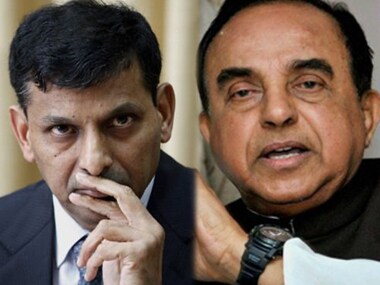

The BJP’s maverick leader and Rajya Sabha member Subramanian Swamy has unpinned yet another grenade on Reserve Bank of India (RBI) governor Raghuram Rajan, when he alleged on Thursday that Rajan has planted a bomb in the financial system that’ll explode later this year. “R3 planted a time bomb in our financial system in 2013. It is timed for December 2016. The redeemable USD 24 billion in f.e. to be paid out by banks (sic),” Swamy tweeted. [caption id=“attachment_2826646” align=“alignleft” width=“380”]  RBI Governor Raghuram Rajan and BJP MP Subramanian Swamy. PTI[/caption] Assuming that the ‘f.e’ meant foreign exchange, Swamy is referring to the upcoming redemption pressure on banks when the foreign currency non-resident (bank) (FCNRB) deposits mature in the September-November period this year. Let’s take a look at what exactly is the issue. When the rupee was still in doldrums in September, 2013 (the local unit had touched a lifetime low of 68.85 against dollar in August 2013), Rajan, then newly appointed as RBI governor, initiated a slew of measures to lift the spirits of the free falling currency. This was done by a series of measures to arrest the outflow of the dollar and attract inflows. That was a time when the country’s economy wasn’t showing any signs of recovery and foreign exchange reserves chest had depleted well below $300 billion. Part of the measures announced by Rajan was letting banks raise dollar through 3-year FCNRB deposits. The RBI made the scheme attractive for banks by opening a rupee-dollar swap window at attractive rates. The RBI did this by subsidising the hedging cost for banks on FCNRB deposits at a fixed rate of 3.5 percent as against the 7 percent. This made the cost of overall deposits for the bank about 9 percent compared with a rate of 12 percent. On the other hand, the scheme worked for the NRI customer this way. He invests an amount in dollar in the foreign branch of a bank and gets an overdraft (loan) on this to reinvest the amount in the FCNRB account of the same bank. The bank pays him a rate 400 basis points above the London Interbank Offered rate (Libor), which is a global benchmark. Ultimately, the customer earns an annual return of 17-18 per cent on his investment. The deal was a win-win for both the banks and the non-resident Indians who invested in FCNRB deposits, some of them on borrowed funds. It still made sense for them on account of the huge interest rate arbitrage opportunity. In other words, the customer gained much more returns on FCNRB deposits than what he had to pay on the loans he borrowed to invest in the FCNRB account. The scheme lured many NRIs who found a big opportunity to make quick money using the FCNRB bonanza. The RBI raised $25 billion through FCNRB deposits and another $9 billion through foreign currency borrowings, thus raising $34 billion in total. The reason why RBI, under Rajan, did this is quite simple. It had to somehow mobilise quick dollar supply to stem the rupee’s free fall. Post the measures, the rupee got a support and started to recover fast. Since then it has gained certain stability allaying the concerns of the financial markets. If the central bank didn’t take emergency measures that time, the story would have been different perhaps. The economy would have probably faced yet another currency volatility crisis that would have spilled over to other segments of financial markets, causing prolonged damage. Now what is the time-bomb Swamy is talking about? As mentioned earlier, the three-year FCNRB deposits are coming up for redemption this year between September and November. Since many of the investors had taken loans to invest in FCNRB, they will have to repay the money by withdrawing the FCNRB deposits. The redemption pressure is estimated to be around $20 billion. Since such a large amount of redemption is coming in a short interval, banks may find it difficult to mobilise dollars. If they fail to do so, that can send a catastrophic signal in the forex and equity markets, which is what Swamy is describing as a ‘time bomb’. But, the fact is that this is a bomb already defused by the RBI governor in his post policy presser. Rajan acknowledged the possible redemption pressure on the banking system later this year. “To the extent that people have borrowed to invest in FCNR deposits, the leveraged portion may not be renewed. Therefore, there could be outflows of the order of $20 billion or so,” Rajan said. But, the governor added that the central bank is prepared to meet the dollar demand of the banking sector in the event of an exigency, but adding that the system shouldn’t take this assurance for granted. “We will supply dollars in case of extreme volatility but no one should take this for granted. But for sure we have plenty of dollars that we can supply if necessary,” Rajan said. The central bank is in a much better position as far as dollar reserves are concerned as compared with three years back. Today, it has reserves of over $360 billion. Typically, when there is a dollar shortage in the banking system, the central bank infuses dollar through state-run banks but in the process the rupee liquidity gets sucked out. Replying to a question at the presser, Rajan has assured on possible shortage of rupee liquidity also saying that the central bank will offer short-term liquidity in the banking system if needed. What Swamy has tweeted, in the capacity of a BJP MP, will only help to create panic in the financial system and add to the speculation. The comment was unwarranted in the backdrop of a firm assurance by the RBI governor just two days back. If indeed Swamy is concerned about the systemic implications of the dollar shortage on FCNRB redemptions, he should have taken up the issue with finance minister Arun Jaitley and persuaded him to initiate a ministry level dialogue with the central bank on the issue. Swamy’s ‘time bomb’ remark, his typical battle style, is an immature response as he seeks more ammunition in his fight against Rajan, whose term is ending in September. Swamy doesn’t want Rajan to continue and has written to PM Narendra Modi asking to sack him, accusing the governor on a range of issues including on Rajan’s efficiency as a governor, his interest rate policy and commitment to the country. The latest attack too will be seen in that context. When the redemption pressure comes in September-November, the financial markets are surely to see some pressure but chances for a ‘time bomb’ bursting is likely to be a work of fiction by Swamy. At the most, it will manifest as a wet fire cracker.

Swamy’s ‘time bomb’ remark, his typical battle style, is an immature response as he seeks more ammunition in his fight against Rajan

Advertisement

End of Article

)

)

)

)

)

)

)

)

)