The Narendra Modi-government has done well by introducing a small dose of reduction in interest rates on short-tenure small savings schemes from April 1 and leaving the long-tenure ones untouched. It was a difficult choice to make but a necessary decision since millions of savers, mainly retired people, bank on such low-risk schemes to park their savings.  But, there was no other way to nudge banks to lower the borrowing costs in the banking system except to rationalize the returns on small savings schemes, aligning it with the market rates. This was precisely banks too wanted and lobbying for. It works this way: unless deposit rates come down, banks wouldn’t be able to cut their lending rates. If they do so, they will have to take a serious hit on their net interest margins (interest earned on advances minus expended on deposits). But reducing the deposit rates wasn’t easy since the depositors would then plan a mass exodus to the small savings schemes that offered higher returns, which banks cannot afford. Government’s current move will logically put pressure on banking system to lower their deposit rates at par with the new rate structure and follow it up with a cut in lending rates too. Lowering the borrowing rates in the economy is critical to give a leg up to the struggling corporate sector. Remember, even after a 125 bps reduction in key rates by Reserve Bank of India (RBI), banks have delivered only about 60 bps cut in their base rates (minimum lending rates) citing competition from small savings schemes as one of the reasons. That excuse is no longer valid.  The government has announced a 25 basis points (one bps is one hundredth of a percentage point) reduction in the interest rates of small savings. Accordingly, the five-year recurring deposits, and one-year, two-year and three-year term deposits will stand to lose their interest rate advantage with the government removing the 25 bps spread over Government securities of similar maturity from April 1, 2016. It is likely that the returns on long-term savings products too will be brought down to align with market rates. Presently, the interest rates on various small savings schemes of the government such as Kisan Vikas Patra, public provident fund and National Savings Certificate are some where close to 8.5-8.7 percent. Currently, a five-year bank fixed deposit offers a rate of return of about 7-8 percent to the customer. Savers to suffer As noted earlier, the other side of the story is that the whole exercise (reduction in short-term savings schemes now and on longer-term ones likely later) would be a bad news to savers since thy will have to now settle with lower returns, else choose high-risk investment options such as equity. “Its true that the move may come as a bit disappointing to the investors in this scheme but this is necessary to bring down overall interest rates in the financial system,” D K Joshi, chief economist at rating agency Crisil said. But, for the borrowers this is good news since banks will have to do some convincing reduction in their lending rates, translating to some benefit in the overall interest burden of the end-consumer. But, expecting large reduction in the EMI burden will not be wise since, as Firstpost, has highlighted before, a few basis points cut in banks’ base rates wouldn’t significantly reflect in the EMI burden. Nevertheless, it’s certainly an incentive to average Indian consumer, for whom, even a minor decline in their interest cost burden is a boon. On the other hand, making long-term investment schemes unattractive to investors may not be a prudent move on the part of the government if it wants to channelize long-tem savings such as PPF and pension funds to infrastructure funding eventually. The bottom line is this: bringing down the small savings rate is a necessary evil that the government had to choose sooner or later. It’s good it has begun with a small dose. Data support by Kishor Kadam

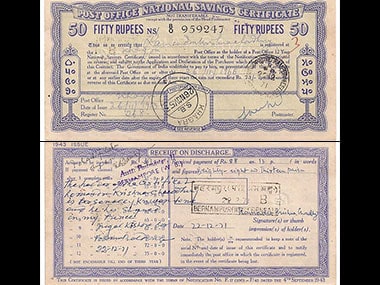

The government has announced a 25 basis points reduction in the interest rates of small savings

Advertisement

End of Article

)

)

)

)

)

)

)

)

)