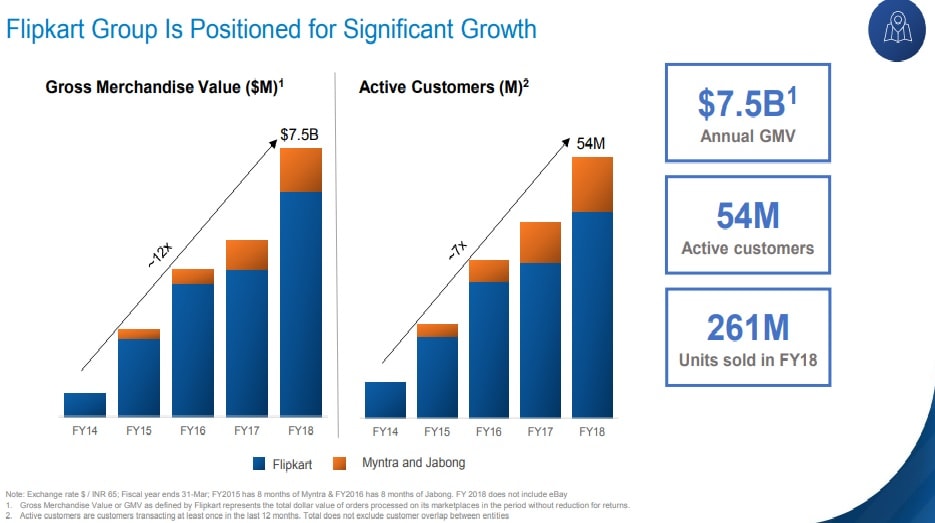

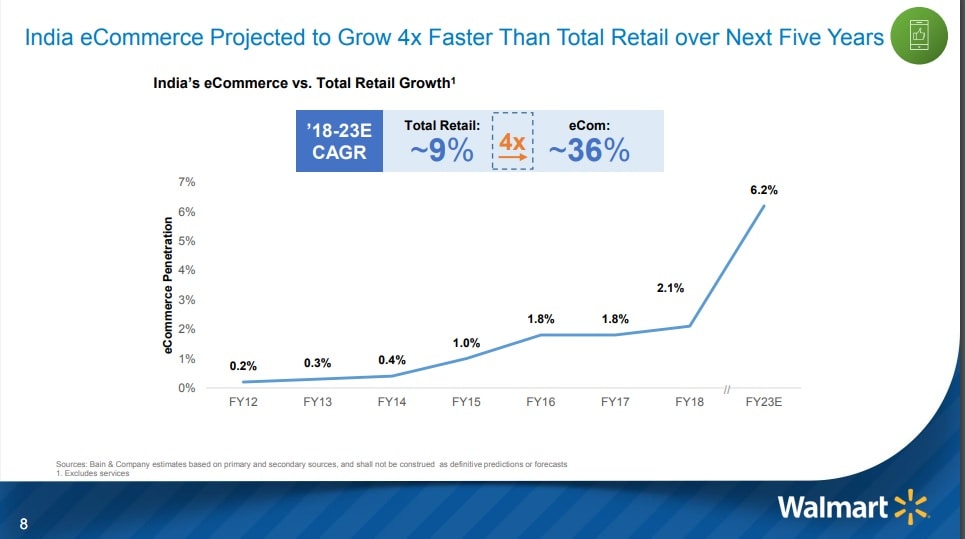

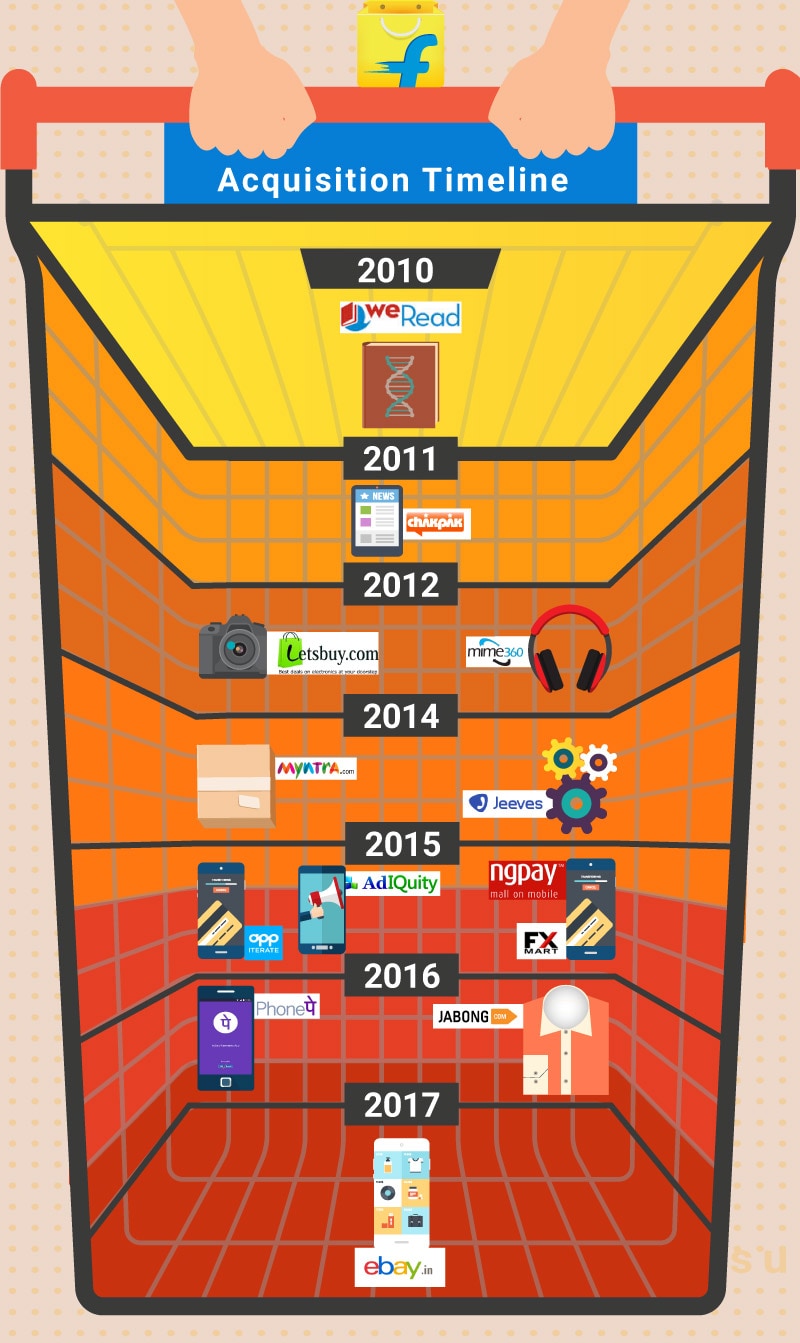

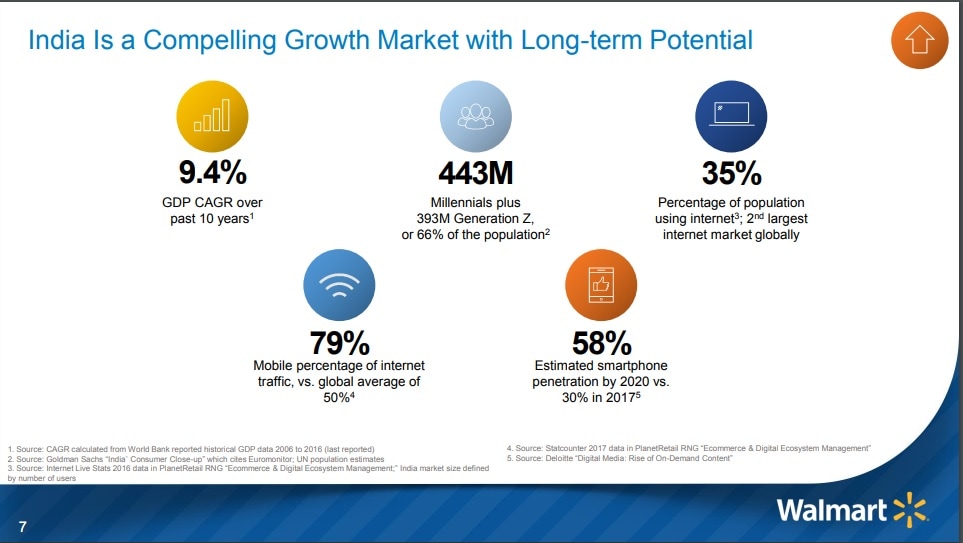

Walmart Inc, on Wednesday, said it will buy a 77 percent stake in Flipkart for about $16 billion (Rs 1.05 lakh crore), its biggest deal, which will give the US retailer access to the Indian e-commerce market that is estimated to grow to $200 billion within a decade. The deal, which will see Flipkart co-founder Sachin Bansal and Japan’s Softbank Group exiting, values Flipkart at $20.8 billion. This is the biggest M&A deal in India so far this year. Walmart, in a statement, said the “investment includes $2 billion of new equity funding, which will help Flipkart accelerate growth in the future.” So why exactly did Walmart court Flipkart? Well, for starters, Flipkart, thanks to its first-mover advantage in India, is poised for growth. In the financial year ended 31 March, Flipkart recorded a gross merchandise value (GMV) of $7.5 billion and net sales of $4.6 billion, logging more than a 50 percent year-over-year growth in both cases.   Walmart expects e-commerce in India to grow at four times the rate of the overall retail space, and with well-known platforms like Myntra, Jabong and PhonePe, Flipkart is uniquely positioned to leverage an integrated ecosystem, which is backed by localised service, deep insights into customer behaviour and a well-established supply chain. Flipkart’s logistics arm eKart operates in over 800 cities and makes as many as 5,00,000 deliveries a day.  