State Bank of India’s results were the best gift for the markets today, which, before the results were announced, were drowning in negative territory.

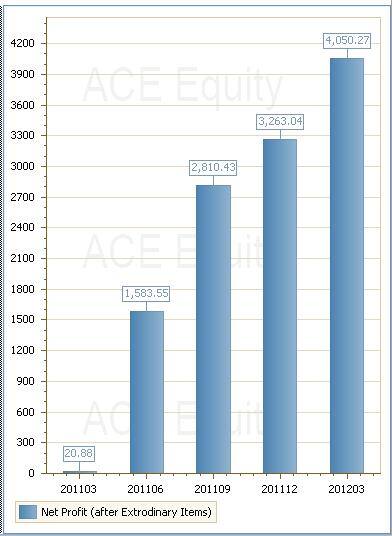

Its fourth-quarter net profit of Rs 4,050 crore, which blew past expectations of around Rs 3,580 crore, lifted investor sentiment on a day when the rupee touched a new intra-day low of 54.90 against the US dollar. The Sensex finally closed 82 points higher at 16, 153.

[caption id=“attachment_313955” align=“alignleft” width=“380” caption=“AFP”]

[/caption]

[/caption]

(The net profit was also 200 times higher from a year ago but the figures are not comparable because last year, the bank made a huge provision for non-performing assets (NPAs) which sharply brought down its profit in the quarter ending March 2011.)

India’s largest bank also announced a full-year net profit of Rs 11,707 crore, up 42 percent from a year ago.

SBI’s shares closed nearly 6 percent higher at Rs 1,955. A last burst of gains for the stock came when chairman and managing director Pratip Chaudhuri issued a sunny outlook for the bank at a press conference. Here are some of the key highlights from the conference:

1. Pratip Chaudhuri began the conference by saying that “even in modest terms, the results were ‘blockbuster’”. He said there has been a lot of doubts about the growth and asset quality of the bank after the bank started cleaning up its balance sheet last year. he also quelled doubts about the bank’s level of non-performing assets. “We declared a war on NPAs and we seem to be winning this,” he said.

Impact Shorts

More Shorts2. Net interest income (which is the main form of revenues for a bank) rose to Rs 43,291 crore for the year, equivalent to Rs 3,700 crore per month. Chaudhuri said interest income would remain robust since the environment was still good.

3. Other income (generated from treasury operations and fees) for the year fell to Rs 14,351 crore from Rs 15,825 crore a year ago. Last year, the company made some good gains from the sale of Tata Corus shares. This year, however, it suffered a Rs 920 crore loss on equity investments after making a gain of a similar amount last year. Its subsidiaries had also not been pressed to dole out higher dividends, Chaudhuri said.

4. The company made a provision of Rs 2,837 crore against Rs 3,006 crore for NPAs in the March-ended quarter. That’s a fall of 13 percent from last year, and 6 percent from the previous quarter. However, he dismissed doubts that the provisioning was “economical”, insisting that the provisions were more than adequate.

5. He said the profit was the third-highest for any company for the year, breaching Rs 11,000 crore. The only other two companies to have achieved this feat are ONGC and Reliance so far. The bank’s quarterly profit of Rs 4,050 crore is also the highest quarterly profit achieved by the bank.

6. Operating profit for the year ended March 2012 jumped by 25 percent to Rs 31,574 crore, Chaudhuri said.

**

7.**While staff expenses climbed by 11 percent for the year, Chaudhuri promised no further controversies on pension payments since this time around, the company has provided adequately for the same.

7.**While staff expenses climbed by 11 percent for the year, Chaudhuri promised no further controversies on pension payments since this time around, the company has provided adequately for the same.

8. Net interest margin - the difference between cost of funds and interest received - came in at 3.89 percent for the quarter, which beat the bank’s own estimate of 3.75 percent.Domestic NIM (from local operations) came in at 4.17 percent for the same period.

9. After being challenged on the bank’s Tier I capital ratio, he said SBI had improved it to 9.79 percent. The improvement came about for three reasons: robust internal capital generation, a capital infusion of Rs 7,900 crore by the government and efforts to optimise capital use.

10. The bank’s book value now stands at Rs 1,215 per share. By improving its NPA level, Chaudhuri said, SBI could now possibly allay concerns among analysts and investors about the bank’s asset quality. While he acknowledged that analysts would assign valuations to the bank’s stock taking into account the external circumstances, he said he was certain the bank had beaten market expectations.

)