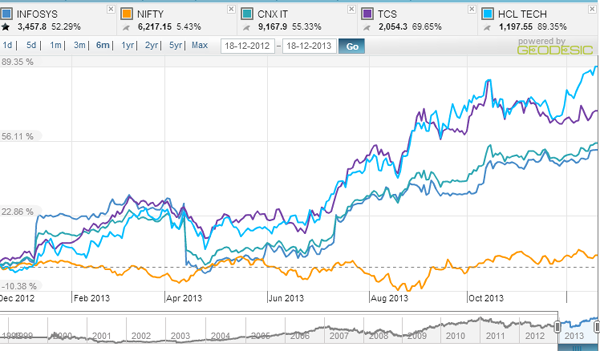

NR Narayana Murthy’s return to Infosys may be doing the company good, but the nearly 50 percent surge in its stock price in the last six months cannot be attributed to Murthy alone for IT stocks in general have performed welldue to a pick-up in discretionary spending with the improvement in the US macroeconomic environment.

The share prices of Infosys, India’s second largest IT services company, on Monday closed at a nearly three-year high. Its shares ended at Rs. 3,449.85 on the BSE, its highest since 1 January 2011.

Shares of most Indian IT companies have been on the rise in the past few months, due to expectations of a rise in demand in the coming year. Most large and mid-size IT players have hinted at a marginal uptick in spending by clients and a rise in discretionary spending during 2014.

[caption id=“attachment_1296331” align=“aligncenter” width=“600”]

Chart[/caption]

Chart[/caption]

The chart above clearly shows that that both the CNX IT and the Infosys stock have seen the same percentage gain in the last six months. While Infosys has jumped 43 percent since 1 June 2013, the CNX IT index has jumped 42.9 percent. But the big winner in the IT pack is mid-sized HCL Technologies, which has shot up a whopping 67 percent. From Rs744.85 in June 2013, the stock is now up to Rs1,245.30. TCS, on the other hand, has underperformed the index, despitebeing an investor darling. The stock has only risen39.7 percent in the last six months. Maybe, it is simply too expensive.

)