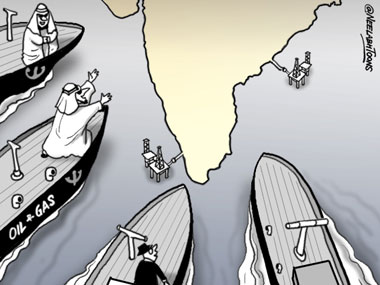

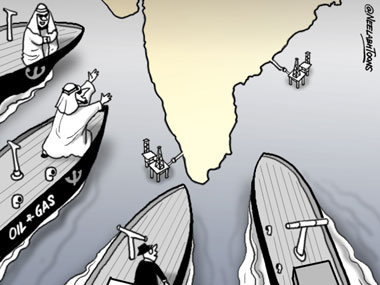

Last weekend the top-notch buyer for India, Messrs Petronet LNG Ltd, broke its 25-year LNG supply contract with Qatar. It became the first company in Asia to renege on an LNG deal. What could have forced their hand? The hard decision was taken despite the fact that it could spiral into a diplomatic embarrassment. Could it be only to gain a few dollars more? [caption id=“attachment_2460694” align=“alignleft” width=“380”]  Cartoon courtesy Neelabh[/caption] Huge savings motivated the tough resolution. Buying LNG from the distressed spot market was around 40 percent cheaper for the company willing them to risk steep penalties for breaking their steel clad long-term contracts with Qatar. Petronet had been taking 7.5 million tonnes of LNG a year from RasGas, Qatar for the last 11 years. The company is witnessing a historic slump in prices. Weakened demand and burgeoning supplies have squeezed the spot LNG prices to tumble more than 50 percent in the past year to about $6 mmbtu. Everyone everywhere is delaying purchases, renegotiating contracts and willing to risk huge penalties. In this case the fine may touch Rs10,000 crore for Petronet. But Petronet will still profit because the buyers in India have an enormous appetite for gas and are queuing up. By artificially suppressing domestic gas price, the government of India only ended up with more loss to exchequer in royalty and cess along with a depressed investment climate. Left to the souks of the world to decide, India would by now have a rational, equitable and affordable gas price as it happened in oil. “If only I had found oil” It was in the summer of June 2010 that India decided to finally do away with discounting crude oil. Petrol prices got linked to the international markets. Oil marketing companies heaved a sigh of relief. The two stalwarts ONGC and OIL who had a raw deal propping up the product unlocked around Rs 50,000 crore from subsidising oil. They now could start investing in exploration for more oil and gas; bring in new technologies and innovations to a sector that had stagnant growth. The fact that the economy was on life support by then and an outgo of Rs 1,37,000 crore annually on subsidies had forced the government’s hand is a topic for another day. It is five years since that day. Today no one, or his lobby, any industry or their association has raised any question on freeing the oil price. It can shoot to $100 or plunge to $50 and bob merrily at $45, the Indian economy does not get rocked. So what stopped the government then from withdrawing a strangle hold on gas pricing? When you are aware that the exploration, development and production costs are similar for both oil and gas, what clogged them? It is incomprehensible and baffling. Given this background, how would a company exploring for hydrocarbons behave in India? When it sinks the drill bit in the deep waters for a Rs 150 crore well in the Bay of Bengal or a Rs 50 crore one in the shallow waters of Arabian Sea, or even a Rs 5 crore conventional land well in Assam, the CFO of the company would propitiate the Gods twice over. Firstly, for an oil discovery and secondly for a ‘no gas show’. This is because the catharsis of a gas discovery could ruin the company’s financial prospects for all time! This might seem over-dramatised but it is the truth. Despite a 50 percent fall in the prices of crude oil in the international market in the last year, companies still make profits while operating an efficient oil field. In contrast, the government administered domestic gas price is based on a complex formula that is 50 percent lower than the equivalent global oil price. Just the other day global ratings agency Standard & Poor’s pointed out that this is a faulty formula that equates India with countries with gas surplus and with developed gas transportation infrastructure. Domestic gas producers cannot sustain this and opt out as they keep getting impacted with each slump in the global oil markets because of this quirky Indian formula. ( Also see Moody’s latest, report on similar lines here ). Look around and you will find the bits and bobs of all those companies who have left the Indian shores. They were the misbegotten explorers of gas in India who said “If only I had found oil”. (Disclosure: Firstpost is part of Network18 Media & Investment Limited which is owned by Reliance Industries Limited.)

By artificially suppressing domestic gas price, the government of India only ended up with more loss to exchequer in royalty and cess along with a depressed investment climate.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)