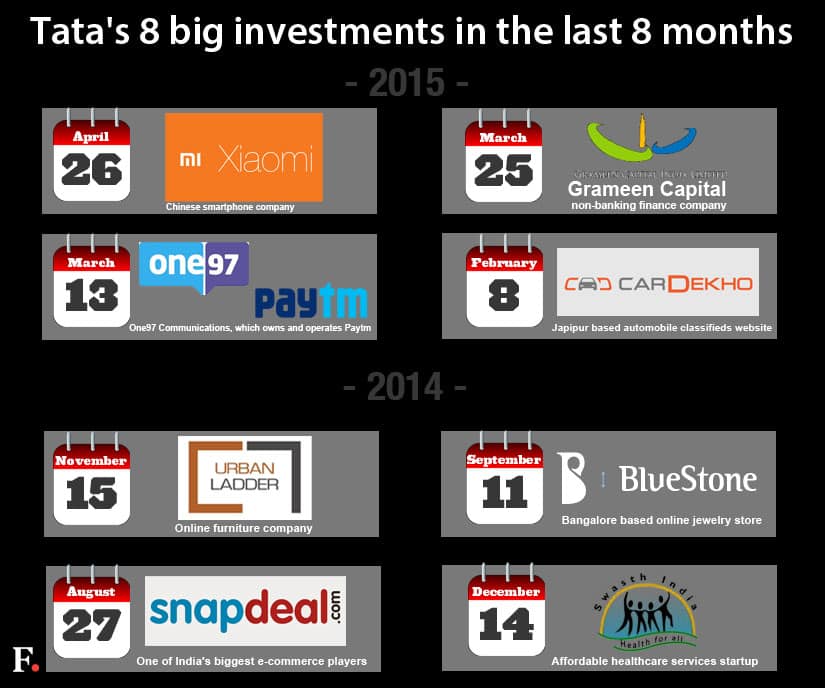

When corporate India’s stalwart Ratan Tata retired as the chairman of the Tata group in January 2013 after a 50-year run he had said he would devote much of his time to his first love — flying. While Tata did achieve that with being directly involved in Tata Son’s airline ventures Air Asia and Vistara — he has been rather busy by turning himself into a mentor for young entrepreneurs and making investments in several online companies and start-ups. Tata is estimated to be worth Rs 6,000 crore and is using his personal wealth to fund India’s startup ecosystem. Over the last eight months alone, Tata ( 77) has invested in eight start-up companies through his personal investment company, RNT Associates, most of them in the e-commerce sector and some in automobiles, retail, jewellery as well as design and telecom with the latest being the world’s third-largest smartphone maker Xiaomi. With over half a dozen in his portfolio, Tata can be easily termed as a mini venture capitalist. Even though Tata’s first big investment post retirement started with Altaeros Energies, a US-basedhigh-altitude wind power developer, his ecommerce journey began with an investment in Snapdeal in August last year, following which he invested in Bluestone, which is an online jewellery portal started by IIT graduates. Considering that Tata owns their own jewellery chain Tanishq, this investment raised a few eyebrows.  In November 2014, Tata invested in Urban Ladder, an online furniture retailer. A month later he invested in an affordable healthcare services startup — Swasth India as he was keen on pursuing investments which have a social impact. On March 24, 2015 Tata picked up a stake in Grameen Capital India, a firm that advises and arranges funds for microfinance institutions in India. A week earlier, he had bought into One97 Communications, which owns mobile payments and e-commerce firm, Paytm, while in February, Tata invested in Jaipur-based online automibiles classifieds website CarDekho.com. And on April 26, Tata invested an undisclosed amount in China’s largest smartphone maker, Xiaomi, making him the first Indian investor in the world’s most valued technology startup. Earlier this year, he also joined venture capital firm Kalaari Capital, which has UrbanLadder, Bluestone, Snapdeal and Cardekho, Zivame as its portfolio companies among 23 others, in an advisory role. Even Railways Minister Suresh Prabhu has got Tata to head Indian Railways’ innovation council, ‘Kayakalp’. “The purpose of the council is to recommend innovative methods and processes for the improvement, betterment and transformation of Indian Railways,” the ministry stated. Taking retirement to an entirely new level, Tata is putting his buck where the next big idea is and lending not only his brand value but also his wisdom. His investments in these new-age companies lend credibility to these firms and also gives Tata the status of a sought-after celebrity investor for Indian e-commerce ventures. Little wonder that many growth stage e-commerce companies are now tying to woo Tata to get him onboard and increase their chances of survival as the consolidation game gets stronger. When Tata had invested in Snapdeal last year, the company’s founder and CEO had said “An investment by a legendary and respected figure like Tata is an excellent validation of our focused strategy on building a long term enterprise and marks the start of a very important phase for the company.” On Sunday, Xiaomi founder and CEO Lei Ju said “He (Tata) is one of the most well-respected business leaders in the world. An investment by him is an affirmation of the strategy we have undertaken in India so far.” So why is Tata betting big on start-ups? At the MISB Bocconi’s 2015 convocation held in Mumbai on Thursday, Tata termed entrepreneurship as the ‘engine’ of any economy, and said that Indians are naturally enterprising and have a long history to show it. He added that entrepreneurship had become the style of the day and that a good idea backed by good resources was well worth taking the risk. But Tata is not the only Indian corporate honcho to aggressively invest in the burgeoning online retail sector. Wipro Chairman Azim Premji has investments in Myntra and Snapdeal, while his rival and Infosys co-founder Narayana Murthy (through Catamaran Ventures) started a joint venture with Amazon to help small and medium businesses come online.

When corporate India’s stalwart Ratan Tata retired as the chairman of the Tata group in January 2013 after a 50-year run he had said he would devote much of his time to his first love — flying. While Tata did achieve that with being directly involved in Tata Son’s airline ventures Air Asia and Vistara — he has been rather busy by turning himself into a mentor for young entrepreneurs and making investments in several online companies and start-ups.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)