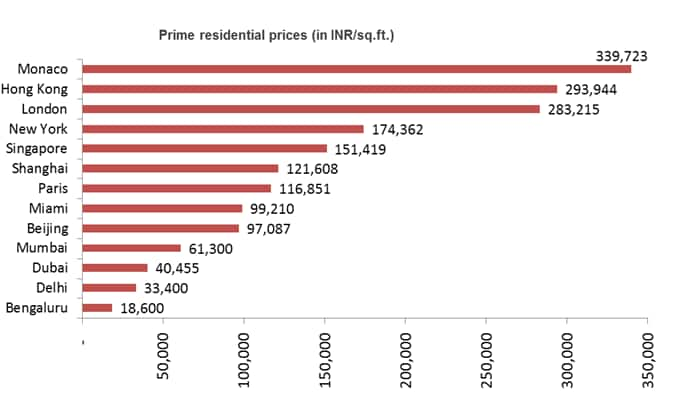

The world’s richest are lapping up properties in the world’s most expensive cities, pushing up prices of luxury homes, so much so that $1 million (roughly Rs 6 crore) will buy you only 1,033 square feet of prime property in Mumbai. One can buy 96 square metres of prime property in Mumbai for $1 million compared with just 17 square metres in Monaco, 20 in Hong Kong, 39 in Singapore and 21 in London, according to data provided by real estate consulting firm Knight Frank. For the same investment, one gets gets 41 square metres in Sydney, 50 square metres in Paris, 79 square metres in Moscow, 48 square metres in Shanghai and 96 square metres in Mumbai. Among the list of 20 cities surveyed, Mumbai is placed 17th with Cape Town taking the last slot, where a $1 million buys 284 square metres. So only Dubai, CapeTown and Sao Paulo are cheaper than India’s financial capital for prime real estate in the residential space. [caption id=“attachment_2143443” align=“aligncenter” width=“516”]  Source: Knight Frank[/caption] “Although not purely for investment purpose, a quarter of Indian UHNWIs are contemplating purchase of another home in 2015. From an investment perspective, as high as 87% of Indian UHNWIs wish to increase allocations towards prime residential property which bodes well for the real estate sector. In spite of the government of India taking bold steps towards financial inclusion, wealth concentration continues to remain a challenge. At 0.1 UHNWI per lakh population, India ranks a distant 84 among 97 countries globally in terms of equitable distribution of wealth. The concentration of wealthy Indians also extends geographically as the top 6 cities contribute 58% of the number of UHNWIs, which is likely to accelerate to 68% in the next 10 years,” said Samantak Das, Chief Economist & Director, Research, Knight Frank India. Property is increasingly seen as a preferred investment class, with nearly half of the Indian ultra high-networth individuals’ (UHNWIs) investment portfolios allocated to property, the highest across the globe, followed by the Australians at 42%, according to the Wealth Report released by real estate advisory firm Knight Frank. Globally, on average 23% of UHNWIs’ wealth is accounted for by their main residence and any second homes purely as an investment, according to our survey results. In Australasia and Asia the proportion edged up to almost 30%, led by India and Singapore. The value of luxury residential property around the world rose by just over 2% on average in 2014, based on the performance of the 100 locations covered by Knight Frank’s Prime International Residential Index (PIRI). In the table below, it can be seen that the average per square foot price for prime residential property in Mumbai is a whopping Rs 61,300 as opposed to Rs 33,400 in Delhi and Rs 18,600 in Bangalore. So luxury property in Mumbai will cost you nearly nearly double of what it costs in Delhi and three times of what it would cost you in Bangalore.  Source: Knight Frank India The Wealth report also showed that New York’s luxury property market registered the biggest gains globally, with value of high-end residential property in the U.S. financial center soaring 18.8 percent between December 2013 and December 2014, far outpacing the global average price growth of 2 percent. New York was followed by Aspen, Bali, Istanbul and Abu Dhabi, which saw gains of between 14.7 percent and 16 percent. San Francisco, Dublin, Cape Town, Muscat and Los Angeles rounded out the top 10, with price advances between 13.2 percent and 14.3 percent. The survey also showed that private investors accounted for a quarter of all commercial property deals in 2014, contributing an estimated $153 billion of commercial property deals transacted. Many of these transactions were funded by ultra high net worth individuals (UHNWIs) - those with $30 million in assets or more - through family-owned funds, companies or private offices. The figure represents a seven percent rise from $143 billion invested by UHNWIs the previous year, contributing to an estimated total of $646 billion worth of commercial property deals throughout 2014. The results of the Knight Frank Wealth Report’s Capital Markets Survey show UHNWIs are now looking beyond prime or trophy offices and retail space as a safe haven for their funds and are prepared to look up the risk curve to non-core locations.

The world’s richest are lapping up properties in the world’s most expensive cities, pushing up prices of luxury homes, so much so that $ 1 million ( roughly Rs 6 crore) will buy you only 1033 square feet of prime property in Mumbai.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)