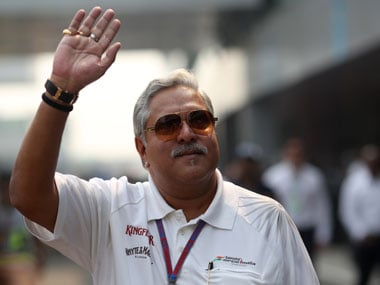

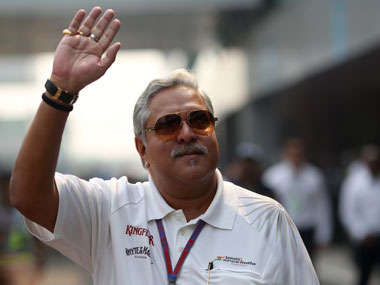

The banks’ battle with Kingfisher Airlines continues with the leading lender in the consortium State Bank of India (SBI) finally tagging Vijay Mallya and two of his companies as wilful defaulters . According to the PTI report, besides Mallya, the grounded Kingfisher Airlines and its holding company United Breweries Holdings, too have been tagged as wilful defaulters by SBI after Mallya’s lawyers failed to make a strong case in the Supreme Court on their client’s genuine state of stress in repaying bank money. Mallya owes more than Rs 7,000 crore to some 17 banks, most of them state-run lenders. One good thing about SBI’s move is that it may prompt the other more than a dozen banks in the consortium too to clamp down on Mallya now since most of them have been waiting for cues from the country’s largest lender. According to a senior banker at United Bank, the lender was looking at the progress of SBI-Kingfisher case in Bombay High Court, before taking further action on Mallya. The bank would reassess the situation now, the official said. However, a look at the history of the case, which has seen a protracted legal battle, shows that it may not be all that easy for them. [caption id=“attachment_2234274” align=“alignleft” width=“380”]  Vijay Mallya. Reuters[/caption] On 18 September, the SC had given permission to Mallya to present his side in the court represented by lawyers and not him in person, despite the fact that there was a clear case of default that happened way back in December, 2011 and alleged fund diversion and financial irregularities by Mallya while dealing with the bank money. One can’t be so sure how long will the tag remain on Mallya, since the liquor baron still can file a review petition in the apex court. The way Indian courts have handled cases of large defaults and wilful defaults would make the crony promoters happy. This is because in most instances, they have managed to use the judiciary to their advantage for delaying the loan recovery process and leaving the banking system helpless. Some time towards the middle of last year, Kolkata-based United bank of India first declared Mallya as a wilful defaulter. But, that tag stayed only until December, when Mallya’s lawyers challenged the bank’s action on technical grounds. They said the committee that identified Mallya as a wilful defaulter comprised of four members instead of three as mandated by the Reserve Bank of India (RBI). Wilful defaulter tag, once imposed on an individual or entity, ostracises that party from the Indian financial system. He cannot borrow any more or be part of any listed companies. The Kingfisher case clearly highlights the need for a separate court to deal with large-ticket chronic non-performing asset (NPA) cases. Currently, such cases are heard across multiple judicial platforms ranging from debt recovery tribunals to the Supreme Court. The prolonged process delays the loan recovery and leads to painful degradation of assets, like what happened in the Kingfisher case. Though Mallya owes over Rs 7,000 crore to lenders, at a recent effort by banks to auction some of the Kingfisher assets the reserve price of these assets was set at just Rs 65 lakh. This means chances are that banks will recover only a minuscule fraction of their several thousand crores of dues even if they manage to sell these assets. Banks’ experiences in similar cases are not too different. One must remember that when an asset is tagged as bad, the value deterioration begins and banks stop earning from that asset. If such cases get entangled in years of legal battle, there would be nothing much left at the end for banks to recover. According to another report in the Business Standard, Mallya is willing to settle his dues with banks by selling his stake in group companies. The report says Mallya’s 32.62 per cent stake in United Breweries is valued at Rs 8,500 crore, but a part of this stake is pledged, requiring him take the lenders into confidence before encashing this. If indeed this plan works out, this can offer a big relief to banks, who have been hoping to get their money back. But one needs to wait and watch whether banks actually get their money back. Remember, Kingfisher became NPA in late 2011. Mallya has not so far showed his willingness to repay but has chosen to confront the creditors in courts. The bottomline is this: The Kingfisher case shows that Mallya has cleverly managed to use the judicial system to delay the loan repayment to banks. Creation of a separate court to address large-ticket chronic debt NPAs can solve this problem to a great extent. This court should be constituted with a clear mandate of fast track resolution of NPA disputes and should have pan-India jurisdiction to handle all such cases. The current system of multiple courts has proved inefficient to handle big-ticket bank NPA cases. Even the success of proposed bankruptcy code would depend up on faster resolution of legal disputes. It’s not wise to let cronies misuse the judicial system to their advantage and take the banking system for a ride. Till the time an effective judicial platform is set up to handle such cases, even the wilful defaulter tag — once described by RBI governor Raghuram Rajan as a powerful weapon — is nothing more than a child’s toy.

Till the time an effective judicial platform is set up to handle such cases, even the wilful defaulter tag is nothing more than a child’s toy

Advertisement

End of Article

)

)

)

)

)

)

)

)

)