Subrata Roy, the controversial chief of the shadowy Sahara Group, surely has half a point when he says that market regulator Sebi, instead of beginning the process of refunding the money owed to investors in two of his companies, has been slow on this front. Instead, Sebi has been focused on targeting him.

According to a Supreme Court judgment dated 31 August 2012, Roy was to return over Rs 24,000 crore collected through optionally fully convertible debentures (OFCDs) by two group companies - Sahara India Real Estate Corporation (SIREC) and Sahara Housing Investment Corporation (SHIC) - to three crore investors. Even though Roy has not paid this amount to Sebi, he has given the regulator a cheque for a lesser amount (Rs 5,120 crore), which is enough to begin the process of repayment.

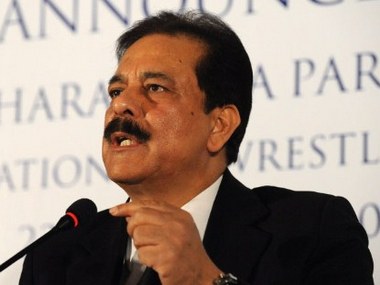

[caption id=“attachment_694594” align=“alignleft” width=“380”] He claimed personal assets of less than Rs 5 crore even though his empire runs into tens of thousands of crores. AFP[/caption]

He claimed personal assets of less than Rs 5 crore even though his empire runs into tens of thousands of crores. AFP[/caption]

Thus Roy is not wrong in pointing out to The Economic Times that Sebi is jumping in to repay investors after verifying their antecedents. “I requested them to kindly look into these two things (verification and paying investors) seriously. Until the verification is complete, our money will be stuck with them. Sebi is not taking any action on that front. Start the verification so that the money can be released. I requested that people from both Sebi and Sahara should sit together so that the process of verification speeds up.”

Not only Roy, even the Supreme Court has been harsh on Sebi in the past. At a hearing in February, where Sebi had sought to file a contempt notice against Sahara for failing to comply with court orders, the bench observed harshly: “We wonder whether Sahara is committing contempt (of court) or you (Sebi) are committing contempt. You have done nothing, except issue notices after notices (to Sahara). Who is committing contempt?”

Impact Shorts

More ShortsThis is what spurred Sebi into action against Sahara, when it moved to freeze the assets of these two companies and also the personal assets of Roy and some of his close associates.

Roy, of course, is now busy painting himself as a victim of vendetta whereas the truth is that his own illegal acts were instrumental in bringing down his two companies. “Many government agencies have been targeting us… Will reveal at the right time… there is vengeance against us.”

And, of course, he went through the “poor me” routine of politicians - he claimed personal assets of less than Rs 5 crore even though his empire runs into tens of thousands of crores. ““My gold ornaments and stones are worth about Rs 3 crore. Cash and bank balance is Rs 34 lakh and fixed deposits is Rs 1.59 crore. My immovable property is nil.” Even though his group disclosed multiple types of property as underlying assets belonging to investors , are we to presume he himself lives in someone else’s hut somewhere?

While Roy may have half a point - about Sebi taking too long to begin the process of repayments - he is surely being too clever by half.

First, in asking Sebi to chase his investors - many of whom may be non-existent - Roy is essentially asking the regulator to go on a wild goose chase while he watches the fun. The suspicion against Roy is that he may have many benami investors, none of whom will show up when required. So when he asks Sebi to verify his investors, he is essentially laying a trap for the regulator. The chase may lead nowhere, and Sahara would have gotten years of reprieve in the process.

Second, Roy has not told us why his data records are so bad. In a petition filed by Sebi with the Supreme Court, where it sought the arrest of Roy and two of his directors, Sebi offered data to show that just about 1 percent of the investors Sahara had indicated were contactable by post.

The regulator had sent out 21,253 registered letters to Sahara OFCD investors based on information provided by the group. Only 233 debenture holders responded - a success percentage of just 1.09 percent. Approximately 7,733 letters were returned unopened and undelivered, some with the legend “incomplete address/address not found.”

This suggests that at least 36 percent of Sahara’s investors are either non-existent or have moved away from their stated addresses. Or it could mean that the Saharas have not kept proper records of their investors’ addresses. Not exactly a great advertisement for how the group treats other people’s money. The obvious question is: why should Sebi chase non-existent or non-responsive investors? Just to give Sahara more time to doctor its list of investors?

Three, a plain reading of the 31 August Supreme Court order suggests the following: Sahara gave the court no inkling that it was returning the money to investors; after the judgment, it failed to deposit the Rs 24,000-and-odd crore that it had to. Even after another bench of the court gave Sahara three more months to comply, Roy hasn’t paid up.

What this suggests is that the Saharas have managed to confuse the real issues by constantly seeking court interventions that compound the problem rather than clarify it.

These actions of Sahara are consistent with the group’s continuous efforts to forum-shop. When the Reserve Bank asked it to wind up, it went to the registrar of companies to avoid Sebi scrutiny and raised huge amounts of OFCD money. When Sebi found out and got into the act, Sahara went to the Supreme Court. When the court ruled in its favour, it went to another part of the Supreme Court with another grievance and stalled the 31 August order.

Why should one man be allowed to play ducks and drakes with various regulators and also the courts, including the Supreme Court? This is as much a question for the courts as for Sebi and other regulators.

)