Investigators going after erring bank officials in connection with fraudulent transactions or rule violations is nothing new; that’s necessary to bring the guilty to book and cleanse the system. But, when those investigations transform to a witch-hunt, it becomes counterproductive for an already struggling economy. Some of the recent actions by investigators against bank officials in connection with bank frauds and wilful defaults have caused widespread panic among bankers. There have been a series of incidents in the recent past that has triggered panic among bankers. For instance, in June, Maharashtra police arrested

Bank of Maharashtra (BoM’s) managing director Ravindra Marathe, executive director Rajendra Gupta, zonal manager Nityanand Deshpande, former chairman Sushil Muhnoot and three other officials in a cheating case lodged against real estate developer DS Kulkarni and his wife. In another instance, former Canara Bank Chairman S Raman had to quit an RBI panel after the CBI initiated a probe against him in connection with a loan to Winsome Diamonds. In this context, Union minister

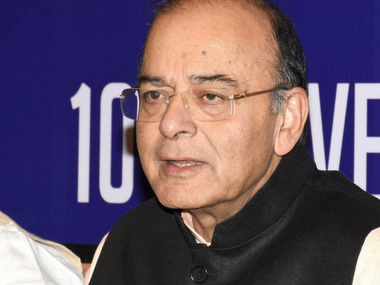

Arun Jaitley made a pertinent point by speaking against the witch-hunt against bankers and calling for a change in the Prevention of Corruption Act to prevent investigators from wrongly targeting bank officials. Jaitley also spoke about state police overlooking the federal structure citing overlapping jurisdictions. [caption id=“attachment_4330469” align=“alignleft” width=“380”] A file image of Union Finance Minister Arun Jaitley. PTI[/caption] The present situation is something similar to what happened towards the end of 2012, when senior executives in many public sector banks (PSBs) increasingly spoke of a fear psychosis gripping the banking system, paralysing the sector. A series of investigations by central investigative agencies into the telecom, mining and real estate sectors had left every banker with a fear of getting prosecuted — even on business decisions they had taken in the past. The context of investigations, back then, was primarily the alleged irregularities by the then government in awarding second-generation airwaves (2g) and coal resources. Logically, post that, most PSBs slowed down decision making whenever a large corporate loan proposal reached their table. This led to further slowing down of credit growth even to good borrowers. Perhaps, a similar situation is playing out now after a series of a bank scams hit the country, beginning with the Rs 14,000 crore Punjab National Bank (PNB) scam. The ongoing NPA-crisis in the banking sector and a series of frauds that have hit these banks are a result of an absence of governance reforms and a lack of professionalism and accountability compared with their private sector counterparts. For several years, state-run banks operated like feudal-era institutions engaging in careless lending practices. In a bid to show business growth and appease the promoter (the government, which is the majority owner), creditworthiness of the borrower was often overlooked. A good example is the Kingfisher-Vijay Mallya case where banks competed with each other to give money to a failing airline, merely looking at the personal guarantee of its flamboyant promoter. Similarly, many bank frauds happened on account of a failure, on the part of the management, to ensure that checks and balances are in place. But, while the guilty need to be brought to book, a witch-hunt is no cure. If that happens, bankers will once again go slow on even genuine loan proposals to industry, fearing investigations, which can delay the economic growth recovery even further. It is important to maintain a flow of credit to the productive sectors of the economy. The unavailability of funds will not only delay the economic recovery but will also trigger the next round of bad loan waivers.

While erring bankers must be brought to book, a witch-hunt is no cure. Because bankers will , fearing investigation, go slow on lending to genuine borrowers, moves that will apply the brakes on the economic recovery

Advertisement

End of Article

)

)

)

)

)

)

)

)

)