Walmart Inc and Flipkart are set to announce the mega-deal shortly, which will see the US-retailer picking up a significant majority stake in the Indian e-commerce major for close to $15 billion, sources said. The deal will see some of the biggest investors in Flipkart offloading their holding in the country’s largest e-commerce company. Japan’s SoftBank Group Corp and Tiger Global Management are said to be selling almost all of their stake in Flipkart. [caption id=“attachment_4237505” align=“alignleft” width=“380”] Representational image. Reuters.[/caption] If all goes well, Walmart will likely end up with 60-80 percent of Flipkart, valuing the company at upwards of $20 billion, the sources said. SoftBank Group chief executive Masayoshi Son has confirmed the deal. The Walmart-Flipkart deal was sealed on Tuesday night, Son said on a conference call after SoftBank reported earnings, adding that its investment in the Indian online marketplace had almost doubled. Sources have previously told Reuters that SoftBank would completely sell its shares in Flipkart to Walmart. Walmart will buy the stake in the Singapore holding company, Flipkart Pvt Ltd, that, in turn, holds majority shares in the multiple companies that run various businesses of the e-commerce company Flipkart.com in India. As a precursor to the deal, Flipkart’s holding company in Singapore has just turned private by buying back over 1.8 million shares worth more than $350 million from its minority investors. According to the information filed by Flipkart with Singapore’s Accounting and Corporate Regulatory Authority, that was sourced by data platform Paper.vc, the move values the Bengaluru-based firm at a whopping $17.69 billion.

Representational image. Reuters.[/caption] If all goes well, Walmart will likely end up with 60-80 percent of Flipkart, valuing the company at upwards of $20 billion, the sources said. SoftBank Group chief executive Masayoshi Son has confirmed the deal. The Walmart-Flipkart deal was sealed on Tuesday night, Son said on a conference call after SoftBank reported earnings, adding that its investment in the Indian online marketplace had almost doubled. Sources have previously told Reuters that SoftBank would completely sell its shares in Flipkart to Walmart. Walmart will buy the stake in the Singapore holding company, Flipkart Pvt Ltd, that, in turn, holds majority shares in the multiple companies that run various businesses of the e-commerce company Flipkart.com in India. As a precursor to the deal, Flipkart’s holding company in Singapore has just turned private by buying back over 1.8 million shares worth more than $350 million from its minority investors. According to the information filed by Flipkart with Singapore’s Accounting and Corporate Regulatory Authority, that was sourced by data platform Paper.vc, the move values the Bengaluru-based firm at a whopping $17.69 billion.

Walmart Flipkart deal updates: CEO Doug McMillon says US retailer's investment to benefit India

Walmart Inc and Flipkart are set to announce the mega-deal shortly, which will see US-retailer picking up a significant majority stake in Indian e-commerce major

)

‘Flipkart has grown rapidly’

The investment is of immense importance for India, says Binny Bansal

We are making a long-term investment in India’s future: Walmart CEO

Doug McMillon, President and CEO, Walmart said that India is the largest and fastest growing economy in the world. “With this deal, we are making a long-term investment in India’s future. We are moving this to sustain India’s economic growth. Jobs will be created. We will invest in local communities. New opportunities will emerge every day and we will move quickly to embrace this change. We are in India to gain new customers, but we see alignment in Walmart and Flipkart in values, India is a priority market for Walmart. Payments business supports the growth of e-commerce We will continue to partner with local Kirana stores and reducing food waste,” McMillon said.

Our investment will benefit India: Doug McMillon of Walmart

Talk of consolidation of e-commerce too early, say experts

According to Mohandas Pai, there are universal players who are individual players. Unless a player becomes a niche player, there won’t be a consolidation, he said. Saurabh Srivatsava of IAN said, “I think the game for players who are trying to be everything to everybody will be tough.”

