Only nine percent of internet users in India transact online. This is surprising since the number of Indians using the internet is growing. A report released recently, Internet in India 2013 by Internet and Mobile Association of India and Indian Market Research Bureau (IMRB) pegs India’s active internet users at 213 million by the end of this year, third in the world after China and US.

Yet, what makes the average Indian so reluctant to transact online and prefer Cash on Delivery (COD) instead? One of the reasons is that a large number of people feel vulnerable when giving out details of their cards online. “Around 55 percent of our orders are COD and the remaining are through online payment,” says Nikhil Rungta, CEO, Yebhi.com, an e-commerce portal for shopping. Various deterrents play spoilsport when it comes to online payments in India.

“It maybe your internet connection, slow server between the merchant and the bank or there might be a problem with the card itself. When you want to make online payments, there are many details to be filled. The customer feels it is not worth it,” elaborates Satyen V Kothari, CEO, Citrus Payments, a two-year-old online payment solutions company in Mumbai.

Online options

Kothari claims that Citrus Checkout, a technology from Citrus Payments, increases the chances of a successful transaction. If a bank’s payment gateway does not work owing to poor connectivity, the software detects it and automatically shifts the process to another bank’s gateway system, to complete the transaction. The company also offersanother payment gateway, Insta-Buy, which it claims finishes transactions for buyers and merchants in minimal steps by easing out the sign-up process.

“We ask the buyer first if he wants to save personal information. Once he says yes, he will never have to enter the details again across all our merchants. He just has to enter one or two passwords and we send shipping and other details to the merchant,” explains 35-year-old Kothari.

Presently, Citrus processes 1.7 million transactions per month on the back of 1,100 clients including Sun DTH, Healthkart.com, and Lenskart.com.

A minimum of Rs 500 is charged monthly and this can increase depending on volumes.

“For InstaBuy, we take a percentage of the transaction and for Citrus Checkout, we charge a monthly fee which varies on features and the number of transactions,” says Kothari. He claims that Citrus is showing 25 percent year-on-year growth in transactions, which will grow by 80 percent this year.

Tech errors

Mohit Bhatnagar, Managing Director, Sequoia Capital India Advisors, who invested $1.8 million in Citrus in 2012 says, “Merchants don’t need just a processing vendor but rather someone who solves payment problems and enhances revenues,” he says.

Amit Chaudhary, COO, Valyoo Technologies, a six-month-old subscriber to Citrus’ software solution and payment gateway, says it has increased successful transactions by 10 percent. Valyoo owns watchkart.com, lenskart.com, etc. “Earlier, we were using other payment gateway solutions, but had hiccups during transactions,” he says.

Bhatnagar says the onus is on new players to plug payment glitches and prevent failure or frauds. “The first wave of e-commerce in India gave birth to payment processors. However, the first generation payment solutions suffered a setback due to high failure rates of transactions,” he says. Sequoia has also invested in other similar companies like Pine Labs and Prizm Payments.

Upasana Taku, Co-Founder of Delhi-based Zaakpay says, “Until 2012, besides banks, there were just a few third party payment companies ruling this segment. Almost all of them had high sign-up costs, long sign-up processes or inferior technology, or sometimes all of these issues.” Its solution, WebPay provides an integrated online payment processing solution that enables organizations to accept credit cards, debit cards and carry out net banking as well.

The sign-up process for merchants at Zaakpay is paperless leading to quick approvals, 33-year-old Taku says. “We have the fastest merchant account approval records of all payment gateways in India and we get a merchant up and running in 24 hours.”

The new model

Apart from large and medium-sized online merchants like Snapdeal, MakeMyTrip, etc., there are various small merchants in the unorganized retail sector in India who do not have a dedicated online business but their customers wish to make online transactionsat times. Six months ago, PayU, a two-year-old Naspers-backed payment gateway company in Mumbai, launched PayU Paisa to cater to such merchants. “There are millions of small merchants for whom we provide a different payment service,” says 30-year-old Nitin Gupta, Co-Founder, PayU.

Within six months of operations, around 5,000 small merchants have used PayU Paisa and the startup claims to add up to 110 merchants daily. With 7,000 clients to date, the company claims to have made 250,000 transactions per day across large and small clients.

For large merchants the company has a regular payment service with a setup fee. For every transaction, the merchant has to pay 2.9 percent of the transaction as a transaction fee. However, it charges no setup fees to small merchants.

“Small merchants can’t or don’t want to pay an upfront fee. In certain cases, we even create a website for them as their primary business is offline,” Gupta tells us.

Mobile mode

Almost all payment gateway companies have realized the potential of mobiles phones and its utility with regard to online transactions. The IAMAI and IMRB report says that compared to 0.4 percent mobile internet users in 2012, penetration has grown to 2.4 percent this year. PayU says that 12 percent of their online transactions are made through mobile phones.

Zaakpay also has a dedicated mobile payment technology for merchants with specific solutions for mobile websites and mobile applications to simplify payment collection.

The mobile web (browser-based) payment solution works across browsers. An in-Application payment solution can also process the transactions within the applications (Android and iPhone) itself.

To date, the company processes mobile transactions worth over Rs 50 crore. Zaakpay charges a commission per purchase to merchants apart from a one-time setup fee ranging from Rs 10,000 to Rs 30,000.

“The most important thing for a marketplace is to be able to make every merchant live instantaneously. We are able to make new merchants live within a day,” says Taku.

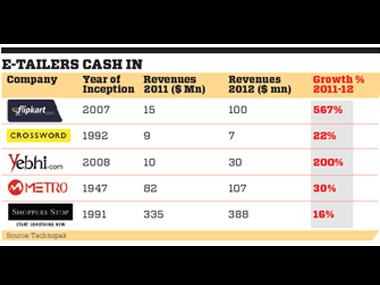

[caption id=“attachment_76216” align=“alignnone” width=“380”]  Source: Technopak. Image: Entrepreneur India[/caption]

This article first appeared in Entrepreneur India magazine.

)

)

)

)

)

)

)

)

)