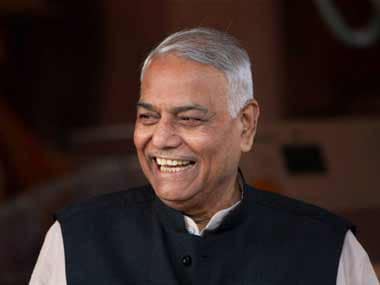

With Prime Minister Narendra Modi back in office with a clear mandate, the focus now shifts on the Union Budget 2019. On 5 July, Finance Minister Nirmala Sitharaman will present her maiden budget in the Lok Sabha. In order to make the budget process more inclusive and participatory, the finance minister has sought inputs from citizens until 20 June. The government has urged citizens to submit their suggestions either directly in the comments box or attach a PDF document on www.mygov.in. [caption id=“attachment_4094507” align=“alignleft” width=“380”]  File image of Yashwant Sinha. PTI[/caption] Union Budgets, historically, have played a key role in shaping the Indian economy after Independence. Many of the announcement made by finance ministers in their Budget speech have had long-lasting on India’s economic trajectory. The budgets presented for the financial years 1957-58, 1973-74, 1986-87, 1991-92, 1997-98 and 2001-02 have often been considered some of the most important in the history of Independent India. Ahead of the Budget on 5 July, here is a brief look at the Budgets presented in the fore-mentioned Financial Years. 1957-58 Budget Presented by: TT Krishnamachari The Budget is remembered for the introduction of Wealth Tax, which remained in some form or the other for the next six decades. This tax instrument was a levied on the total value of personal assets. The 1957 Budget introduced the import licensing system, which put severe restrictions on imports. Interestingly, the excise rate was increased to a whopping 400 percent in this Budget. 1973-74 Budget Presented by: YB Chavan This Budget is also called “Black Budget” by critics. The Budget was presented at a time of great economic distress in India, largely due to the failure of monsoon and the cost of the 1971 Bangladesh war. Economic pressures meant that the Budget showed a deficit of over Rs 550 crores. The Budget was heavily criticised for setting aside Rs 56 crore for the nationalisation of the general insurance companies, Indian Copper Corporation and coal mines. Moreover, the nationalisation of coal mines reportedly hampered production in the long run. 1986-87 Budget Presented by: VP Singh The second Budget presentation by Singh heralded reforms in India’s indirect tax system. In fact, some commentators have said that the early steps for the Goods and Services Tax were laid down in this Budget. Also known as the “carrot and stick Budget”, the 1986 Budget sought to curb smuggling and black marketing. One of the reforms was the introduction of the Modified Value Added Tax (MODVAT), which allowed the manufacturer to obtain instant and complete reimbursement of the excise duty paid on the components and raw materials. 1991-92 Budget Presented by: Manmohan Singh Perhaps the most important Budget in the history of Independent India, it opened up the Indian markets to global competition in the wake of a Balance of Payment crisis. The Budget began the process of dismantling the Licence Permit Raj, which opened the economy for foreign investors. The Budget overhauled India’s trade policy as it slashed import licensing and promoted exports while maintaining an optimal import compression – a term used to denote deliberate reduction in imports to keep trade balance surplus. 1997-98 Budget Presented by: P Chidambaram This Budget is also known as the “Dream Budget” by the media and analysts. The Budget reduced personal income tax rates from 40 percent to 30 percent and cut corporate tax rates. It also encouraged higher investments from Foreign Institutional Investors and prepared the ground for the first round of disinvestments. The Budget helped India take its first steps as a low tax regime. Consequently, lowered taxes may have also helped widen the tax base. This is because income tax collection grew from Rs 18,700 crore in 1997 to over Rs 2 lakh crore by 2013. 2000-01 Budget Presented by: Yashwant Sinha This Budget is also known as the Millennium Budget. The Budget helped the Information Technology sector grow exponentially in the first decade of the 21st Century. The Budget phased out Manmohan Singh’s incentives for software developers while cutting down on customs duty, which were levied on various key components required in the IT sector. The Budget also introduced transfer pricing regulations, which played a big role in the prevention of erosion of the tax base in India. Follow full coverage of Union Budget 2019-20 here

The Budget is remembered for the introduction of Wealth Tax, which remained in some form or the other for the next six decades.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)