New Delhi: If car loan rates remain high and diesel prices relatively lower than petrol, growth in small cars could again be muted in 2012-13.

For perhaps the first time in many years, small cars reported a decline in growth in 2011-12 (FY12), largely on account of Maruti Alto’s decline. Now, the Society of Indian Automobile Manufacturers (SIAM) has forecast 10-12 percent growth in overall passenger cars for this fiscal, but this number may be lower if small car growth is again hindered.

Small car customers are typically the most sensitive to interest rate fluctuations; also, small cars do not have diesel powertrains at a time when most of the growth in FY12 came from diesel cars. According to industry estimates, at least 4,00,000 diesel car customers are waiting for deliveries even as petrol cars languish at dealerships.

Do small car manufacturers now need to consider price reductions and larger discounts to lure customers to showrooms?

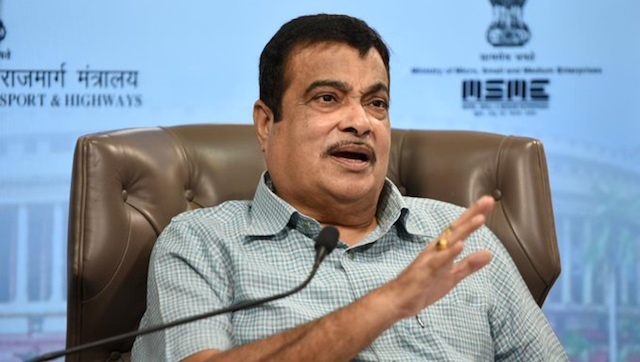

SIAM President S Sandilya said no separate forecast has been given for the growth in small cars but he issued an appeal to the government to lessen the price difference between petrol and diesel. “Even if the government cannot decontrol diesel prices immediately, it should announce a roadmap for decontrol. Government could transfer subsidy to farmers directly (like it has begun doing in the case of kerosene) while decontrolling diesel prices for other users. Farmers account for only 12-15 percent of diesel consumption as per our study”.

Meanwhile, SIAM data showed that the mini car segment - which comprises Maruti 800, Alto, A-Star, and WagonR, the Chevy Spark and Hyundai’s Santro and Eon - declined by about 7 percent to 6,42,009 units (6,90,812 units) last fiscal. Maruti Suzuki India has said earlier that sales of the Alto, the single largest selling car in India, had fallen by about 11 percent between April and February 2012.

According to SIAM, car sales rose 19.7 percent in March, a fifth straight monthly increase against an increase of merely 2.2 percent in FY12 due to sluggish sales in the first half of the year. Demand for cars in India fell for the first time in three years last July as high interest rates and rising fuel costs deterred buyers.

So 229,866 cars were sold this March against 192,105 in the same month last year while fiscal sales were 2,016,115 units (1,972,845 units).

Sales of trucks and buses, a key indicator of economic activity, rose 14.8 percent in March and an overall 18.2 percent in the 12-month period. Motorcycle sales rose 1.2 percent in March and 12 percent in the fiscal year.

SIAM’s FY13 forecast appears conservative for some vehicle categories.

According to the industry body’s calculations, cars should grow 10-12 percent, buses and trucks by 9-11 percent, scooters and bikes by 11-13 percent and three-wheelers by 5-7 percent.

Listen to Firstpost’s views on the automobile sector and its outlook here.

)

)

)

)

)