is one such basic regulation to remember - you must identify if filing is legally applicable to you. Let us take a look at the various criteria/situations that make return filing mandatory for taxpayers. When your gross total income exceeds the threshold limit For deciding if the gross total income of the taxpayer exceeds the threshold limit or not, the taxpayers have been divided into three categories: a) Citizens under the age of 60: The limit is Rs 2,50,000 b) Senior citizens (60 years of age or above but below the age of 80): Limit is Rs 3,00,000 c) Very senior citizens (80 years of age or above): Limit is Rs 5,00,000 Avoid paying penalty From this financial year onwards, if there is going to be a delay in filing the return i.e beyond 31 July 2018, a maximum penalty of Rs 10,000 will be applicable. However, if the return is filed before 31st December 2018 the maximum penalty will be Rs 5,000. [caption id=“attachment_4268069” align=“alignleft” width=“380”]  File image. Reuters[/caption] Claim a refund There are situations when a taxpayer has paid taxes in excess of what he is required to pay. A taxpayer pays an advance tax in anticipation of higher income and the ‘higher income’ never happens that year. Then, he can claim a refund for the excess amount of tax paid. To claim the refund, the taxpayer must file an income tax return for the particular year. This may also be true if your taxable income is less than the threshold and TDS has been deducted on it. You can then file a return and claim a refund. Carry forward losses When a taxpayer faces losses in a financial year, those losses can be set off against other sources of income subject to meeting the terms and conditions. Several losses can be carried forward and set off in the future years. A taxpayer is entitled to carry forward losses to the next year, if there isn’t sufficient earning in the current year. The easiest way to carry forward your loss is to file your tax return. Assets held outside India It is possible for resident individuals to hold assets outside India. Even if they do not have any taxable income in India in a financial year, it is mandatory for them to file an income tax return. Details regarding foreign bank accounts, financial interest, immovable property, accounts in which an individual has signing authority, trusts, any other capital asset held by the individual outside India need to be disclosed in the return of income. Signing authority outside India When an individual resident has a signing authority in any account outside India, it is mandatory to file an income tax return in India. This is irrespective of whether the income is taxable or not. Claiming relief under section 90/90A Being a resident Indian, one can run businesses outside India and pay taxes in the other country. To ease the tax burden, the Indian government has entered a Double Taxation Avoidance Agreement (DTAA) with various countries. The core of DTAA is that if a taxpayer has already borne the tax in one country, then he need not pay taxes in the other country. Therefore, it is mandatory for the taxpayer to file the income tax return to claim this. Even if you do not fall in any of the above-mentioned categories, it is strongly recommended that you file your tax return. Timely filing of returns can simplify a number of other legal and financial processes like securing loan approvals and getting a visa for travel to another country, among other things. (The writer is Founder & CEO, ClearTax)

Taking a look at the various criteria/situations that make return filing mandatory for taxpayers.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)