ByArjun Parthasarathy

The US Federal Reserve (Fed) Chairman Ben Bernanke is expected to pull out all the stops to prevent the US economy from slowing down in the wake of high unemployment and lack of government support to the economy.

The US unemployment rate of 9.1 percent has gone almost 4.5 percent higher over the last five years. The US government is forced to cut spending in the wake of its huge debt, the ceiling of which had to be raised this month in order to pay off maturing bonds.

Forecasts for US economic growth are being revised downwards by 30-75 basis points (100 basis points make 1 percent) by various think tanks. In this kind of economic situation, all eyes are on the Fed Chairman to rescue the US economy.

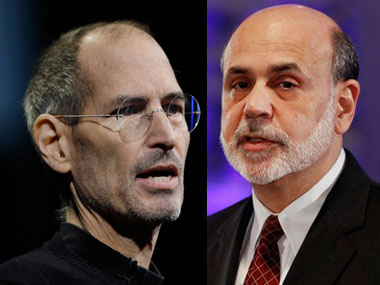

[caption id=“attachment_71276” align=“alignleft” width=“380” caption=“Reuters/AP”]

[/caption]

[/caption]

It is ironical that the US economy is looking at a self-confessed great depression student to bring them out of trouble, specially when a visionary named Steve Jobs just announced his retirement.

The difference between Ben and Jobs cannot be starker. Ben bases his thoughts on what happened 80 years back, Jobs bases his thoughts on what is going to happen 80 years ahead. Ben has never really led the US economy out of trouble, he has only been fire fighting the trouble. Jobs led Apple to become the most valuable company in the world from the pits.

Ben’s tools are as outdated as Jobs tools are advanced. Ben is a man of the past, Jobs is a man of the future.

Jobs announced his retirement last week due to his health. Apple is a company that is always running ahead of its competitors and the job at the top requires not just vision but also physical fitness.

Impact Shorts

More ShortsBen is far from announcing his retirement, though if there is a change in political power in the US in 2012, Ben’s job may well be on the line. It is the right time for Ben to catch up with Jobs to change his (Ben’s) way of thinking.

What can Ben learn from Jobs?

The first lesson will be that the world has changed since the great depression. Ben has to stop thinking of what happened in the past, and begin thinking about what will happen in the future given the current changed nature of the world.

Apple has changed the world and Jobs is the best person to explain the changes.

The second lesson will be on innovation. Agreed, monetary policy is the not the most dynamic tool for innovation, but Jobs should wean Ben away from Keynes, who is a relic of the past.

The third lesson will be using all resources available for execution. Apple uses the best talent and most cost-effective suppliers located globally for its products. Ben should take his mind away from throwing good money after bad, which is what quantitative easing does.

Finally Jobs should highlight that Apple affects the world, as the world is Apple’s marketplace. Ben does not look beyond US borders in framing monetary policy.

Jobs has time now, Ben should use that time.

Arjun Parthasarathy is the Editor of www.investorsareidiots.com , a web site for investors.

)