Snapdeal’s Kunal Bahl congratulates the Bansals

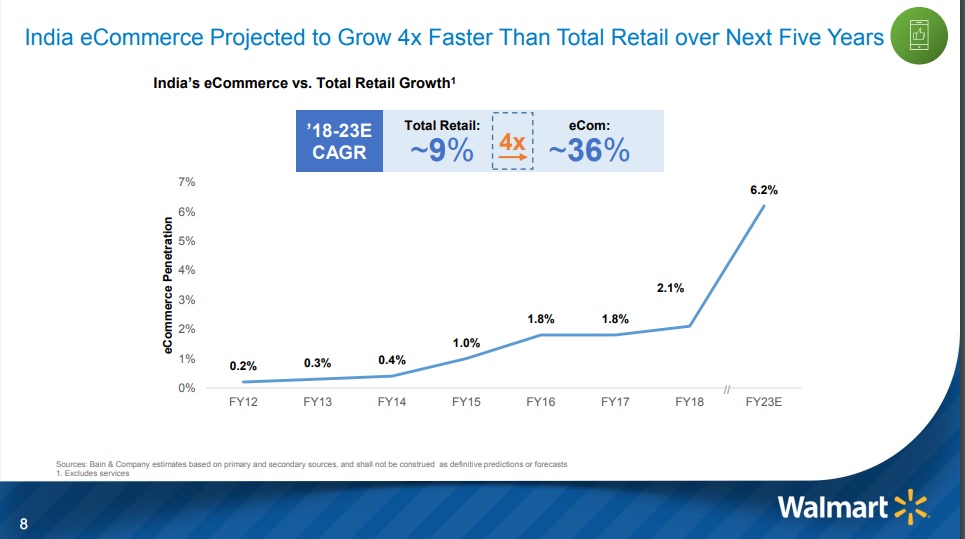

Walmart predicts e-commerce boom

Investment Community Call

Walmart will host a conference call for analysts and investors at 7:00 a.m. CDT and 5:30 p.m. IST. The conference call will be webcast live and accessible by following this link . The webcast will be archived and available beginning at approximately noon CDT on 9 May.

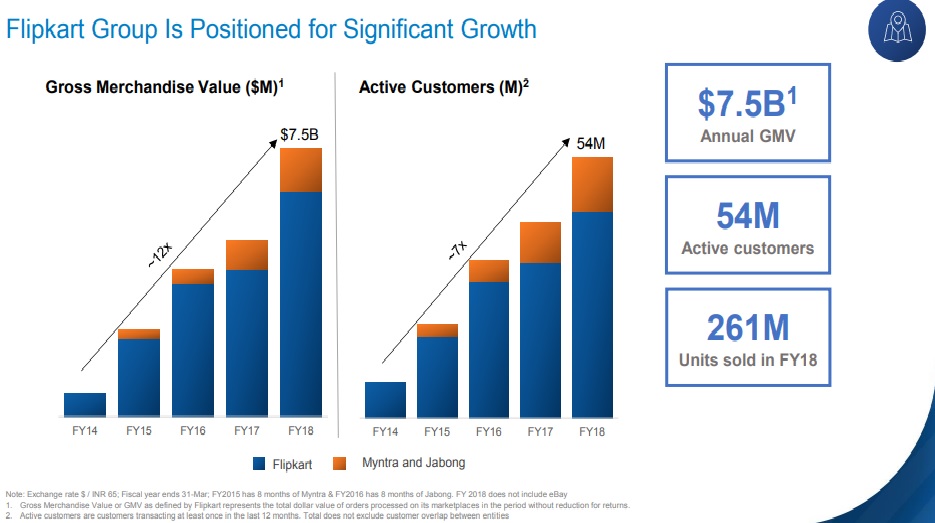

Flipkart set for significant growth

Advisers to the deal

JP Morgan Securities LLC is acting as the lead financial advisor for Walmart, along with Barclays, with Hogan Lovells, Shardul Amarchand Mangaldas & Co. and Gibson, Dunn & Crutcher LLP as outside counsel to Walmart. Goldman Sachs & Co. LLC acted as exclusive financial advisor to Flipkart. Gunderson Dettmer LLP, Khaitan & Co., Allen & Gledhill LLP and Dentons Rodyk & Davidson LLP provided legal counsel to Flipkart.

“Flipkart is a good cultural fit for Walmart”

Flipkart has established itself as a prominent player with a strong, entrepreneurial leadership team that is a good cultural fit with Walmart,” said Judith McKenna, president and chief executive officer of Walmart International. “This investment aligns with our strategy and our goal is to contribute to India’s success story, as we grow our business. Over the last 10 years, Flipkart has become a market leader by focusing on customer service, technology, supply chain and a broad assortment of products. With Flipkart and the other shareholders who have come together, we will continue to advance the winning eCommerce ecosystem in India,” McKenna said.

The discount game will go on, says Ajay Dua

Dua said that the online and offline markets may work together and the difference will go off. With the coming of Walmart, it will benefit farmers but it won’t happen quickly. Organised Indian retailers be it Reliance, Big Basket, Grofers have been in the fresh agri produce but have not invested in the supply chain, he said.