Flipkart made its first acquisition with WeRead in 2010, and, since then, has acquired a number of companies including Letsbuy, FX Mart, fashion e-tail players Myntra, Jabong and the UPI-based payments startup PhonePe. It also bought majority stakes in companies like Jeeves and ngpay. It also owns eBay’s India business. Together, Flipkart-Myntra-Jabong command a 70 percent market share of the online fashion business in India. Here’s a timeline of Flipkart’s M&A moves:  Walmart, explaining the rationale behind its move to stakeholders, said the Indian e-commerce industry, valued at $30 billion at the moment, will zoom to $200 billion by 2026. Data, highlighting economic growth, population growth, internet penetration and smartphone usage, together paint a promising picture.  The deal gives the US brick-and-mortar retail giant – which has seen consumers migrate to online platforms like those run by Amazon – access to a vantage point, as it prepares to battle Amazon and China’s Alibaba in the world’s fastest growing economy. Only 14 percent of India’s over 400 million Internet users shop online and that number is projected to rise to over 50 percent by 2026. Walmart boss Doug McMillion stated: “India is one of the most attractive retail markets in the world, given its size and growth rate, and our investment is an opportunity to partner with the company that is leading the transformation of eCommerce in the market.” (With PTI inputs)

So why did Walmart court Flipkart? For starters, Flipkart, thanks to its first-mover advantage, is poised for growth in an expanding ecommerce market.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)