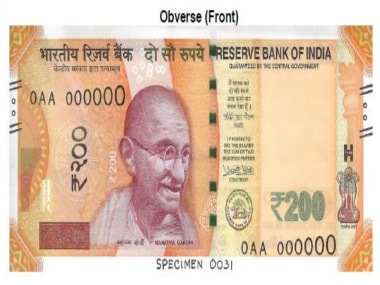

There is good news for citizens who prefer to withdraw money in small amounts and that too from automated teller machines (ATMs). The Reserve Bank of India (RBI) has asked banks across the country to supply newly-introduced Rs 200 through ATMs and has directed lenders to recalibrate all their cash vending machines. So far, banks or cash supplying intermediaries were not filling ATMs with the new lower denomination currency notes the RBI had issued on 25 August, 2017. Since then, citizens have been pressing banks to load Rs 200 notes in ATMs. RBI’s latest directive to banks comes as a big relief for people at large as currently only Rs 100, Rs 500 and Rs 2,000 denomination notes are being supplied through ATMs. [caption id=“attachment_4286807” align=“alignleft” width=“380”]  Courtesy: PTI[/caption] A report in The Economic Times cites two people familiar with the development as saying that the whole exercise of recalibrating ATMs will cost banks Rs 110 crore. In India, there are as many as 2,22,000 ATMs and the cost of recalibrating one cash machine is Rs 5,000. The RBI brought out new Rs 200 notes as part of its massive remonetisation drive in the aftermath of demonetisation on 8 November, 2016. By introducing the bills, the RBI also wanted to fulfill its target of supplying more number of lower denomination currency notes in the banking system. Immediately after recalling the old Rs 1,000 and Rs 500 notes in November 2016, the central bank printed and supplied new Rs 2,000 notes in the system, a move heavily criticized by people who keep a close watch on the banking sector. According to these hawks, the sole purpose of demonetisation to eradicate black money from the system was not fulfilled as after the note ban high value currency note of Rs 2,000 was issued. The ET report adds that even after the government’s big push for cashless transactions was in force, total value of withdrawals from ATMs went up, though marginally, from Rs 2.22 lakh crore in September 2016 to Rs 2.44 lakh crore in September 2017. Apart from that, the total value of currency in circulation as per latest RBI figures is Rs 17 lakh crore which is 95 percent of pre-note ban levels.

The sole purpose of supplying Rs 200 notes through ATMs is to ensure more number of lower denomination currency in citizens’ hands

Advertisement

End of Article

)

)

)

)

)

)

)

)

)