Fight for market through e-commerce, says Mohandas Pai

“It will be a brutal game. There will be Walmart, Amazon, Kishor Biyani and Reliance. Reliance is going to connect front-end shops on their portal. It is going to be interesting, Walmart and Amazon are long-term players. There are two Indian and two American players. Maybe only 2 companies will remain in the market. Two companies will be acquired. Alibaba seems to have lost the market. They will have to lose an enormous amount of money to enter this market,” Pai told CNBC TV18

Softbank will need to pay capital gains tax, say experts

Softbank will have to pay capital gains tax, said Ajay Dua. The buyer will have to collect 10 percent as withholding tax. All short-term investors will have to pay high capital gains tax and will be collected by Indian income tax authorities.

Flipkart could go public, say experts

Sanchit Gogia, Greyhound Research said the fact that there are so many investors at play and the seller community is having only 3 sellers won’t make it complicated. “It is very important to have one country view. Having a holding company structure where all the companies as one will be fundamental for the working out of the deal,” Gogia said. Experts say that Flipkart could go public after the acquisition.

Walmart statement says it will pay approximately $16 billion to acquire Flipkart

Will Walmart re-brand Flipkart?

Biggest beneficiaries will be Indian farmers, say experts

Gurcharan Das, former CEO, P&G India said that the deal will be a game changer for both India and Flipkart. “What Walmart does better is the efforts they make in getting fresh farm produce to the cities at the lowest cost. I remember when Walmart went to Africa, they spent the first two years in countries like Nigeria to grow the right kind of tomatoes, potatoes. What happened there was that the farmers were huge beneficiaries,” Das said.

He said that deal will give global access to Flipkart and its private labels. Flipkart Walmart deal will also create a huge number of jobs, Das said.

Not a two-way battle anymore!

The deal is expected to herald a three-way fight in the Indian e-commerce space. Walmart-Flipkart combine will battle Amazon and Alibaba in Asia’s third-largest economy. Walmart and Flipkart coming together is a sweet spot, say the experts.

Not an easy entry for Walmart in India

Former DIPP secretary Ajay Dua said that the exchange of shares worth $15 bn, held mostly outside the country is huge. The deal won’t result in actual FDI in the country, he said. There are 56 percent shares of the company held overseas. The valuation of $20 bn that Walmart has agreed to is much more than what India has seen.

“In India, Amazon has put in close to $10 bn in the e-commerce space itself. Another $500 mn is being planned in the Indian market,” Dua said.

How will the deal benefit Flipkart?

For Flipkart, the deal would give it additional capital and retail muscle to fight Amazon. Together, Flipkart and Amazon control majority of the country’s $30 billion e-commerce market that is forecast to grow to $200 billion by 2026 (Morgan Stanley estimate).

Amazon is believed to have offered Flipkart a higher valuation of about $22 billion, along with a break up fee of $2 billion, compared to Walmarts $18-20 billion valuation of the Bengaluru-based company. According to Greyhound Research Chief Analyst and CEO Sanchit Vir Gogia, Walmart adding Flipkart to its kitty will act like a shot-in-the-arm and give it a significant up against ace competition, Amazon.

“Flipkart shareholders also stand to gain a better outcome on their returns (as part of deal with Walmart) and the founders and key management get a bigger stake in the game given higher reliance on them to successfully run and grow the commerce business,” he said

Amazon was also in the race to buy Flipkart

Amazon was interested in buying Bangalore-based Flipkart, according to CNBC TV 18. It had even put forth an offer to buy 60 percent stake. But the deal did not fructify. Flipkart was valued at about $12 billion last year, according to researcher CB Insights.

Flipkart and Walmart sign the term sheet

Large investors to exit from Flipkart

Apart from Softbank, Naspers will also completely exit from Flipkart through the deal with Walmart. Tiger Global and Accel Partners will also to sell a large portion of their stake but will retain a small holding post-Walmart’s investment in Flipkart, said the media sources.

Tiger Global and Masayoshi Son-led Softbank hold about 20 per cent stake each in the Singapore holding company of Flipkart.

Walmart signs definitive agreement

Walmart has reportedly signed the definitive agreement to acquire 75 percent stake in Flipkart at a valuation of $20 billion. The deal is likely to be formally announced on Wednesday evening, said media reports.

)

)