The State of Working India 2018 report of Azim Premji University carries a comprehensive assessment of the other side of the Indian economy. It is an unexpected study and no political party and government wants to comment on it. The findings are disturbing for those who still believe that aggressive growth rate of the economy ensures better employment and income to the citizens. This article attempt to compare this finding with the Reserve Bank of India (RBI) and Government of India’s databases to see how severe the intensity of India’s working conditions. [caption id=“attachment_92753” align=“alignleft” width=“380”]

Reuters[/caption] One of the crucial observations of the report is that every 10 percent increase in gross domestic product (GDP) results less than one percent increase in employment. India’s economic reform process has been criticised for this negative correlations, i.e persistence of jobless growth. The Reserve Bank of India’s data on the employment elasticity of India from 1972 to 2012 proved that the country faces declining employment elasticity, i.e the percentage changes in employment with every one percent point change in economic growth. Table 1 proves that the country is facing a declining employment elasticity with increasing economic growth. The RBI data never explains the reasons explicitly, yet, it invites public attention. (See table 1) The State of India Working report moved one step ahead and gives a clear and categorical picture of the declining employment opportunities vis-a-viz GDP growth rate in the country. (See figure 1)

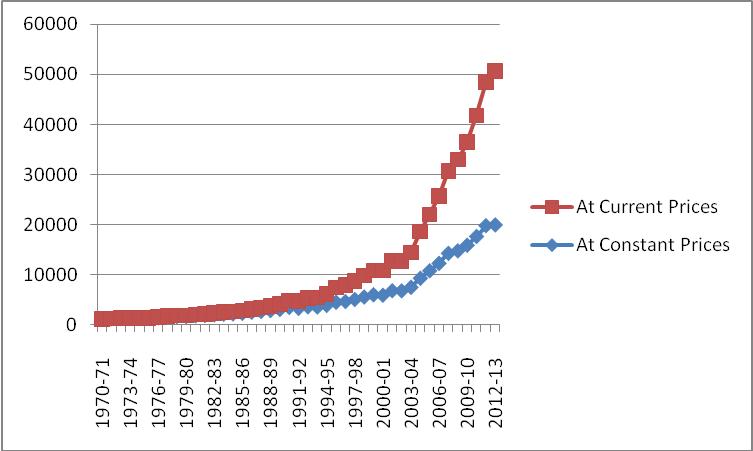

It is evident from the data that the country had been experiencing better employment generation before liberalisation. From 1999 to 2004, the country made better progress and later on it started to decline. It also demonstrated that fact that higher GDP never ensures employment generation. However, every policy initiative of the government wants to achieve higher GDP and do maximum possible interventions to achieve it. This report questions this argument with facts. A higher GDP also indicates the amount of wealth and capital formed in the country. (See graph 2)

The government shifted the base year of calculation from 2004-05 to 2011-12, according to which investment again shows an increasing trend. (See graph 3) Graph 3: Gross Fixed Capital Formation (GFCF)Base Year : 2011-12=100 Rs in Billion.

Source: www.indiastat.com Graphs 2 and 3 give the trend of capital formation in the county, it is increasing at a higher rate. This macro picture has to be segregated on the basis of source of investments. Graph 4. Capital formation in public and private industrial sectors 2015-16.

Data in the Graph 4 are the missing link of this trend. Private industrial capital formation is overtaking the public sector and also the fact that private capital is largely concentrated in mining and financial services. Investments in these two sectors are largely dependent on government’s policy support and huge tax relaxations. The Graph 5 tells the differences of grows fixed capital formation in public and private industrialm corporate sectors in the year 2016-17 in various sector. The state of India working report has not carries this crucial information. The poor employment generation is also attributed to the preferential investments in the country. Compared to the private sector, public sector capital formation is less. Interestingly, public sector contributes more in the agriculture sector than the private sector. The State of Working India report also shows that employment growth in agriculture sector is growing at a negative growth rate. This huge difference in capital formation has to be assessed in the context that the labour productivity increases six times based on 1982 to 2016-17, however the real income of the workers grown by only 1.5 times. This disparity added to the labour vulnerability in the country at the macro and micro level.

Another disturbing finding of the state of working India report is that scheduled caste workers earn only 56 percent of their upper caste counterparts. For schedule tribe it is 55 percent and OBCs it is 72 percent.

This is perhaps the first report which carries such a crucial date after Justice Rajinder Sachar Committee report in 2005 which talks about the cast and religious wise economic disparities in the country. We are celebrating the 27th year of liberalisation and every natural achievement of the economy is being attributed to the private sector which is benefited by liberalisation. The reference report for this article and other authentic data sources give immense reasons to question the tall claims of India’s economic performance. The Indian economy is in a robust condition from a private corporate sector perspective since it provides all sorts of state support to promote it, however, the general public - especially the labour and the majority of deprived sections, don’t accept those claims. This is not the first time the country has seen such a comprehensive report. For instance, the report of the national commission for enterprises in the unorganised sector in 2007 also indicated the informalisation and lack of decent jobs in the economy. No action was taken and similarly this report on the state of working India report is also not going to make any policy-level change in the country. It does not mean that it is impossible for the government to revert the existing economic policies; however, it is about the possibilities attached with the vision and mission of drastic social transformations. The information discussed above could be read as the sign of an emerging market economy only and not an economy which accommodates the toiling masses. (The writer is Assistant Professor, Jamsetji Tata School of Disaster Studies, Tata Institute of Social Sciences)

)

)

)

)

)

)

)

)

)